How to calculate cost versus benefits of insuring sales

Can you afford not to get paid? This decision-making guide will help you weigh your options.

Your decision-making guide to obtaining credit insurance

The money your company is owed by your clients—also called your accounts receivable—is arguably your most important asset. When that money doesn’t come in, it’s easy to find yourself in serious financial trouble, a risk that is heightened in our current uncertain economic climate.

Credit insurance protects you if your clients don’t pay. It’s a great way to manage risk, but like all insurance, it’s not free. So, when companies look at buying credit insurance, the first question they ask is: Do the benefits outweigh the cost? This straightforward guide will help you judge whether credit insurance makes sense for your company.

Measuring the benefits of credit Iinsurance

Credit insurance can give you peace of mind because you know you’ll get paid regardless of your customer’s circumstances. But, to get a better idea of what that means in dollars, let’s start with an example.

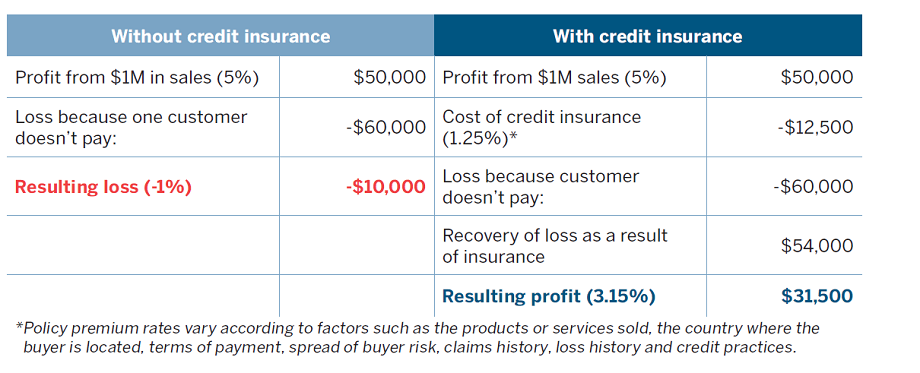

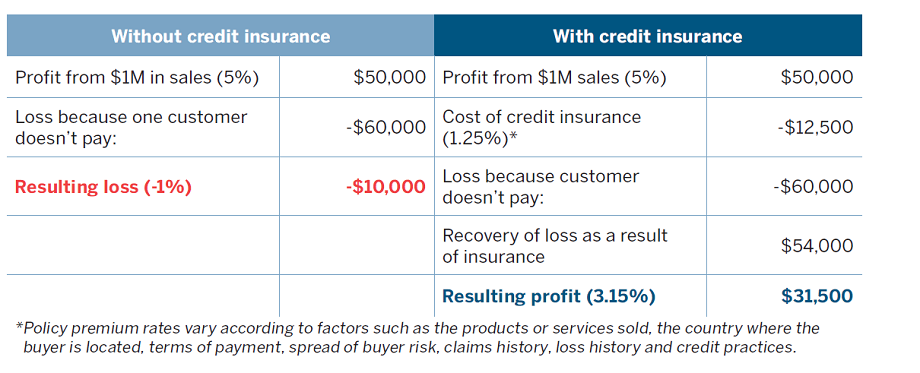

Suppose company XYZ sells super widgets. They have $1 million in annual sales and a profit margin of 5%. However, one of XYZ’s customers can’t pay their outstanding account. Here’s the impact:

How much will credit insurance cost me?

Just like other types of insurance, policy rates vary. Here are the factors we take into account when determining how much your premiums will be:

- The type of product or service you are selling

- Where your customer is located

- The terms of payment you have set up with your customer

- The credit profile of your customer

- Your claims history

- Your loss history

- Your credit practices

Since every company and every sale is different, we can’t guarantee what kind of premium you will need to pay for credit insurance before we talk to you. That said, for an insurable volume of less than $10M, the cost of credit insurance typically ranges between 0.5% and 1.5% of the total sales being insured. Get an instant insurance quote to see how that converts to dollar amounts for a particular sale under EDC’s Select Credit Insurance.

Going without insurance

Many companies choose not to use credit insurance. Instead, they accept the risk of non-payment. But, in today’s economic climate, and given that receivables can account for up to 40% of your assets, consider the magnitude of that risk. If one of your best customers goes bankrupt, or a foreign government issues a policy restricting business, you could be facing severe financial difficulties overnight. This is where credit insurance can help.

The key benefit of credit insurance is that it can shield your receivables from these kinds of risks, covering up to 90% of your insured losses if you don’t get paid.

Asking for payment up front to avoid losses

One way to avoid buying credit insurance is to ask for payment up front. The downside is that this may make it harder to close a deal because it places all the risk on the customer and drains their cash flow. With the importance of liquidity at a premium right now, such payment terms are likely to increase your demand. Alternatively, not offering flexible terms may put you at a disadvantage compared to competitors.

With credit insurance, you can maintain flexible payment terms while protecting yourself against non-payment. Insurance also provides peace of mind, allowing you to take on new customers with confidence and a sense of security. You won’t feel the same level of stress, wondering if this new customer will come through for you, particularly during difficult economic times.

It’s not always your customer you need to worry about

It’s not always your customer you need to worry about—it’s your customer’s customer. And more.

