EDC aims to be relevant and responsive to the changing needs of the international marketplace and to support the Canadian economy of the future by helping to accelerate trade and investment in important growth sectors. To do this, EDC must apply its efforts to the areas of greatest value to Canada and its customers, ensuring it is economically relevant, and helping its customers grow in new and existing markets through a sustainable portfolio of products and services.

EDC believes that climate change is one of the most important and complex issues of our time and that it presents both risks and opportunities to its business, as well as the business of its customers. As Canada’s export credit agency, EDC’s mandate is to support and develop Canada’s export trade, and the capacity of Canadian companies to engage in that trade and respond to international business opportunities. EDC has a large and diverse portfolio operating across several sectors, including clean technology, and believes that companies across this spectrum can play a role in the transition to a lower carbon and climate-resilient economy. EDC also believes that the most important contribution it can make is to continue to provide its products and services in support of its customers’ innovation and transition, as it builds the portfolio of the future.

EDC is proudly taking a proactive approach to addressing climate change by understanding and managing risks, and identifying and investing in opportunities. The recommendations of the TCFD provide a framework within which EDC can disclose information about this proactive approach.

EDC is proud to have been the first export credit agency and first Canadian Crown corporation to become a supporter of the TCFD recommendations (September 2018) and to have issued its first disclosure in its 2018 Annual Report. This is EDC’s second climate-related disclosure, and there remains much to learn and much to do. As stated when EDC announced its support for the recommendations, as well as in last year’s disclosure, EDC’s goal is to continue to evolve its understanding of its climate-related risks and opportunities. EDC will increase the amount and granularity of the information disclosed year-over-year, as its approaches mature, as supporting data systems improve and as EDC’s TCFD journey continues. The subsequent pages detail EDC’s climate-related progress in 2019, as well as its planned next steps, under the four pillars recommended by the TCFD (Governance, Strategy, Risk Management, and Metrics and Targets).

Governance

Progress in 2019:

✔ Published EDC’s Climate Change Policy

✔ Updated and published EDC’s Environmental and Social Risk Management Policy, Environmental and Social Review Directive, and Human Rights Policy

Climate Change Policy

Following extensive stakeholder consultation, EDC issued its first dedicated Climate Change Policy in January 2019, which articulates the principles and commitments guiding EDC’s approach to this issue. The Policy, approved by EDC’s Board of Directors, is one element of EDC’s Environmental and Social Risk Management (ESRM) Policy Framework, which also includes EDC’s ESRM Policy, Environmental and Social Review Directive (ESRD), Human Rights Policy, and Transparency and Disclosure Policy.

Board of Directors

The Risk Management Committee of EDC’s Board of Directors has oversight of EDC’s Enterprise Risk Management Framework, including the ESRM Policy Framework. The Board’s Risk Management Committee receives quarterly updates regarding the implementation of the ESRM Policy Framework, which includes the Climate Change Policy.

Management

EDC’s Senior Vice-President, Sustainable Business and Enablement, is accountable for the Climate Change Policy’s development, implementation and maintenance, as well as its execution, effectiveness and attestation. The Director, ESRM, is responsible for day-to-day implementation of the Policy. EDC’s Internal Audit group is responsible for providing independent assurance to the Board of Directors and Executive Management team in accordance with EDC’s Internal Audit Charter.

EDC’s Risk Management Committee, comprising EDC’s President and CEO and its Executive Management team, provides feedback on significant Climate Change Policy implementation initiatives.

CSR Advisory Council

EDC’s CSR Advisory Council was established in 2006 to provide guidance to EDC on matters related to evolving best-in-class responsible business practices, including those pertaining to climate change. The Council is made up of leaders from business, civil society and academia, as well as EDC’s President and CEO. In 2019, the Chair of EDC’s Board of Directors joined as an Ex Officio Council member. The Council meets semi-annually, and other members of EDC’s senior leadership team, in addition to the President and CEO, are invited depending on the topic of discussion.

