MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

Learn how credit insurance safeguards your business and opens doors to new markets.

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

Discover resources for smarter exporting

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

With the benefit of initial indicators, we now know that the COVID-19 lockdown measures—imposed to save lives and contain the deadly virus—hit the global economy very hard. The world is living through the sharpest and most synchronized downturn since the Great Depression.

But there’s still so much we don’t know about this pandemic’s impact on Canadian businesses. Given the rapidly-changing developments and delays in releasing official economic statistics, EDC conducted an online survey in April 2020 to collect timely insights into the economic challenges facing Canadian exporters due to COVID-19. Of the 114 respondents, we were able to get a better understanding of the initial impacts on their sales in both domestic and international markets, company operations and supply chains.

Here are 10 key findings from our survey:

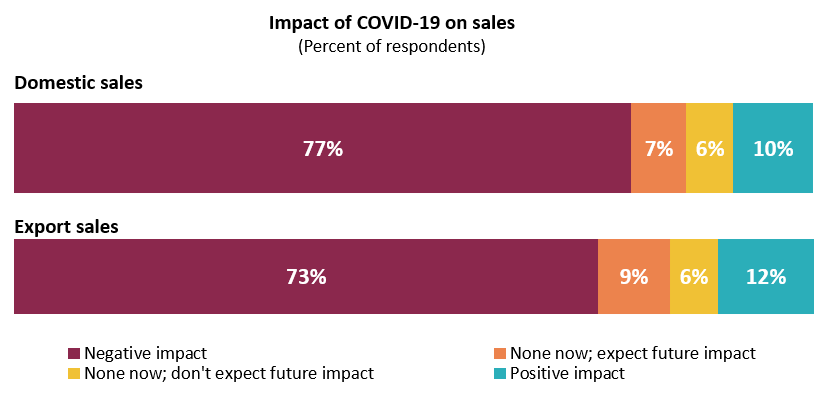

Few companies are unaffected. Roughly three-quarters of respondents report a negative impact on their sales (both domestic and exports), while a much smaller share have seen a positive result.

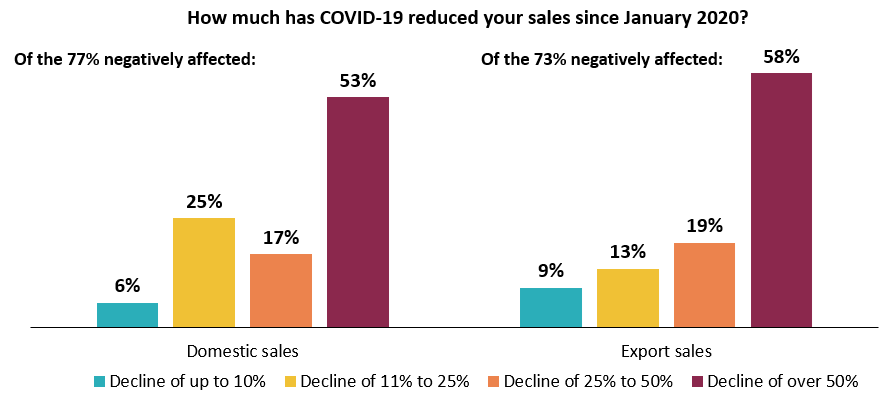

Our survey responses imply a drop in domestic and export sales of roughly 15% from January to mid-April. The largest negative impacts are concentrated among the more than one-in-three respondents, who reported sales declines of more than 50%.

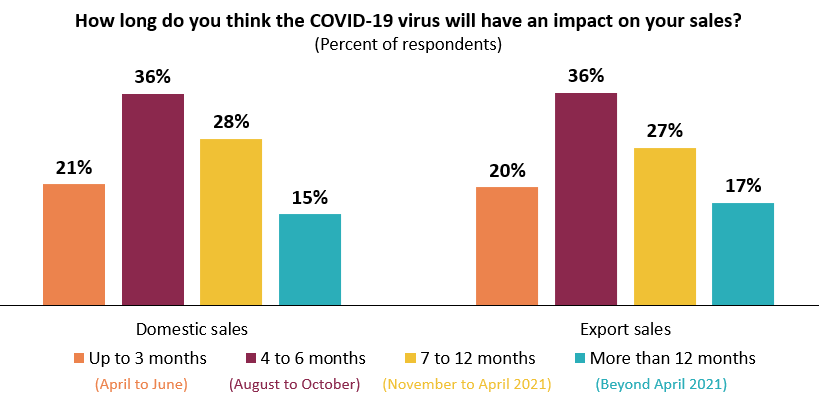

While there are a wide range of estimates on the duration of these impacts, most respondents expect sales impacts to last more than three months, remaining with us into the fall and perhaps even into 2021.

