Canada–India services exports surge, but growth may slow

Author details

Lili Mei

Senior country risk analyst – Europe | Economic and Political Intelligence Centre

Marina Malcheva

Junior associate - Economic and Political Intelligence Centre

In this article:

India has quietly emerged as one of Canada’s largest export markets over the past decade. In 2024, India ranked as the 10th-largest destination for Canadian merchandise exports, valued at $5.4 billion. But when services are included—often overlooked in trade discussions—India jumps to No. 5 overall.

Canada and India share deep ties and more than 75 years of diplomatic relations. We exported $16.1 billion worth of services to India in 2024, up from more than $1 billion a decade earlier. This makes India the third-largest destination for Canadian services exports, behind only the United States (U.S.) and the European Union (EU).

This rapid growth raises key questions: What’s driving this significant demand without a free trade agreement? And can this momentum continue amid growing global trade uncertainty? For more market conditions and trade opportunities, please also see Export Development Canada’s Doing business in India article.

Travel services—personal and business—have long been a cornerstone of Canada’s services exports. According to Statistics Canada’s 2021 census, India was the top country of birth for recent immigrants, accounting for 18.6% of all newcomers between 2016 and 2021.

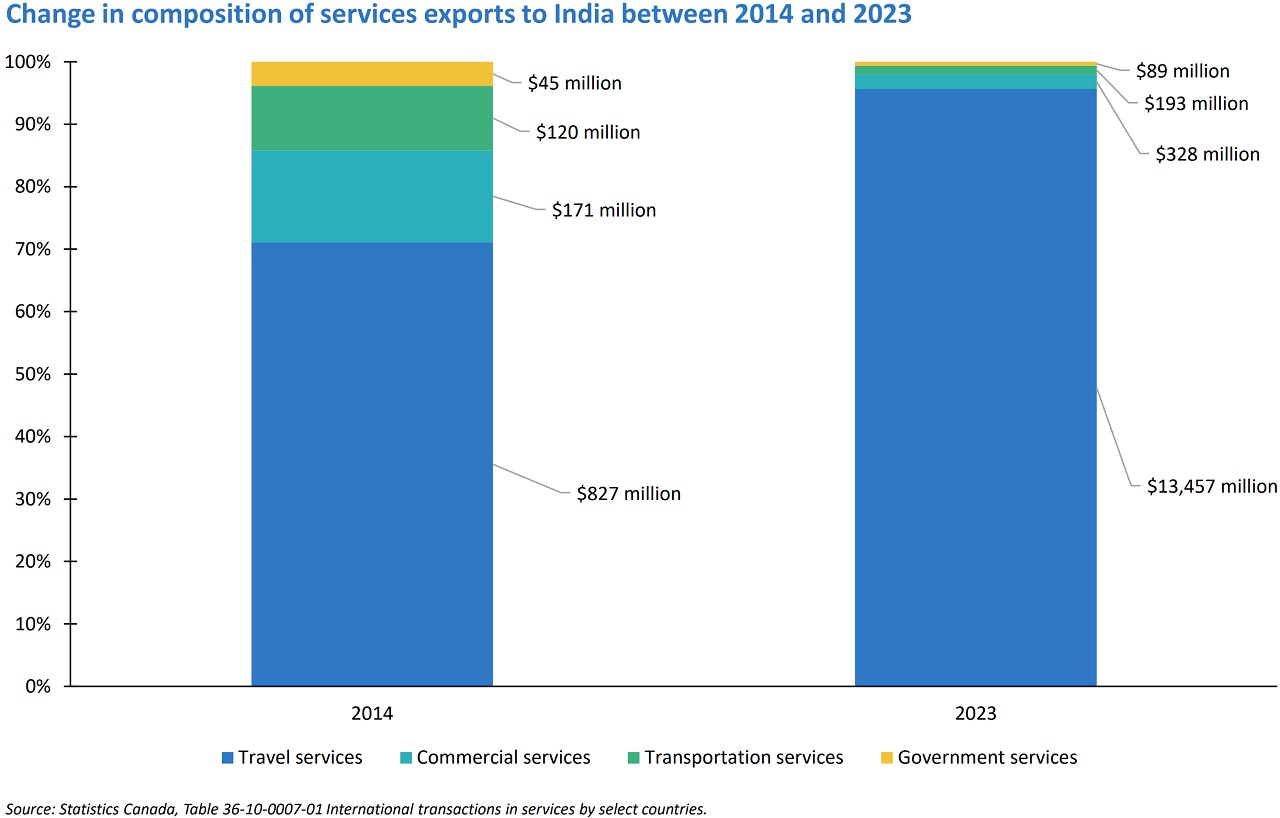

Given these strong personal ties, it’s no surprise that travel services dominate Canada’s services exports to India. In 2023, travel accounted for 96% of all service exports to India, up sharply from 60% in 2013.

