3. Inflation and the impact of monetary policy

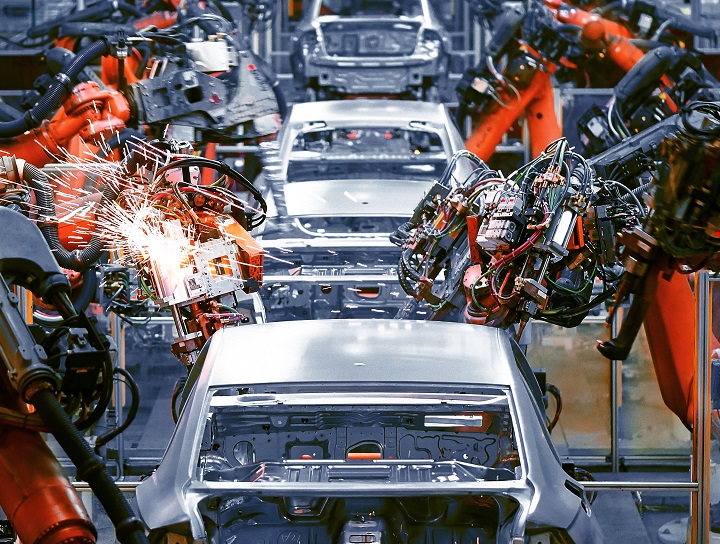

As economies emerge from a deliberate lockdown of activity, and government stimulus works its way through the system, demand pressures are intensifying in the context of ongoing supply headwinds. While the industrial capacity exists, shutdowns have led to a scarcity of key inputs, both manufactured and resource based. It may be some time before supply can adjust to feverish levels of demand, especially as concerns around the Delta variant persist. Various transport bottlenecks, including stretched port capacity and container shortages, are further exacerbating supply chain logjams. And then there’s the impact of labour shortages, which are feeding wage pressures in key areas. Add all this together and pricing pressures go beyond the more volatile price elements, with so-called “core” prices also up sharply. Aside from the disruptive impact that inflation can have on the economic recovery itself, faster than anticipated price growth may require central banks to be more aggressive in hiking interest rates. But higher rates won’t be without consequence. Low-interest borrowing is currently allowing governments to spend and is underpinning historic stock market valuations and abundant credit. An abrupt change in the interest rate outlook could be painful, hitting equity and credit markets, taking the shine off certain commodities and impacting currency stability. The move would expose overleveraged corporations and reverse capital flows into emerging markets that have been experimenting with larger budget deficits and unconventional monetary policy themselves. Impacts could persist beyond the short term.