Next steps for 2020–2023:

➜ Publish Board-approved Transparency and Disclosure Policy

➜ Develop executive attestation process for policy compliance

Strategy

Progress in 2019:

✔ Created executive leadership role for corporate strategy

✔ Hosted third annual Cleantech Export Week

EDC’s corporate strategy

With fast-changing global dynamics resulting from climate change impacts, EDC intends to be a leader in supporting Canadian companies as they innovate in response to the global drive to a lower carbon future. EDC believes that taking a proactive approach, supported by its Climate Change Policy, is critical to ensuring EDC and its customers are positioned strategically to respond to the rapidly evolving risks and opportunities resulting from the climate change challenge. EDC aims to do so through an ongoing commitment to Canada’s energy sector and by helping to drive innovation and transition, as Canada works toward achieving net-zero emissions by 2050.

To date, EDC has taken several actions:

- Embedded action on climate change risks and opportunities in its approach to Corporate Sustainability and Responsibility

- Identified EDC’s impact on the environment among the key corporate values anchoring EDC’s 2030 corporate strategy

- Began to develop EDC’s first long-term corporate strategy, taking a forward-thinking view of risk and opportunity, with energy and climate change as particular areas of focus

Strategic approach to clean technology opportunities

A significant opportunity related to climate change is centred around the cleantech sector. EDC made cleantech a corporate priority in 2012 and has a team dedicated to building out EDC’s cleantech offering and portfolio. In 2019, EDC established a Renewable and Sustainable Technology Structured Project Finance team, which focuses on project finance needs in the cleantech space. EDC also hosted its third annual Cleantech Export Week, which included a new Women in Cleantech component. EDC is currently developing the next phase of its cleantech strategy. The strategy will be focused on further building cleantech sub-sector knowledge in order to increase EDC’s penetration in the market for its offerings, maximize its overall impact to cleantech companies and continue to leverage its ecosystem partnerships.

Next steps for 2020–2023:

➜ Integrate climate change considerations into EDC’s long-term corporate strategy via the articulation of a broader energy strategy

➜ Assess the resilience of EDC’s strategy to different climate-related scenarios

➜ Update EDC’s cleantech strategy

Risk management

Progress in 2019:

✔ Published EDC’s Due Diligence Framework: Climate Change

✔ Co-chaired the Equator Principles’ Climate Change Working Group in developing the updated Equator Principles Environmental and Social Risk Management Framework

Enterprise risk management at EDC

Identification and assessment of climate change–related risk forms part of EDC’s enterprise risk management framework. EDC has established a Three Lines of Defence governance model that distinguishes organizational roles and responsibilities via three lines of risk management:

- First Line: Teams or individuals who assume, own and manage risk.

- Second Line: Individuals and teams that oversee risk taking. Typically, EDC’s Risk Management Office acts as a second line of defence, providing independent oversight and effective challenge of risk assessments and recommendations.

- Third Line: EDC’s Internal Audit, which is responsible for providing independent assurance to the Board of Directors in accordance with EDC’s Internal Audit Charter.

Identifying and assessing climate change–related risk

EDC’s approach to identifying and assessing climate change–related risk has been integrated into EDC’s environmental and social due diligence processes. The details of this approach are articulated in the Due Diligence Framework: Climate Change, which supports EDC’s Climate Change Policy and the thermal coal position in Appendix A of the Policy. The steps outlined in this Framework are a starting point. EDC anticipates that its climate change–related due diligence approach will evolve over time, as the organization’s understanding of this complex issue, and the implications for its business and its customers, continues to mature.

Climate-related physical and transition risks

Climate-related physical risks are those risks resulting from climate change, which involve event-driven (acute) or longer-term (chronic) shifts in climate patterns. Acute physical risks refer to those that are event-driven, including increased severity of extreme weather events such as cyclones, hurricanes or floods. Chronic physical risks refer to longer-term shifts in climate patterns (e.g., sustained higher temperatures) that may cause sea level rise or chronic heat waves.