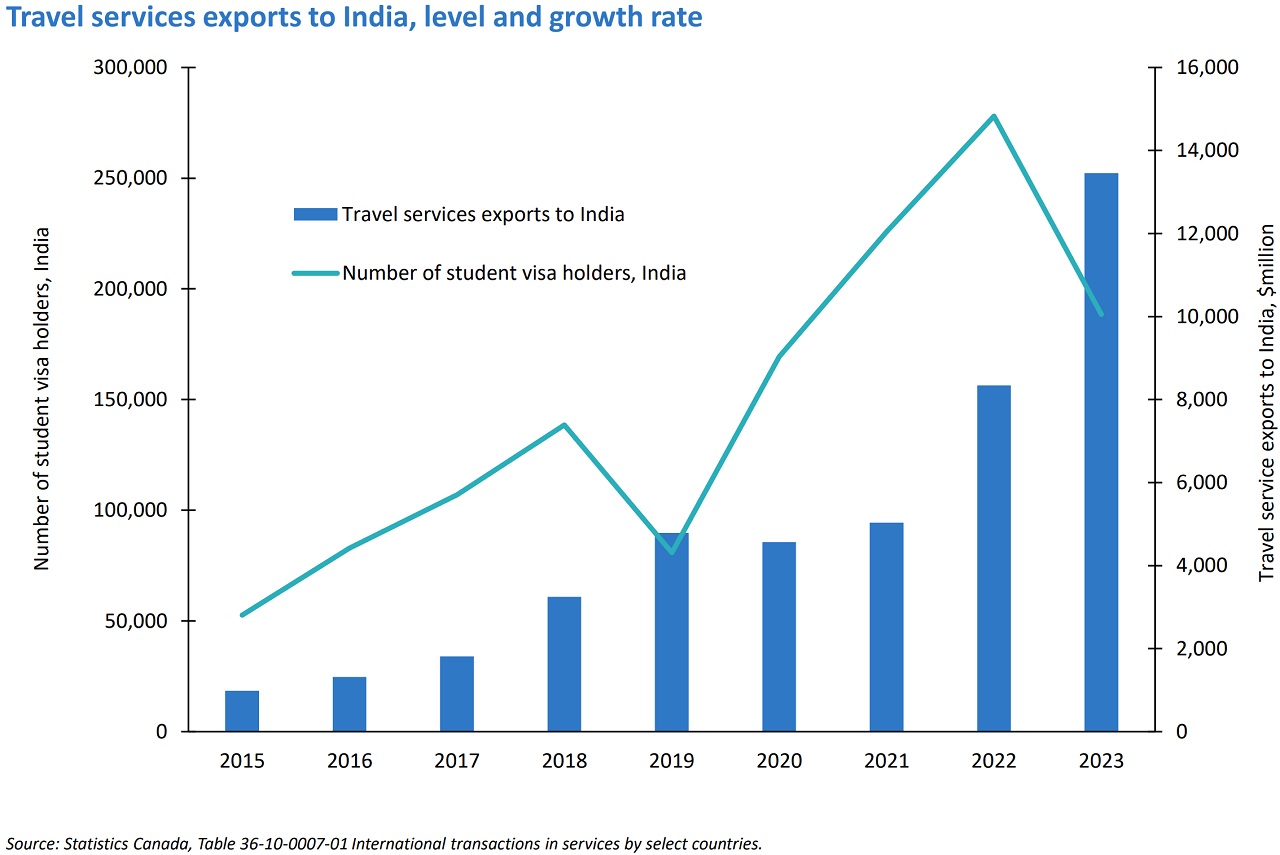

Much of this growth stems from education-related travel. Of the $13.5 billion in travel services exported to India in 2023, 88% came from spending by Indian international students in Canada. These expenditures—including tuition, housing and living costs—occurred in Canada but are counted as exports because the students are non-residents.

In nominal terms, education-related travel services exports tripled since 2018, reaching $36 billion in 2024. This surge was driven by rising costs and a sharp increase in the number of international students.

Higher tuition and living expenses have pushed up spending on housing, food and other essentials for international students. Yet despite these rising costs, Immigration, Refugees and Citizenship Canada (IRCC) data shows a substantial increase in Indian international students, likely linked to Canadian immigration policy changes since 2020.

Starting in 2022, the federal government made key adjustments to the Temporary Foreign Worker Program (TFWP) and the International Mobility Program (IMP) to attract international students. These included temporarily lifting caps on off-campus work hours and increasing the number of low-wage temporary foreign workers employers could hire.

Between 2019 and 2024, Canada saw a significant increase in student permit holders from countries, like Nigeria, the Philippines and Nepal. But India remained the largest source by far, with student numbers rising from around 138,600 in 2019 to more than 278,000 in 2023, according to IRCC data.

Based on the latest data of TFWP and IMP applicants, work permit holders from India have also surged, more than doubling since the pandemic to reach 209,000 by the end of 2024. Spending by these temporary residents contributed heavily to travel services demand.

Canada-India education exports face slowdown

However, it’s unclear whether this growth can be sustained. In fall 2024, the federal government tightened rules for international student visas and temporary foreign worker programs. IRCC data shows a 30% drop in Indian student visa holders in the first quarter of 2025 compared to the same period in 2024. Similar declines are occurring in other countries.

You should also check out

Read this Export Development Canada guide on doing business in India

While travel dominates Canada’s services exports to India, commercial services—such as financial, telecommunications and cultural services—are the leading export category globally. These account for more than two-thirds of Canada’s services exports to the U.S. and EU, but just 2% to India in 2023.

Although commercial services exports to India more than doubled over the past decade—from $171 million in 2014 to $328 million in 2023— growth has slowed since 2022. This contrasts sharply with India’s global position as a top commercial services exporter.

According to the UN Trade and Development Data Hub, India ranks among the leading developing economies in commercial services, just behind China and Singapore, with strengths in telecommunications, informatics and business services.

Canada’s services exports to India are at an inflection point. The extraordinary growth of recent years—driven largely by education-related travel—is likely to moderate due to policy changes. Still, the deepening personal and economic ties between Canada and India present opportunities to diversify and expand our trading relationship.

Explore EDC’s market intelligence for the Indo-Pacific to identify emerging sectors and strategic opportunities.

Acknowledgments

We extend our sincere thanks to Alec Forbes of the International Accounts and Trade Division at Statistics Canada for the generous support. The data and insights provided were instrumental in shaping this analysis and deepening our understanding of Canada’s evolving services export dynamic.

You should also check out

With timely insights and analysis from our experts, Export Development Canada can help you enter new markets, grow your business and reduce risks with confidence.