How wildfires disrupt Canada’s economy: Trade & infrastructure impacts

Author Details

Karicia Quiroz

Economist | Country & Sector Intelligence

William Thomas

Senior Associate | Country & Sector Intelligence

In this article:

Wildfires have become an increasingly disruptive force across Canada’s landscape. In recent years, they’ve grown in both intensity and cost—burning millions of hectares, displacing communities and significantly disrupting business operations.

As of Sept. 3, the 2025 wildfire season saw 5,065 fires scorch 8.3 million hectares, with the largest burn areas in Saskatchewan and Manitoba (3 million and 2.1 million hectares, respectively). Wildfires have become more severe this year across most regions, including Nova Scotia and Newfoundland and Labrador, which have provincewide bans on open fires in effect.

The impacts of wildfires extend far beyond the destruction of homes and businesses. They can significantly disrupt livelihoods, harm public health and reduce the productivity of communities in their path. Their impact on trade is twofold: Directly, through disruptions to a region’s exports, and indirectly, through damage to trade-enabling infrastructure.

Economic impact of wildfires

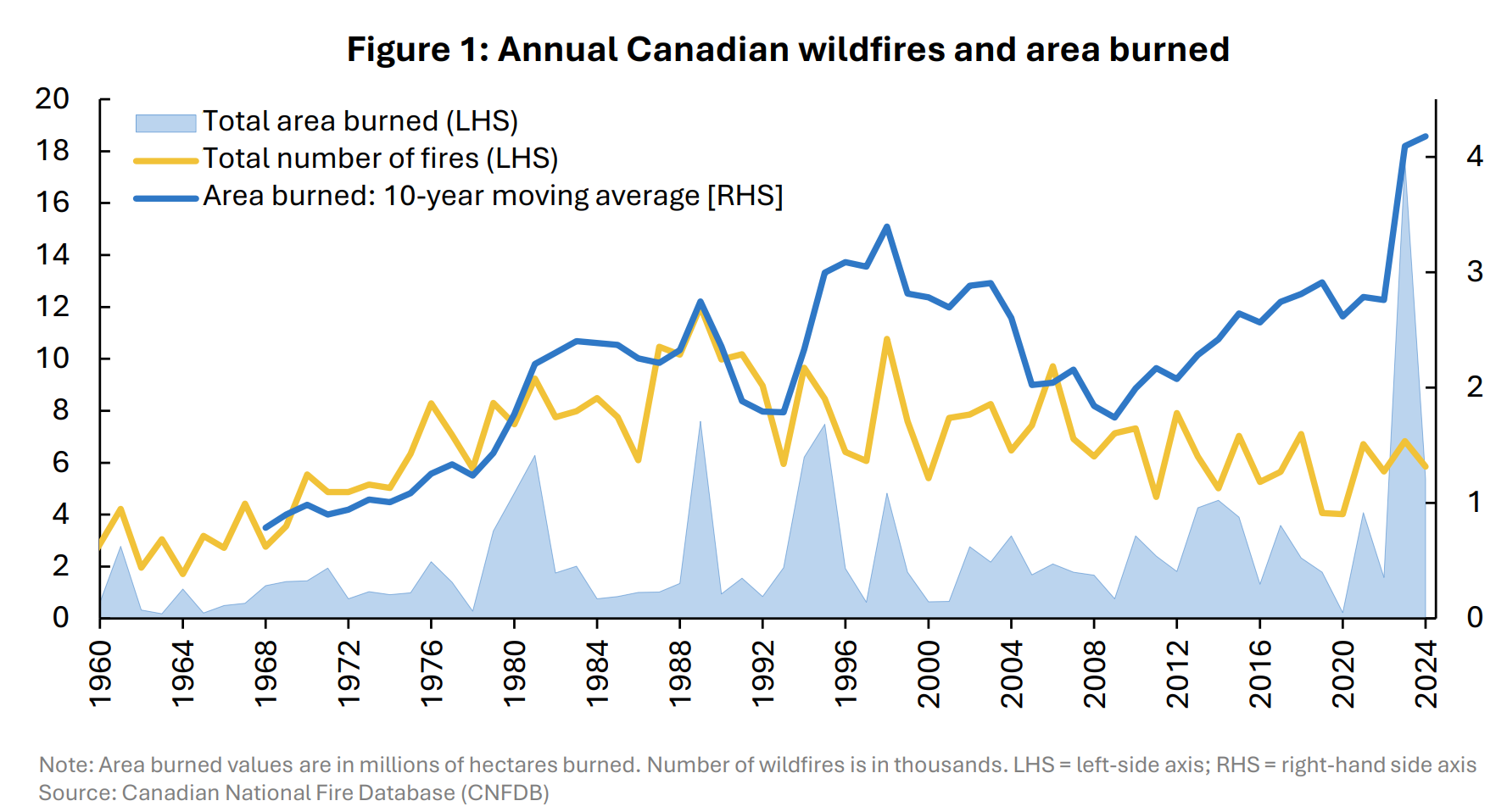

While the frequency of Canadian wildfires has declined since 1989 (see Figure 1), largely due to improved fire prevention strategies, their severity has increased dramatically. Rising temperatures and prolonged dry seasons—driven by climate change—continue to worsen wildfire conditions.