Climate-related transition risks are risks which can arise from the process of adjusting to a lower carbon economy. These include policy and legal risks such as policy constraints on emissions, imposition of carbon tax and other applicable policies; water or land use restrictions or incentives; shifts in demand and supply due to technology and market changes; and reputation risks reflecting changing customer or community perceptions of an organization’s impact on the transition to a low-carbon and climate-resilient economy.

(source: TCFD Recommendations, June 2017)

Equator Principles’ Climate Change Working Group

As co-chair of the Equator Principles’ Climate Change Working Group, EDC worked with other Equator Principles Financial Institutions (EPFIs) to ensure a more focused integration of climate change–related risk in the updated Equator Principles Environmental and Social Risk Management Framework for project-related transactions. Equator Principles 4 (EP4), effective July 1, 2020, includes updated disclosure requirements, as well as a requirement that EPFIs consider climate-related physical and transition risks, based on specific criteria. EDC will be applying this new EP4 approach, as outlined in EDC’s Due Diligence Framework: Climate Change.

Next steps for 2020–2023:

➜ Implement Equator Principles 4, including through development of a systematic approach to assessing physical climate-related risks

➜ Identify and understand potential climate change impacts on credit and portfolio risks

Metrics and targets

Progress in 2019:

✔ Established target to reduce EDC’s exposure to carbon intensive sectors by 15 per cent

✔ Served 227 cleantech sector customers and facilitated $2.5 billion of business

✔ Issued new Green Bond, worth $500 million, and published 2019 Green Bond Impact Report

