With timely insights and financial analysis from our experts, Export Development Canada can help you enter new markets, grow your global business, and reduce risks with confidence.

Canadian exporters adapt to tariffs and volatility in EDC’s Global Export Forecast

Outlook: Stalled growth now, but growing in 2027

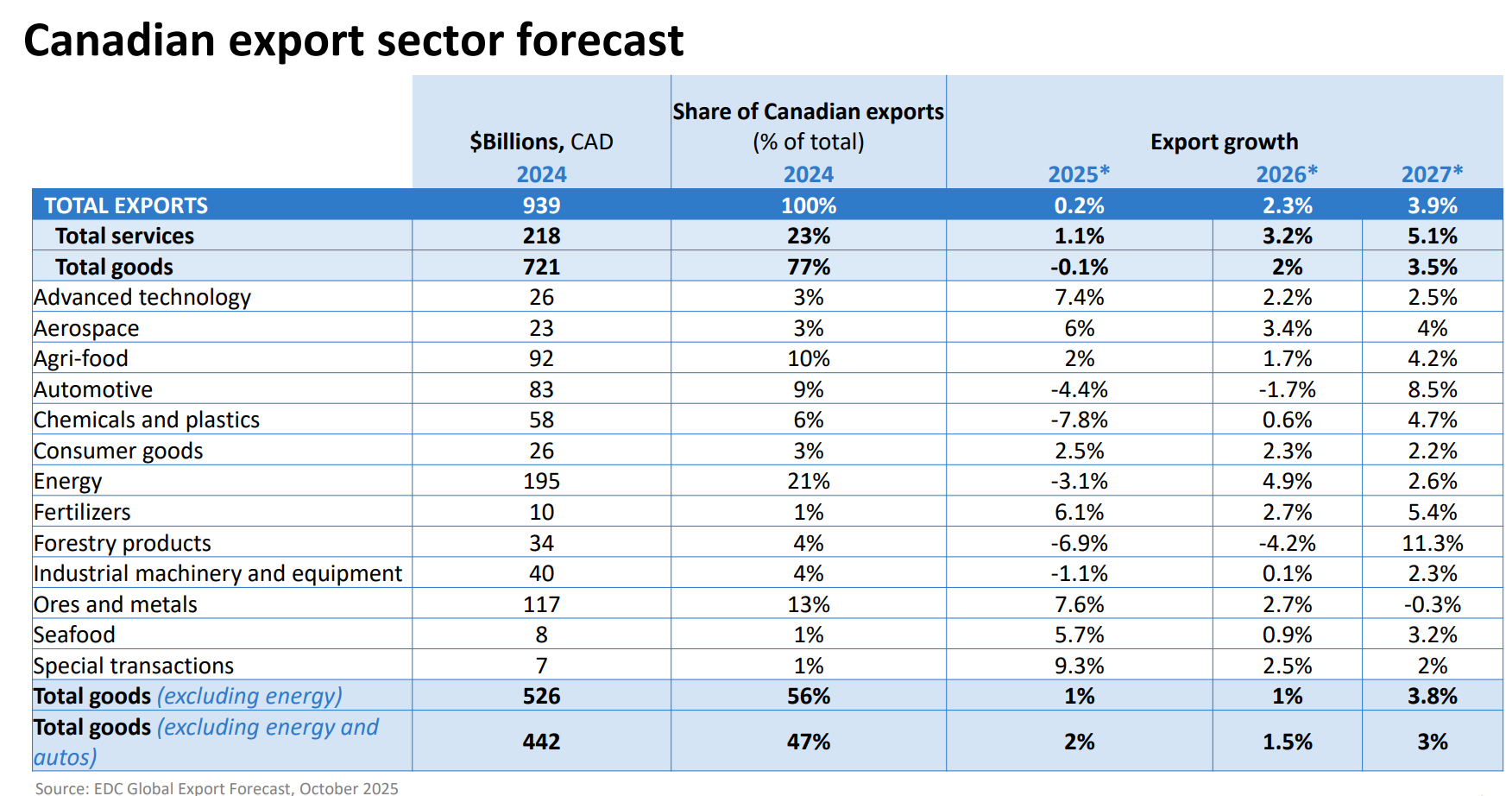

In this Global Export Forecast (GEF), we expect uncertainty and weak trade conditions to stall Canadian export growth in the near term, with total export growth reaching just 0.2% in 2025 and 2.3% in 2026, before rebounding to 3.9% in 2027.