In recent years, the total annual area burned by wildfires in Canada has reached record highs. The 2023 wildfire season alone scorched approximately 17.6 million hectares—more than double the previous record in 1989 (see Figure 1). The 2025 season is continuing this trend, with more than 8.3 million hectares burned to date (as of Sept. 3), potentially making it the second-worst season on record.

You should also check out

Commodity prices can impact exporting, global trade and your business, so it’s important to be prepared for the challenges ahead.

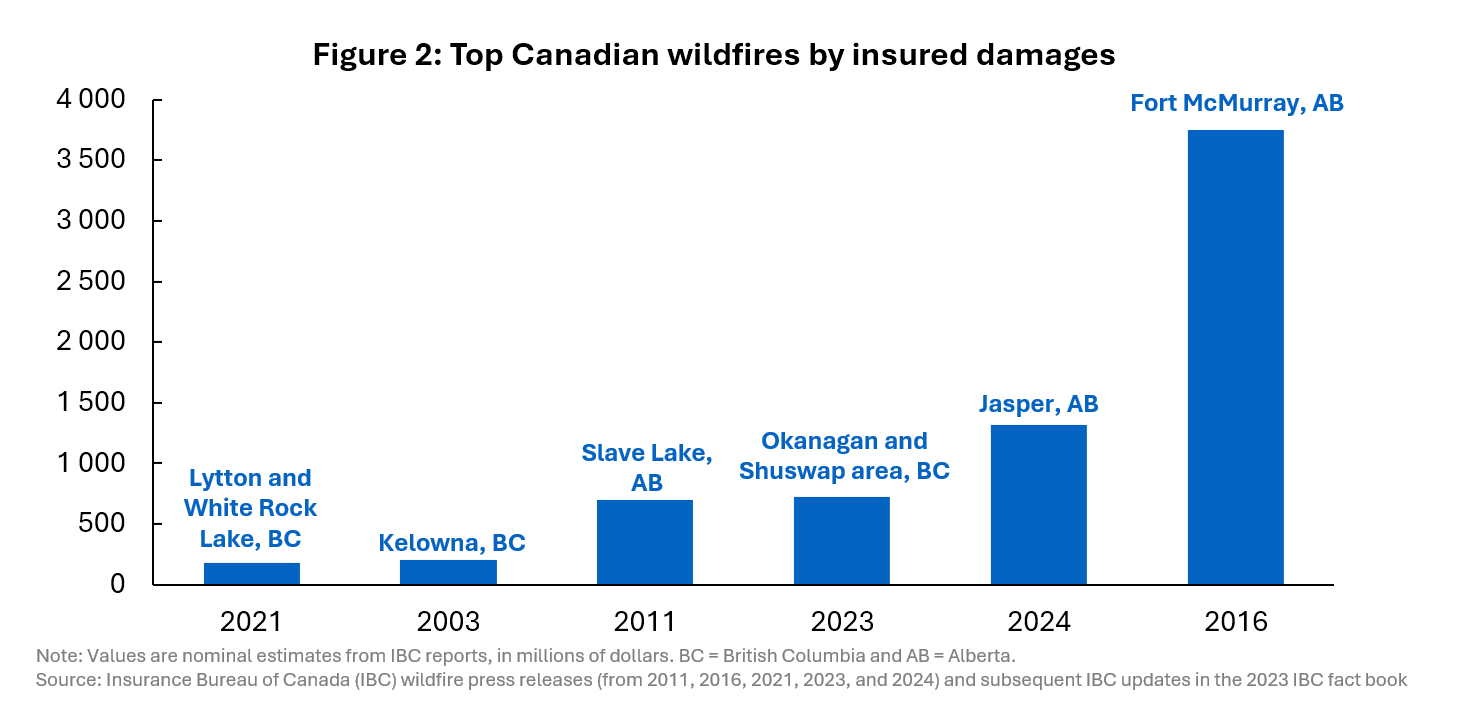

To better understand the true cost of wildfires, it’s important to focus on their localized impacts and the direct financial toll on homes and businesses, particularly insured damages. Examples include:

- The 2016 Fort McMurray, AB, wildfire, which holds the record for insured damages at nearly $3.8 billion.

- The 2024 Jasper, AB, wildfire and the 2023 Okanagan and Shuswap, BC wildfires, which rank second ($1.3 billion) and third ($720 million) in insured damages (see Figure 2).

- Over the past decade, three of the costliest wildfires on record have occurred. With the increasing severity (total area burned) of wildfires in recent years, such large-scale events may become more common.