Overall portfolio

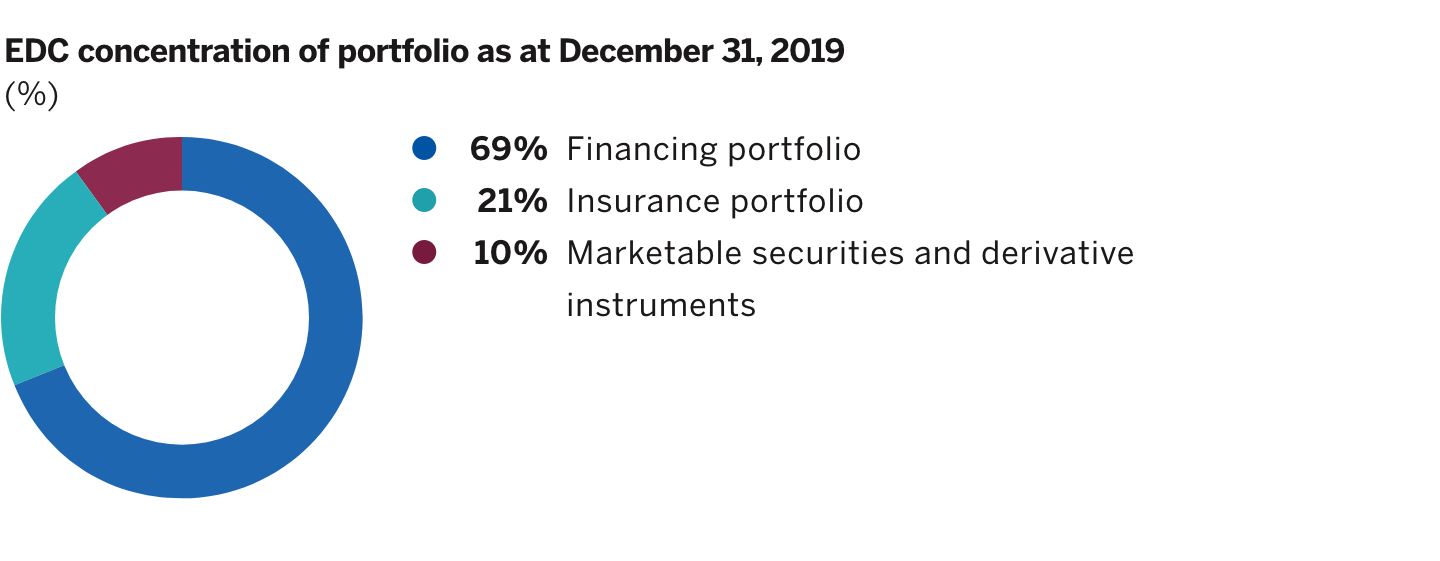

EDC’s objective is to be more transparent regarding its exposure across product lines at a sector level. EDC is working to improve the granularity at which it reports on the composition of its portfolio, starting with its financing portfolio, which represents 69 per cent of EDC’s overall portfolio (see Chart A). This granularity will help EDC and its stakeholders to understand how exposed EDC’s portfolio is to climate-related physical and transition risks and opportunities. Further details on EDC’s overall exposure can be found on page 56 of the full EDC 2019 Annual Report.

Chart A

Financing portfolio

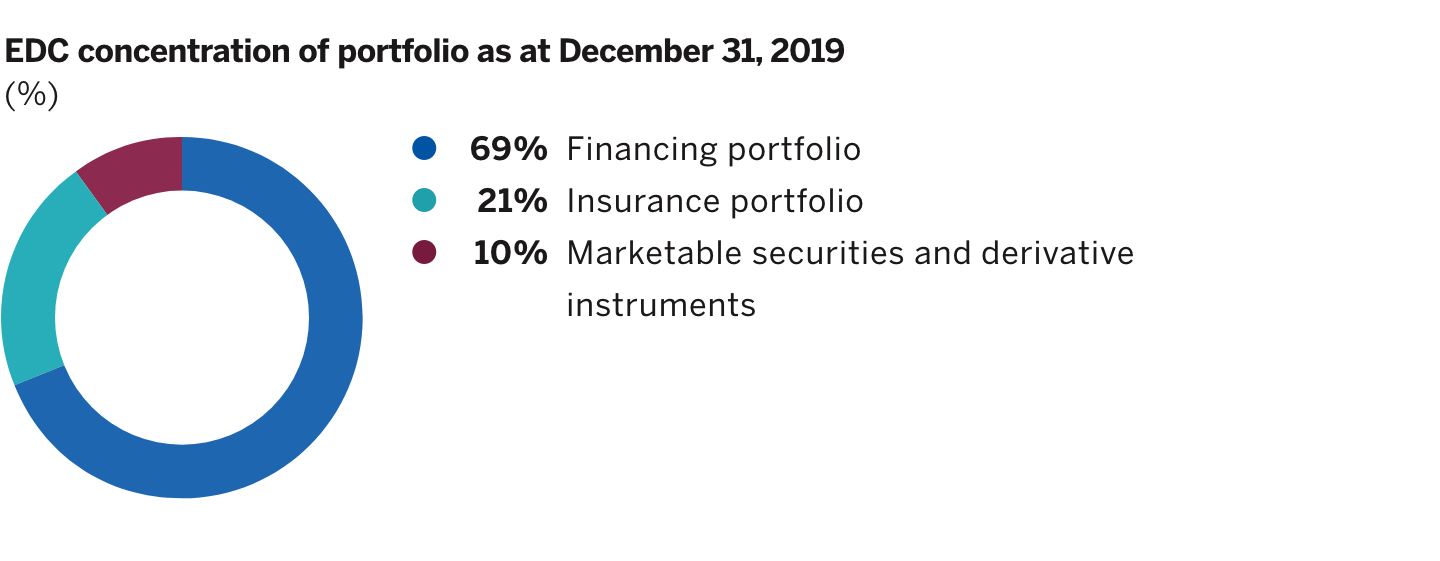

In reviewing its portfolio from a climate-related perspective, EDC’s initial focus is on transition risk related to the most carbon intensive assets within the portfolio. Chart B provides a view of EDC’s total financing portfolio along with the portion that is currently being assessed for its exposure to more carbon intensive sectors. Within EDC’s financing portfolio, the initial focus is on EDC’s structured and project finance, as well as corporate finance loans, which represents 88 per cent of EDC’s financing portfolio. The remaining financing portfolio comprises investments and letters of offer.

