Canada’s trade-enabling infrastructure under strain

Author details

Prerna Sharma

Senior economist, Economic and Political Intelligence Centre (EPIC)

In this article:

Canadian governments have renewed their focus on expanding and supporting trade. As a large country with vast resources and industries, improving Canada’s trade-enabling infrastructure is essential to make shipping products more efficient and competitive—and to position Canada for future growth.

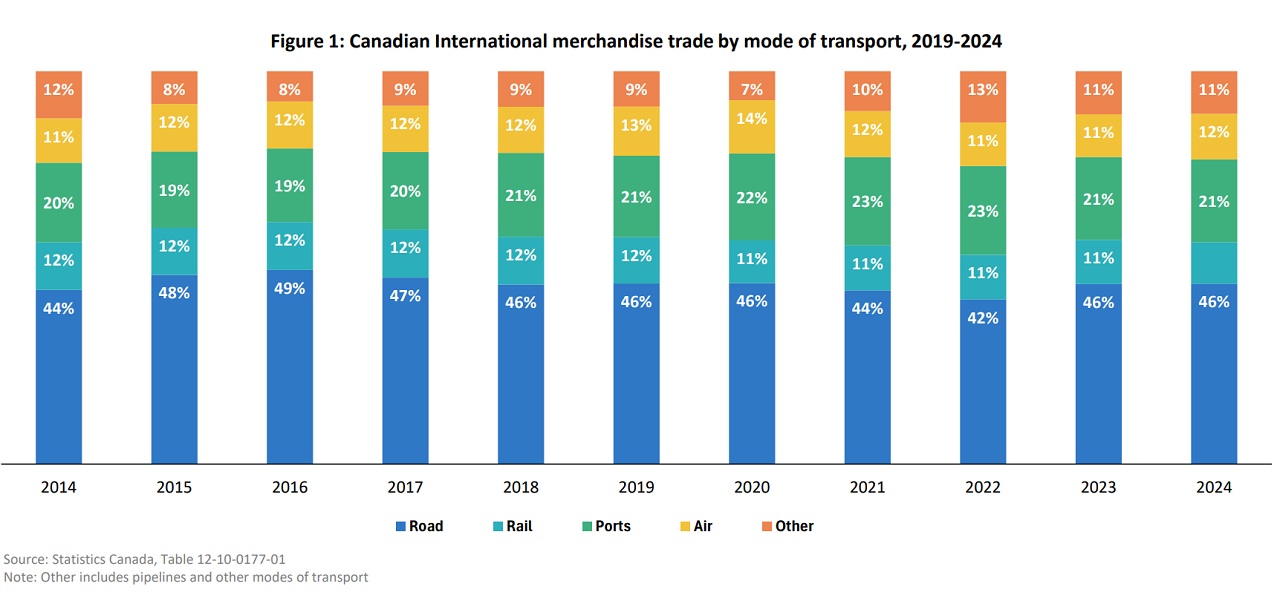

Canada’s trade has long depended on road transportation—particularly to and from the United States—because of our shared border and economic integration (See Figure 1). This reliance has led to significant underinvestment in infrastructure that supports high-volume trade through ports, railways and airports. Note: This analysis doesn’t cover pipelines, which are notable parts of trade-enabling infrastructure.

- Lack of investment: Canada invests less in infrastructure than many Organisation for Economic Co-operation and Development (OECD) peers. In 2018 (latest year available), Canada invested 0.6% of its gross domestic product (GDP) on infrastructure, compared to an average of 0.72% in France, Germany, Italy and Japan. Over the past four decades, the ratio of Canadian infrastructure investment to trade volumes has declined. Transport Canada estimates that $4.4 trillion in trade-enabling infrastructure investments will be needed by 2070. Canada’s infrastructure deficit is estimated between $110 billion and $270 billion.

- Structural and regulatory challenges: Productivity growth in the Canadian transportation sector has plateaued since 2010, with declining logistics performance and aging infrastructure. Regulatory complexity and fragmented governance add inefficiencies and discourage private sector participation.

- Consolidation of key players: Limited competition and slow regulatory processes have led to consolidation among major operators, including the Canadian National Railway (CN) and Canadian Pacific Kansas City (CPKC).

