PDAC insights: Canada’s mining industry shines amid global uncertainty

Author details

Karicia Quiroz

Economist | Country & Sector Intelligence

In this article:

Despite concerns over increased tariffs, inflation and global economic uncertainty, Canada’s mining industry prospects are paved with gold. Literally.

That was one of the key messages shared at the Prospectors & Developers Association of Canada’s (PDAC) annual convention in Toronto, March 2-5. Organized to showcase the latest market insights, innovation and investment opportunities in mineral exploration and mining, PDAC 2025 attracted more than 27,000 corporate leaders, government decision-makers, investors and industry experts from around the world.

“Minerals are the backbone of modern technology and are indispensable to our daily lives, highlighting the essential role of mineral exploration and mining in Canada’s economic strength and resilience,” said Raymond Goldie, PDAC president, of an industry that directly contributed $112 billion to Canada’s gross domestic product (GDP) in 2024.

The need for critical minerals to drive the energy transition—despite an uncertain U.S. outlook—was highlighted, with Canada cited as having significant opportunities in valuable commodities. Gold and copper are among Canada’s top ores and metals exports, but questions swirled about how they’ll be impacted by the current trade and economic environment.

Al Pritchard, Export Development Canada’s (EDC) director of Sectors and International Advisory, leads the development of EDC’s critical minerals strategy, supporting Canadian mining companies both domestically and internationally. He also oversees EDC’s Business Connections Program, fostering business opportunities between Canadian companies and international mining clients.

“In 2024, EDC facilitated C$8.9 billion in business in the mining industry and supported more than 250 Canadian companies. This sector is vital for Canada and EDC is committed to supporting the growth of our mining and mineral processing capacity,” said Pritchard.

As the world transitions to a lower-carbon future, demand for minerals used in clean technologies is surging. In 2022, the federal government announced its $4-billion Critical Minerals Strategy to position Canada as a global supplier of choice for these essential resources.

“As we support the growth of Canada’s critical minerals projects, EDC is keen to leverage international relationships to accelerate development. EDC is well-positioned to lead the financing and support of critical minerals projects.”

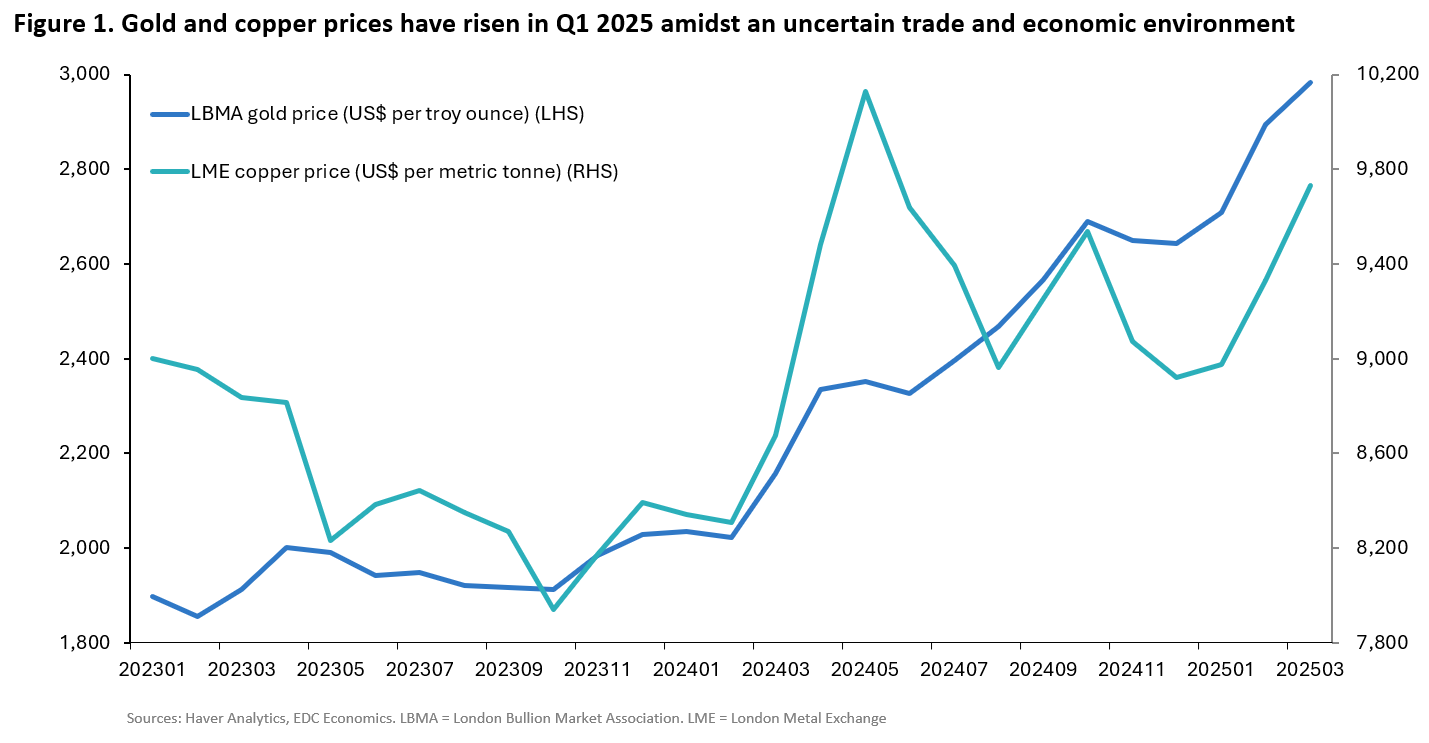

With concerns on tariff impacts, the increased appeal of gold as a safe-haven asset is causing a surge in demand and price. The daily price already surpassed the US$3,000 per troy ounce mark for the first time in history in March this year and there are no signs of slowing down.