Chart B

(1) EDC has identified sectors as carbon intensive based on whether industrial facilities in the sector emit more than an average of 500 kilotonnes (kt) of carbon dioxide equivalent (CO2e) per year in Canada, based on Scope 1 GHG emissions data reported to Environment and Climate Change Canada’s Greenhouse Gas Reporting Program, as well as annual reporting from major Canadian airlines. The 500 kt CO2e/year quantum served as a sectoral screening threshold to identify the primary sectors of focus from a carbon intensity perspective and will not be used on an individual transaction-by-transaction basis to determine whether a transaction is in/out of scope for the target. Whether a transaction is in/out of scope of the target is, at this time, based on the sector having been identified by the upfront screening described above. Transaction-level due diligence related to climate change is undertaken as outlined in EDC’s Due Diligence Framework: Climate Change.

EDC has identified the most carbon intensive sectors in its financing portfolio based on the sectors’ average annual greenhouse gas (GHG) emissions, reported in carbon dioxide equivalent, in Canada(1). These sectors include:

- Airlines

- Upstream oil and gas operations

- Petrochemicals, refining and chemicals manufacturing

- Metals smelting and processing (e.g., steel, aluminum)

- Thermal power generation

- Cement manufacturing

Carbon intensity target

In fulfilling its policy commitment to “measure, monitor and, commencing in 2020, set targets to reduce the carbon intensity of its lending portfolio”, EDC has developed an initial exposure-based approach to target-setting.