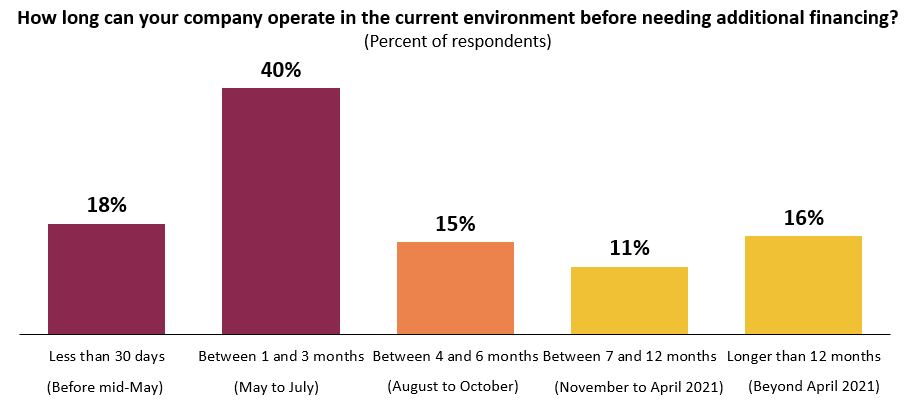

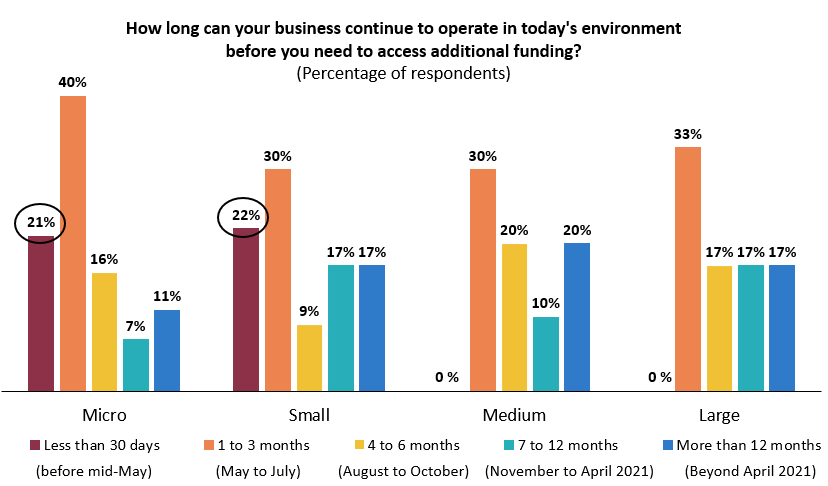

Nearly one-in-five respondents report additional financing needs within 30 days, while 58% report additional financing needs by July.

The smallest business in the survey (including “micros” and “small” defined as annual sales of less than $2 million, and $2 million to $10 million, respectively) reported more immediate financing needs than larger firms.

Given these responses, it’s no surprise that more than one-in-five respondents cited COVID-19 as an existential threat, with genuine worries their business may not be operating in the next six months.

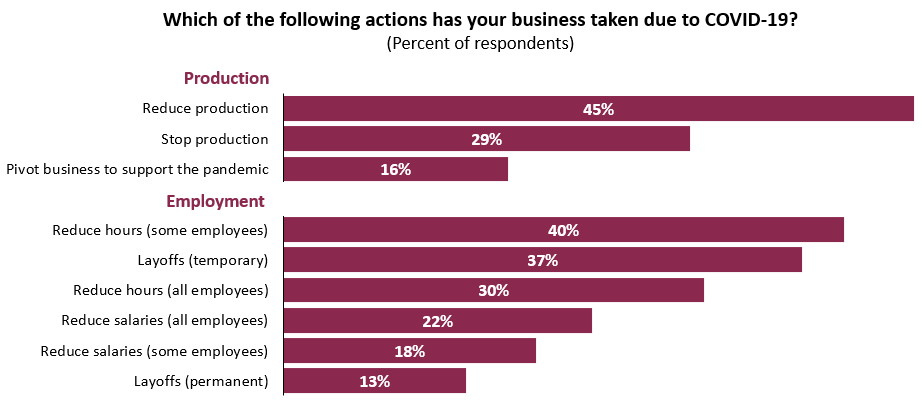

Various actions have been taken, including stopping or reducing production and hours worked, laying off employees, and pivoting to online and in-demand products. Given financing pressures, companies are already reaching out. Almost half of respondents (47%) sought support to minimize the effect of COVID-19 on their business.

