EDC Trade Confidence Index shows exporters navigating uncertainty

Survey hits near-record low as Canadian exporters adapt to global pressures

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

Learn how credit insurance safeguards your business and opens doors to new markets.

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

Discover resources for smarter exporting

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

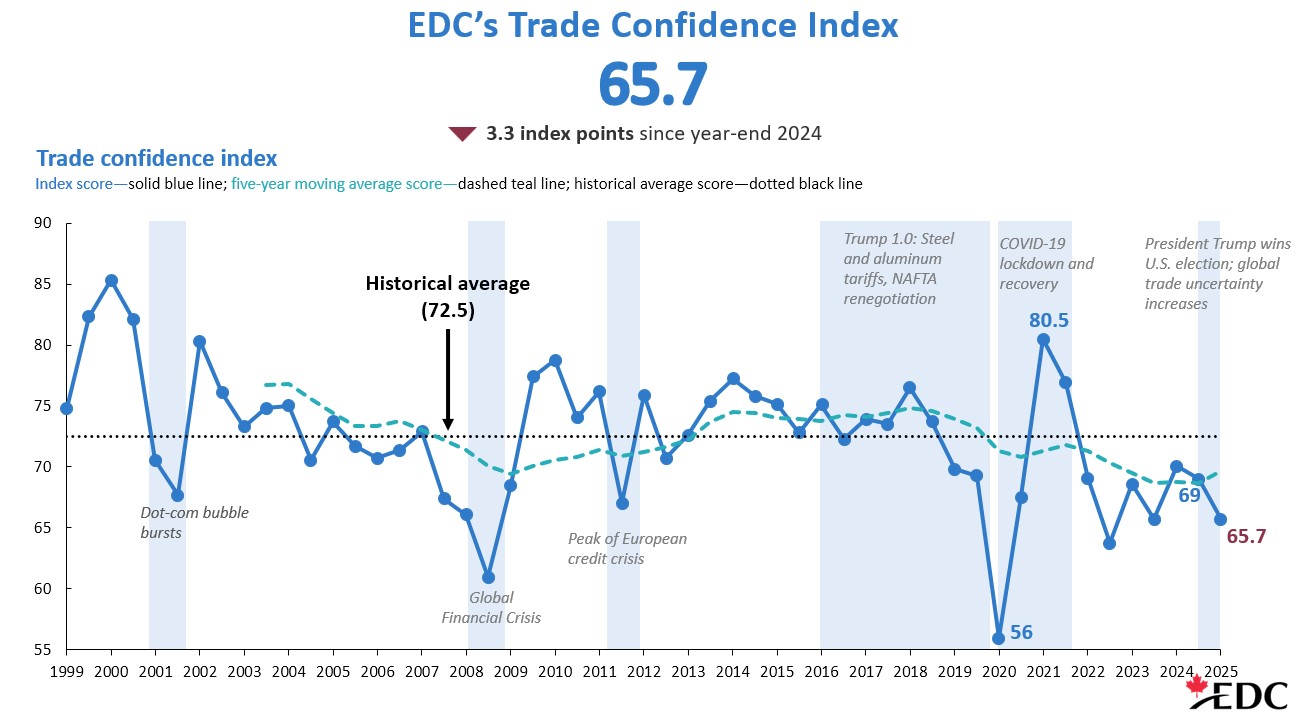

Survey hits near-record low as Canadian exporters adapt to global pressures

Export Development Canada’s Trade Confidence Index (TCI) has dropped to one of its lowest levels on record, even as Canadian exporters pursue new markets to manage rising uncertainty. The latest survey reflects growing concern amid escalating global trade headwinds, while also highlighting a more targeted approach to diversification.

Since 1999, EDC has surveyed Canadian exporters and ready-to-export businesses twice annually to capture timely, forward-looking insights not found in traditional trade statistics. The TCI captures the perspectives of more than 1,000 companies on their international strategies, expectations and challenges.

In this round, 1,073 respondents participated between May 30 and July 13, 2025. The TCI score—based on responses from 688 exporters—dropped by 3.3 points from year-end 2024 and sits 6.8 points below the historical average, landing at 65.7. This is one of the lowest readings on record, with the index falling below this level only during the 2008 Global Financial Crisis, the COVID-19 pandemic and the post-pandemic inflation surge.

Despite the challenges, Canadian exporters are adapting. Strategies include:

From a trade diversification perspective, the use of free trade agreements (FTA) by exporting respondents appears to be uneven. The results suggest significant opportunity to increase FTA utilization among qualifying exporters:

Canadian exporters are navigating a complex trade environment, including the impact of tariffs and evolving global dynamics. As they manage risk and build resilience amid ongoing disruptions, EDC is here to support Canadian businesses.

Discover how exporters are responding to rising costs, cash flow challenges and declining U.S. orders. EDC’s latest Trade Confidence Index reveals one of the lowest scores on record—find out what’s driving the decline and how companies are adapting through diversification and strategic shifts.