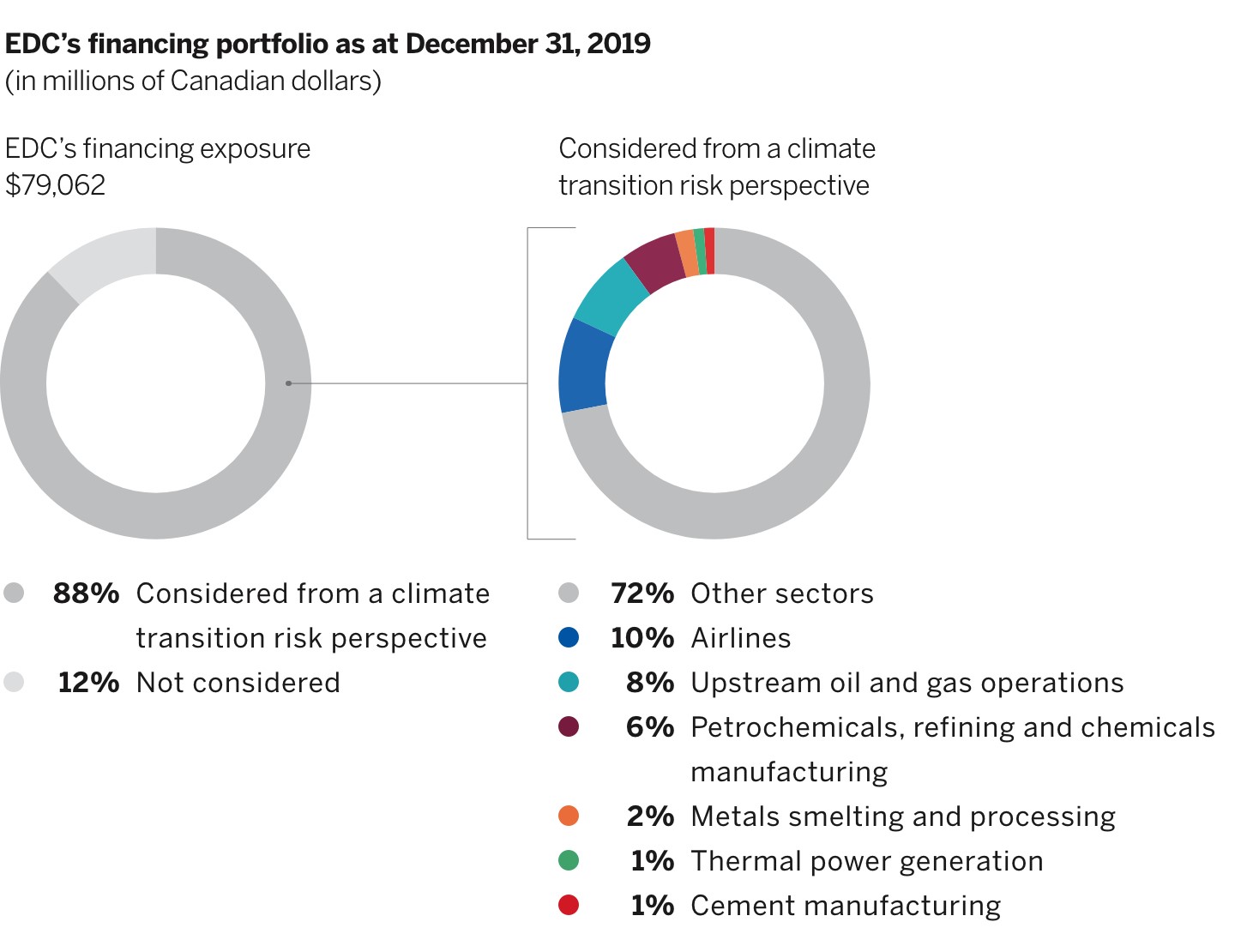

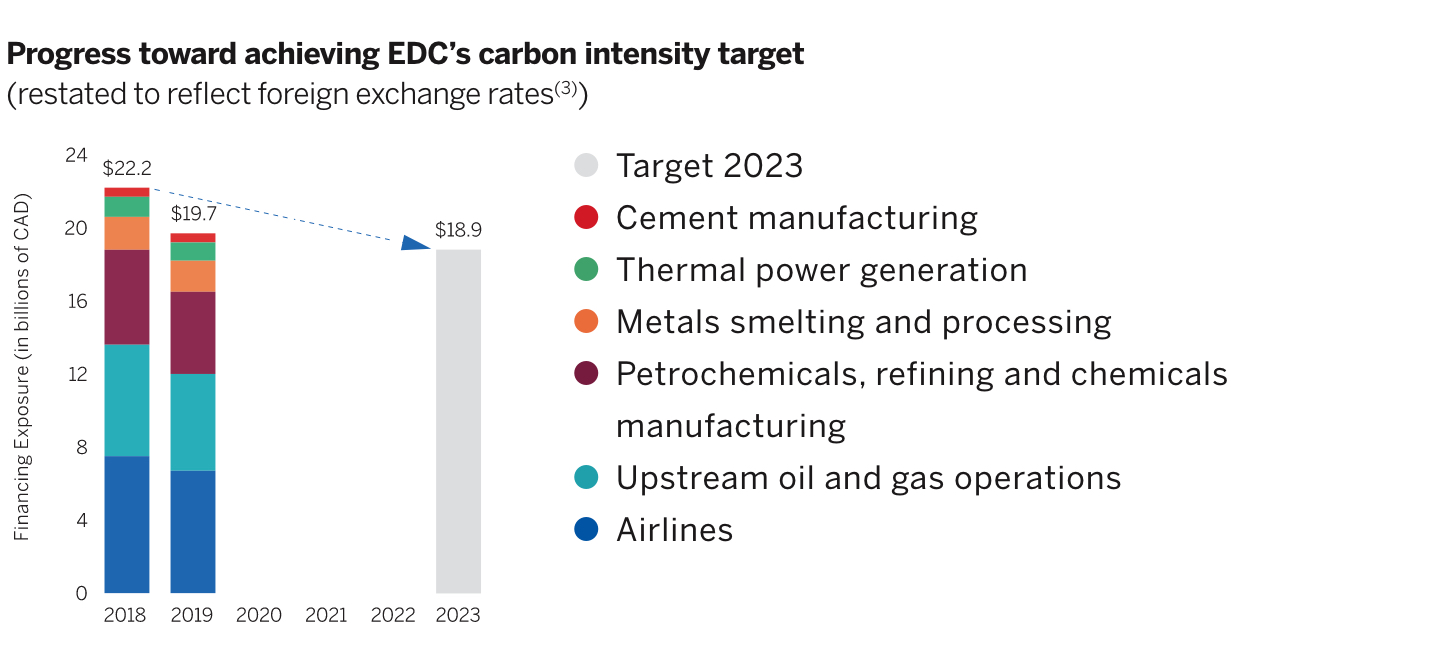

In 2019, with a focus on its financing portfolio(2), EDC set a target to reduce its exposure to the most carbon intensive sectors by 15 per cent over five years against a December 31, 2018 baseline. As a result of this reduction, the carbon intensive exposure of EDC’s financing portfolio at December 31, 2023 is targeted to reduce to $18.9 billion(3), a decrease of approximately $3.3 billion over the five-year period.

As demonstrated in Chart C, EDC has made initial progress toward achieving this target in 2019. EDC will provide target progress updates in its annual TCFD disclosure.

Chart C

(2) In this context, the financing portfolio comprises structured and project finance, as well as corporate finance loans.

(3) EDC’s assets are primarily denominated in U.S. dollars; as such, exposure values presented have been restated to reflect the foreign exchange rates prevailing at the time the target was set.

EDC is taking a proactive approach to the development of the targets impacting its business. EDC will further develop its approach to reducing the carbon intensity of its financing portfolio in a representative way, with a focus on ensuring a reduction in the financed emissions within the EDC portfolio. As EDC evolves its approach in the coming year, its target will continue to acknowledge the important role that carbon intensive sectors, such as oil and gas, need to play in the transition to a lower carbon and climate-resilient economy, consistent with the principles guiding EDC’s Climate Change Policy.

As a key element of this work, EDC is considering emerging GHG measurement and target-setting methodologies that are relevant to the financial sector, such as the Partnership for Carbon Accounting Financials and the Science-Based Target Initiative, as well as tools such as the Paris Agreement Capital Transition Assessment. EDC will continue to consult with experts and stakeholders on this matter and will provide a progress update in its 2020 climate-related disclosure.