Companies may feel they don’t need insurance because they’ve been doing business with their customers for a long time. They’ve never had any issues, so there’s no risk—or so they like to think.

Even in ideal economic times, that kind of thinking is a gamble. Few companies have inside knowledge of their customers’ financial health and you may not find out that a longtime, trusted customer is having serious cash flow problems until it affects your company. Here are just a few of the scenarios your customer may suddenly be facing:

- they aren’t paying on time because of pandemic-related issues;

- one of their supply chains has broken down; or

- global political conditions are affecting their business.

When things like this happen, even the most reliable customer may not be able to pay on time – or, at all.

Get more cash flow from your financial institution

A credit insurance policy can also help you get more from your financial institution. If you don’t have any kind of insurance, you assume the credit risk of doing business, and that fact won’t be lost on your financial institution. As a result, it might be reluctant to extend financing to you for bigger operating lines, more capital expenditures or overseas expansion. But if your company has credit insurance, your financial institution may have more confidence that your receivables will turn into cash and that you know how to manage risk. This may make them more willing to increase your company’s borrowing capacity.

Helping businesses of all sizes, in all sectors

You may still be wondering if credit insurance is a good fit for your type of business; here are some examples of the types of sectors and businesses who’ve benefited from EDC Credit Insurance:

Software as a service (SaaS) sector

Based in Kitchener, Ontario, software company Vidyard has done extremely well during the COVID-19 pandemic, since they provide a service that hosts and analyzes video performance—a product that experienced skyrocketing demand when people started working from home in far greater numbers. Despite their success, they knew many of their clients were facing financial challenges and decided to get EDC Credit Insurance to protect themselves. “It made sense for Vidyard to insure our accounts receivable with EDC in this climate, given the current vulnerability in the global economy and the fact that we have customers in many countries around the world,” says Matt Hodgson, Vidyard’s chief financial officer. “The EDC insurance is a great way to manage this risk for our business.” Read about Vidyard CEO Michael Litt’s thoughts on SaaS companies’ success and his decision to use credit insurance.

Food and beverage sector

Piccola Cucina is a family-owned Winnipeg business run by Pina Romolo and her mother, Anita. They make almond-based products, including six different kinds of gluten-free macaroons, almond pie shells and almond meal. When it came to their first export shipment to the U.S., they decided to get EDC's Select Credit Insurance on the order. That same customer defaulted on payment and Romolo made a successful claim on the lost revenue. “The point of having accounts receivable insurance is to protect yourself and your business from customers who don’t pay,” Romolo says. “You hope you never have to use it. However, when a big order comes in and the customer refuses to pay, you’ll certainly be glad you bought it.” Discover the Piccola Cucina story and learn how they were able to leverage EDC’s financial solutions to protect their business..

Health care sector

Umano Medical is a Quebec-based business that produces specialized medical equipment and exports many of its products. Established in 1920, the company set ambitious growth objectives in recent years and decided to use EDC's Portfolio Credit Insurance to lower their risks. “With bold objectives and demand coming from all over the world, we were in need of strong partners,” says Robert Dion, Umano’s vice-president of finance and administration. “EDC helped us reduce our risks so that we could continue to develop new products and implement our growth plan both here and abroad.” Learn how EDC helped Umano carve a place in the international market to improve patients’ experiences around the world.

Consumer goods sector

Even though she’s a one-person company, Joy Yap launched Wyld Skincare in 2016 with a sponge made from the roots of the konjac plant. Working out of Toronto, Yap’s sponges are sold online and in more than 150 boutiques around the world, tapping into a growing market for natural beauty products. Yap decided to purchase purchased EDC Select Credit Insurance to protect herself against loss of payment for the export of a full container-load of sponges to a client in the U.S. “I feel very looked after by EDC,” she says. Read her story and find out how EDC Select Credit Insurance provided her with the peace of mind she needed to expand her business internationally.

EDC’s credit insurance options

Protecting yourself, your business and your assets with insurance can provide you with the confidence you need during stressful economic times and beyond. Whether your business is large or small, EDC has an insurance program that will suit your needs and keep you and your company protected.

Just some insurance: Select Credit Insurance

When one unpaid invoice can mean the difference between being in the red or the black, you might want to consider EDC’s Select Credit Insurance, which provides short-term coverage just when you need it. It’s an ideal solution when:

- you’re a new or occasional exporter;

- you’re exploring new markets and business relationships with a few customers;

- you need fast and simple coverage exclusively online; and/or

- you need to insure transactions under $500,000.

You can even start your application for Select Credit Insurance online.

Bigger insurance needs: Portfolio Credit Insurance

When you consider that your accounts receivable can be worth close to half your balance sheet, you may want to consider covering all of your receivables with EDC’s Portfolio Credit Insurance. It covers 90% of your losses if an American or other international customer can’t pay.

We’ve developed an easy-to-use online portal where you can access and manage your policy anytime. You can pay premiums, report an overdue payment, submit claims, and speak to our caring support staff.

Even better, when you insure your contracts, your financial institution is often more willing to lend against your invoices—up to 90% of their value. Fees are based on the type of coverage you need, the type of goods you’re exporting, your customer’s credit risks and where you’re sending your goods and services.

To find out more about Credit Insurance and how it may benefit your business, send your questions using our inquiry form.