- Gold is a hedge against inflation. Inflation doesn’t affect the value of gold; gold is a “store of value,” meaning it maintains its value over time. With inflation concerns from U.S. President Donald Trump’s policies, investors will continue to leverage gold to diversify their portfolio to hedge against inflation.

- Central banks will continue to buy gold to “de-dollarize” the global market. Russia’s full-scale invasion of Ukraine in 2022 was the initial catalyst for increased purchases of gold by central banks. To reduce geopolitical risk and dependence on the U.S. dollar, central banks have been buying more than 1,000 tonnes a year of gold since 2022—more than double the annual average of the past decade. With uncertainty of the economic impact of President Trump’s policies, central banks will likely continue buying gold at the same pace this year.

- Gold flows West. There has been a recent movement of gold into the U.S. to counter the potential risk of U.S. tariffs on gold imports, with New-York based Commodity Exchange (COMEX) gold inventories reaching COVID-19 highs. With potential inflation and interest rate cuts this year, western investors will likely build on this gold market momentum and increase their gold investments.

You should also check out

Discover trends in ores and metals, nuclear energy, and the auto, cleantech and services sectors.

Copper is a key input in cornerstone industries such as construction, electronics and transportation. Its demand is closely linked with economic growth—particularly, China’s growth as it takes up more than half of global copper demand. But despite a potentially weaker economic outlook in the near-term driven by rising global trade tensions (especially between the U.S. and China) and China’s slower consumption, copper demand and its price are still expected to rise this year and in 2026 (albeit at a slower pace) due to its strategic importance.

- Copper is a key input in the low-carbon and digital economy. Growing global demand for decarbonization technologies that rely on copper inputs, including renewables and electric vehicles (EVs), will drive up copper demand in the next five years. The growth of artificial intelligence (AI) and data centres will also boost copper demand, with copper in data centres expected to rise sixfold between now and 2050.

- Copper will likely experience a deficit. Amidst growing demand, copper will likely have a deficit, with copper producer, BHP, estimating 10 million tonnes (mt) within 10 years. Copper mines are becoming more expensive to develop since ore grades (concentration of copper in the ore rock) have been declining since 1991. More investment in mine production will be needed to secure enough supply to meet future demand—potentially, up to US$250 billion over the next 10 years.

- Copper has limited substitutes. Copper scrap isn’t expected to be enough to address the deficit. Other potential substitutes, like aluminum, aren’t as viable as copper in specific applications given copper’s superior electrical conductivity.

What does this all mean for Canadian exporters of gold and copper? For gold, an uncertain trade and economic environment are causing both gold demand and the gold price to surge to new records. While, for copper, it’s despite a potentially weaker economic outlook that its demand and price are still expected to grow this year—although at a slower pace (with significant volatility) than it would have otherwise. Exporters should be aware of current trends and potential price movements of both metals, which can impact these metals’ returns.

Source: Haver Analytics, EDC Economics. LBMA (London Bullion Market Association). LME (London Metal Exchange).

Despite uncertainty with the U.S. energy transition outlook, global demand for decarbonization technologies isn’t expected to slow down any time soon. Investments in EVs, renewables, smart grids and energy storage systems (ESS) will require substantial critical mineral inputs. Multiple participants at PDAC noted Canada’s viable opportunities in this space, but acknowledged the technical challenges in finding deeper, more remote deposits “unexplored” within the country as well as infrastructure to get to these more remote projects. Yet, Canada has an apt critical minerals supply with key developments in various jurisdictions. Highlights include:

Ontario

- The province has advanced its critical minerals production with 25% of its 36 active mines allotted to critical minerals. In 2023, the province produced $6.4 billion in critical minerals, with a focus on nickel, cobalt, copper and platinum group metals.

Quebec

Multiple projects could position Canada competitively once they reach production.

- Nouveau Monde Graphite’s (NMG) Phase 2 Matawinie Mine and Bécancour Battery Materials Plant could supply the North American EV and energy storage systems (ESS) markets with graphite—a key component of lithium-ion batteries—in the short term. NMG just issued an updated feasibility study, which means that, based on a positive final investment decision, the project could be built and start production in less than three years.

- The Dumont Nickel project, considered one of the “lowest carbon footprint nickel operations” globally, is targeting production of 39,000 tonnes per year (TPY) of nickel (sulfide concentrate) starting 2028. This would feed into the EV and ESS market.

- Arianne Phosphate’s Lac à Paul project just completed a prefeasibility study to develop a facility to convert its phosphate concentrate into battery-grade purified phosphoric acid (PPA). PPA is a key input in lithium-iron-phosphate (LFP) batteries, a battery chemistry that’s beginning to dominate EV and ESS batteries. The facility, if built, would be the largest PPA producer outside of China.

British Columbia

To counter the potential negative impacts of U.S. tariffs, the province is working to fast-track some of its critical minerals projects for future exports to overseas markets. Premier David Eby recently announced a list of priority projects that would accelerate their environmental assessment and permitting process. But it was also noted during the PDAC sessions the importance of engagement with Indigenous groups throughout the process, ensuring that they had an equal seat at the table.

To learn more about Canada’s commodity outlooks (including gold and copper) amid the current trade uncertainty, read Export Development Canada’s Global Economic Outlook. The spring 2025 edition features expert insights from the EDC Economics team about the world’s key economies and the impacts on commodity prices, interest rates and GDP growth.