Foreign investment promotion and protection agreements

Foreign investment promotion and protection agreements (FIPAs) establish the mutual rights and obligations of the partner countries when dealing with investors. The goal is to ensure that investors are treated in the same way as domestic investors and will, for example, be protected against political risks such as expropriation or currency controls. Unlike free trade agreements, FIPAs have no bearing on trade in goods or services, only on investments.

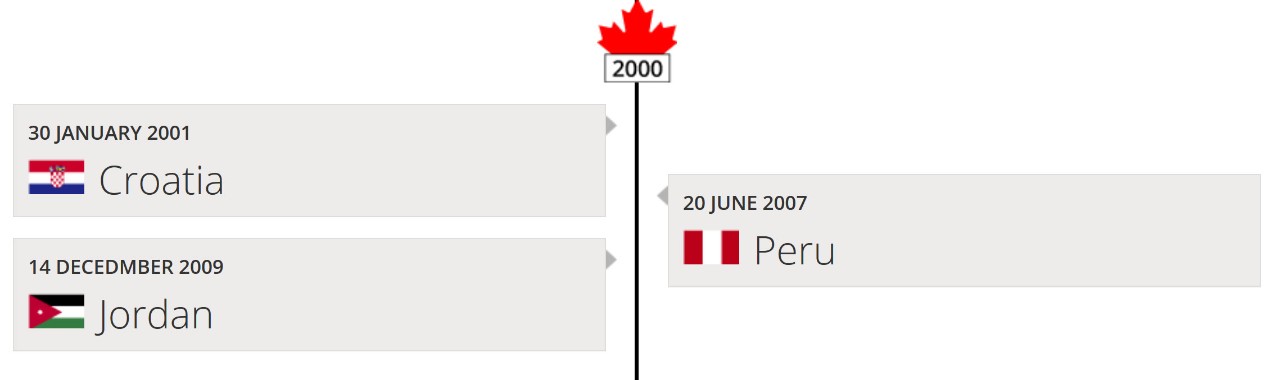

Canada has FIPAs with 36 countries around the world. While the details vary from one agreement to another, they normally deal with matters such as these:

- Equal treatment of both domestic investors and international investors

- Sectors to be excluded from the agreement, such as financial services or telecommunications

- The transfer of funds out of the country (such transfers must be unrestricted except in special cases such as investor bankruptcy)

- How investor losses will be compensated, if applicable

- What taxation measures will apply, and how

- How disputes are resolved

The presence or absence of a FIPA can be important when you’re deciding whether to invest in another country—for example, if you want to set up an affiliate or buy a local business. If there is an agreement in force, your new company will enjoy all the privileges and rights of a locally owned firm and can’t be penalized for being internationally owned. So, all other things being equal, investing in a country that has a foreign investment protection agreement may be preferable to investing in one that doesn’t.

Details of Canada’s FIPAs are available in the Trade and Investment Agreements section of the Global Affairs Canada web site.