- Supply chain bottlenecks: Congestion and poor maintenance in key export regions disrupt the movement of goods by air, rail, marine and roads.

You should also check out

Canada’s export growth depends on trade-enabling infrastructure upgrades.

Canada’s trade transportation infrastructure includes rail, road, port and air. Synchronizing operations across these modes, along with support services such as transloading and warehousing, is critical to building a connected supply chain.

Road transport and trade routes

Canada has more than a million kilometres of roads, most part of the National Highway System. Export goods shipped by road include:

- automobiles and auto parts

- machinery and electrical equipment

- metals

- chemical products

- plastics and agricultural

- food products

The U.S. remains Canada’s largest trading partner, making roads a major trade route. In 2023, most road exports went to the U.S., driven by

- Integrated supply chains: Many trucked goods, especially auto parts, cross the border multiple times before final assembly. The Quebec-Windsor corridor is the busiest trucking route.

- Proximity and cost efficiency: The low value-to-volume ratio of goods like lumber and steel makes trucking to the U.S. more cost-effective than overseas shipping.

- Trade policy uncertainty: U.S. tariffs on steel, aluminum, copper, lumber and autos have impacted Canadian truck exports, forcing supply chain adjustments.

Traffic jams at major highway interchanges near ports, airports and distribution centres add delays. With aging infrastructure, 15% of Canada’s roads are in poor or very poor condition, requiring more than $300 billion to replace or upgrade. Transport Canada estimates $3.3 trillion will be needed for new highways and roads by 2070.

Rail infrastructure and export capacity

Rail is Canada’s primary mode for bulk commodities and intermodal imports (goods that are shipped using multiple means of transport). In 2024, rail handled 11% of Canada’s total export value and about 50% of total export volume (tonnes).

Canadian rail networks face significant capacity constraints and infrastructure gaps, including limited links to ports and airports and underdeveloped infrastructure outside urban centres. Insufficient warehousing and transloading capacity cause congestion at port container terminals, affecting rail lines. Transport Canada estimates $284 billion is needed to upgrade railways by 2070, with an annual investment gap of $2.8 billion.

Port infrastructure and export logistics

Canada has 17 ports managed by port authorities, primarily used to export bulk cargo such as minerals, vegetable products, chemicals, metals and wood and wood products. Between 2017 and 2024, about 19% of exports moved through ports.

However, port capacity lags behind other industrialized nations, falling below the OECD average and countries such as China, the U.S., Singapore and Korea. Long wait times lead to operational inefficiencies and supply chain issues. The Association of Canadian Port Authorities projects an infrastructure investment gap of up to $21.5 billion by 2040.

Air cargo and airport infrastructure

Canadian National Airports System (NAS) includes 26 airports. Air cargo is used for high-value goods, specialized components and time-sensitive products like live fish. E-commerce deliveries are primarily shipped by air through express cargo carriers, like DHL, UPS and FedEx. The pharmaceutical sector, too, relies heavily on air transport to move drugs and vaccines under strict and regulated storage conditions.

Tourism and business travel are significant service exports supported by international flight routes. In 2023, air freight made up 30% of the value of Canada’s non-U.S. cargo traffic, mostly transported through passenger aircraft.

Canadian airports face poor connectivity with commodity sourcing locations, especially in remote communities. Route disruptions post-pandemic have reduced service. Capacity constraints on runways and facilities, along with limited supportive infrastructure, including cold storage and specialized equipment, further hinder efficiency.

Investing in Canada’s trade-enabling infrastructure—seaports, railways, highways, roads and airports—is essential to building a more productive, competitive economy of the future. As a trade-dependent nation, Canada needs infrastructure that connects industries and supports exports to grow our GDP, create jobs and strengthen communities.

Improving operational efficiency and building logistics support facilities can unlock capacity and boost Canada’s competitiveness in global markets. Modernizing these systems now will ensure Canada remains resilient and ready to seize opportunities in an increasingly complex global trade environment.

You should also check out

With timely insights and analysis from our experts, Export Development Canada can help you enter new markets, grow your business and reduce risks with confidence.