Support for clean and low-carbon technology

EDC continued to increase its support for clean and low-carbon business in 2019. In August, EDC issued its fifth Green Bond, worth $500 million, and published its 2019 Green Bond Impact Report. The funds raised from EDC’s Green Bonds have financed nearly 30 transactions, worth more than $2 billion, in a range of sectors, each contributing to environmental protection or the mitigation of climate change. EDC anticipates that approximately 4.1 million tonnes of CO2e will be avoided annually as a result of these transactions.

Additionally, EDC is the largest provider of financial solutions for Canadian cleantech companies looking to expand internationally. In 2019, EDC increased the amount of business it facilitated in the cleantech sector – totalling $2.5 billion across all EDC products – and served 227 companies.

Finally, in 2019 EDC provided $100 million in climate finance in support of the Government of Canada’s commitment to the UN Framework Convention on Climate Change, which focuses on EDC’s support for low-carbon or carbon-resilient transactions in developing countries(4).

(4) In 2019, EDC provided $100 million in financial support for climate-related transactions in developing countries.

EDC operational footprint

EDC has been publicly reporting on its operational carbon footprint for several years, including its energy consumption and business travel metrics. Aligned with the standards set out for corporate accounting and reporting by the Greenhouse Gas Protocol, EDC’s operational carbon footprint for 2019 is 3,539 tonnes CO2e, with a carbon footprint intensity of 2.4 tonnes per employee.

Next steps for 2020–2023:

➜ Refine EDC’s data reporting to provide greater clarity on EDC’s exposures by sector across all product lines

➜ Evolve EDC’s approach to reducing the carbon intensity of its financing portfolio

➜ Develop cleantech-related targets