“Understand what customers are going through”: Help from EDC took this user experience company to new markets

EDC’s Export Guarantee Program helped CubeHX secure working capital.

The challenge

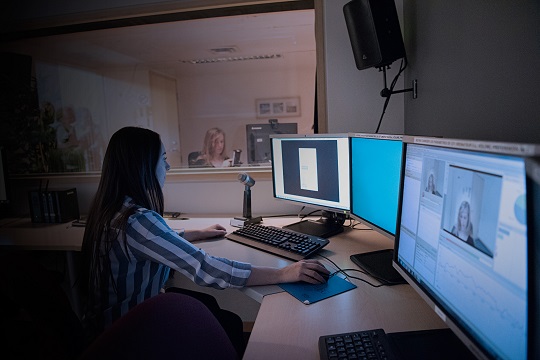

When you open the banking app on your cellphone to make an email transfer, how you’re feeling at each step of the process can be vital. Are you getting hung up on a certain step or having trouble adding a payee? Is there a specific moment when you want to give up? That’s exactly what CubeHX software can measure.

Founded at the Tech3 lab at the business school HEC Montreal, one of the largest user experience testing labs in North America, CubeHX is triangulated quantitative user experience software that gives companies insight into a user’s non-conscious reaction to their products.

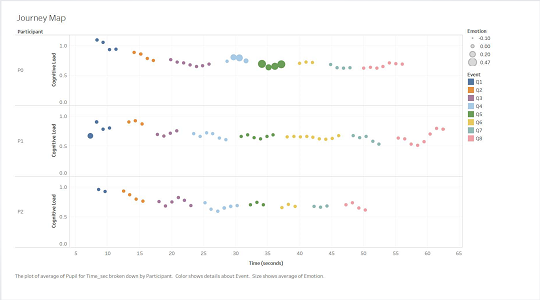

“We look at physiological measures, like emotion, cognitive load, and arousal, in order to understand what customers are going through as they’re interacting with a product,” says CubeHX co-founder Neil Fleischer.

Among its many analysis tools, CubeHX determines the problem spots, known as “friction points”, during a user experience test and creates a user journey that shows how stressed the customer is at each point, how they’re feeling and exactly how hard they’re thinking in order to accomplish the requested task.

“We want our customers to have a true 360-degree view of the human reaction to their products. If there’s friction, the customers will develop a non-conscious bias towards the product and this will affect the product’s market performance,” says Fleischer.

CubeHX’s customers work in a variety of industries and develop products that vary from financial apps to autonomous vehicles. The company’s software helps its customers determine how people will interact with what they’ve developed.

Besides eye tracking, the cloud-based software also measures facial expressions, skin conductivity and pupil dilation. This multimodal approach is called triangulation and is at the core of CubeHX technology. It allows companies to know more about what is happening to their users at any given point along the customer journey.

“At the end of the day, human beings can’t explain what is actually going on at such a detailed level, and our product is able to do that for our customers,” says Fleischer.

For CubeHX to reach a broad audience, Fleischer knew the company would have to go global. But to get started, he needed access to more working capital, so he turned to EDC.

How EDC helped

To access more working capital, CubeHX worked with its bank and leveraged EDC’s Export Guarantee Program (EGP). The EGP gave CubeHX’s bank the confidence to lend the company more since there was a guarantee on the money. “The fact that we could raise capital with the help of EDC and a traditional bank loan was unbelievable for us,” says Fleischer.

With the working capital it needs, CubeHX will be able to able to enter markets in the United States, Europe and Asia. “What I wasn’t aware of was the opportunity for us to grow this business with EDC’s help while maintaining as much equity as possible in our company,” says Fleischer. “Working with EDC allows us to take CubeHX as far as possible, with the eventual capital raise being done, if needed, at the highest valuation possible based on our initial investments.”

The fact that we could raise capital with the help of EDC and a traditional bank loan was unbelievable for us.

The result

CubeHX plans on continuing its global growth by developing leading edge technology that will transform computer to human interaction. “The world is moving towards the importance of artificial intelligence and people need to be able to trust that—understanding how customers are working with these products is what we want to optimize over the next couple years,” says Fleischer.

EDC service used

Working capital

Our Export Guarantee Program can help your bank provide you with additional access to financing.

We share the risk with your bank by providing a guarantee on the money you borrow, encouraging them to increase your access to working capital.