Wildfires can negatively impact the Canadian economy in multiple ways beyond the immediate destruction of property. One of the most affected sectors is forestry, where wildfires lead to reduced supply, processing shutdowns and volatile price swings. The resulting degradation of air quality has far-reaching consequences—disrupting tourism, lowering productivity and harming community health

How wildfires disrupt Canadian exports and trade infrastructure

In addition to the direct impact on the forestry supply chain—whose processed materials (e.g., wood products, pulp, paper and paperboard) are largely export-oriented, wildfires can affect Canadian trade through at least two other channels, based on insights from wildfire subject matter experts (SMEs):

Direct disruption to production and exports in affected regions

- 2016 Fort McMurray wildfire: According to Canada Energy Regulator data, oil sands production losses peaked at up to one million barrels per day (MMb/d), equivalent to nearly $45.2 million in lost revenues per day (based on the May 2016 Western Canada Select (WCS) crude oil price). These losses led to a 14% drop in Alberta’s crude oil export volumes—from an average of 2.9 MMb/d in the first quarter of 2016 to 2.49 MMb/d in June. Fortunately, with limited damage to oil sands facilities, production and exports rebounded quickly, reaching 2.84 MMb/d by August 2016.

- 2024 Jasper wildfire: Jasper, a tourism-dependent community, has nearly 49% of its workforce employed in tourism. According to Prairies Economic Development Canada, in 2023, prior to the wildfire, Jasper National Park generated $446 million in visitor spending—80% of which came from international visitors (considered exports). The 2024 wildfire caused a sharp decline in visitation to Jasper National Park, dropping from 2.48 million visitors in 2023 to 1.14 million in 2024—a 54% year-over-year (YOY) decrease, according to Parks Canada. With 358 homes and businesses destroyed (85% of which have yet to be approved for reconstruction), Jasper has 20% fewer accommodations this season. The wildfire’s impact on tourism exports is expected to persist during the recovery and rebuilding phase.

Wildfire impacts on rail, freight and export infrastructure

- Freight volume declines: Despite the severity of the 2016 Fort McMurray wildfire, total freight volumes of goods transported from Alberta/Northwest Territories were 58.3 million tonnes (MT) in 2016—a modest 1.5% YOY decline, according to Statistics Canada’s rail industry data. However, freight volumes to the United States and Mexico fell more sharply, down 3.8% YOY to 20 MT. Fuel oils and crude petroleum were key contributors, with volumes to those markets dropping 17% YOY. In 2023, during the Okanagan and Shuswap wildfires, British Columbia’s total freight volumes rose slightly (1% YOY to 60.7 MT), but its freight volumes to the United States and Mexico fell 16% YOY, driven by a 20% drop in lumber shipments.

- Rail and port disruptions from the 2024 Jasper wildfire: The Canadian National Railway Co. (CN Rail) temporarily suspended service in Jasper, delaying goods movement to BC export hubs. Smoke conditions also caused train slowdowns, delaying grain shipments bound for the Port of Vancouver for export.

While the full extent of wildfire-related disruptions to export volumes via trade-enabling infrastructure remains unclear, this area warrants further attention given the importance to merchandise exports.

In 2024, road (39%) and rail (12%) accounted for a combined 52% share of Canada’s merchandise exports, according to Statistics Canada trade data.

Given the reliance on vulnerable infrastructure, EDC’s insights on supply chain optimization offer strategies to help exporters mitigate risks and build resilience in the face of such disruptions.

A firefighter in Cache Creek, B.C., sets a backfire to combat a raging forest blaze.

Canada’s wildfire future: Economic risks and resilience strategies

Wildfires are intensifying, with their impacts spreading across broader regions, communities and industries in Canada. The economic costs vary widely depending on factors such as duration, location and the sectors affected.

What we do know is that direct costs from Canadian wildfires—such as insured damages—are on an upward trend, driven by climate change-related conditions. Indirect impacts, including transportation and production delays, remain less studied, but are already significant and expected to grow alongside the increasing severity of wildfires.

Canada’s resource-based economy places a substantial portion of business activity in remote regions that are particularly vulnerable to wildfire risks. These areas also rely heavily on critical trade-enabling infrastructure—such as Canada’s vast rail and highway corridors—which often lack viable alternatives when disrupted.

To safeguard Canadian productivity and reduce damages, sustained investment in wildfire mitigation and infrastructure resilience is essential. Governments, communities and businesses all have a role to play in strengthening our collective response to these escalating threats.

Explore EDC’s support for Canadian exporters facing trade uncertainty and market disruptions. To contact an EDC export advisor, visit our Export Help Hub and sign up for MyEDC account.

Acknowledgements

We’d like to thank the external experts who contributed valuable insights to this piece, including key contacts within Statistics Canada’s Economic Analysis Division, who have worked extensively on GDP-at-risk estimates in wildfire-affected areas; Ryan Ness, director of Adaptation at the Canadian Climate Institute; and Thibaut Duprey, senior director at the Bank of Canada, whose research focuses on the economic impacts of natural disasters in Canada.

You should also check out

With timely insights and financial analysis from our experts, Export Development Canada can help you enter new markets, grow your global business, and reduce risks with confidence.