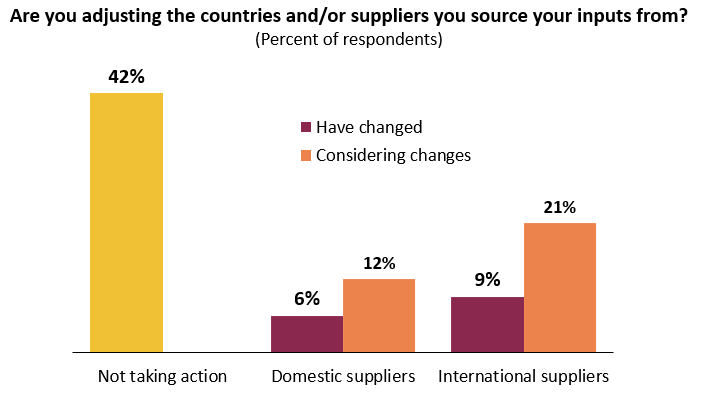

Export activity is being hampered by contract cancellations and business delays, cash flow concerns and travel restrictions, among other things. Supply chain concerns cited include delivery date uncertainty, slower shipments, suppliers’ shutdowns and production delays. Some respondents have already changed suppliers (6% domestically; 9% internationally), while roughly twice as many are considering making supply chain adjustments.

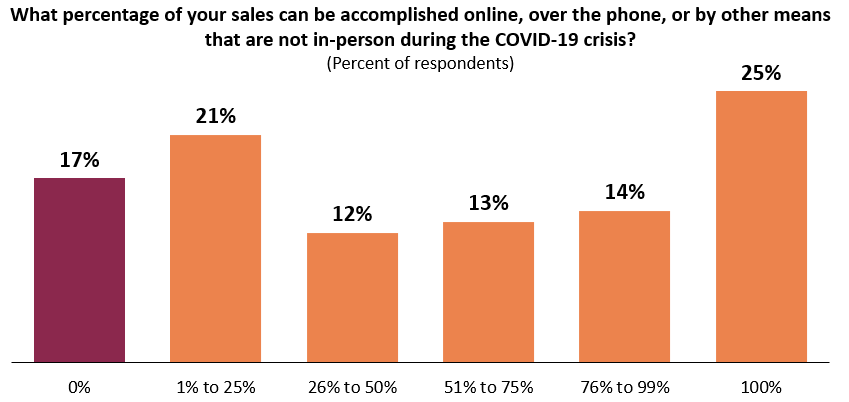

Most businesses can accomplish at least some of their sales online or by other not-in-person means, with one-quarter able to meet all sales online. Conversely, about one-in-five respondents can’t accomplish any sales online—and these firms are being hit much harder; those with well-developed online capabilities have been able to mitigate sales losses.

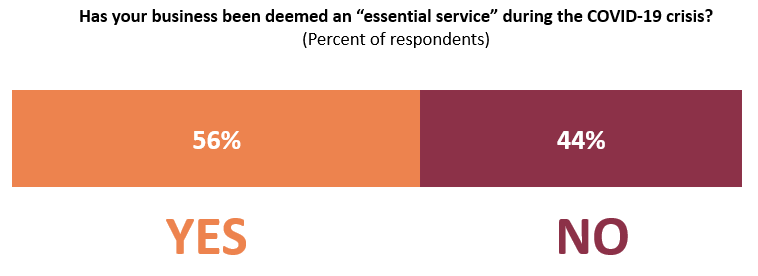

In our survey, 56% of respondents reported being deemed an “essential service” defined by their provincial governments. However, these responses weren’t that different statistically. This suggests that even though these businesses could remain open, the “new normal” of physical distancing is still significantly dampening business.

This was an online survey of EDC’s Research Panel provided a self-selected sample of 114 respondents who are knowledgeable decision-makers about their company’s activities. The businesses surveyed mirror the overall Canadian business population by firm size, region and sector. Given our sample size, the survey’s margin of error is larger than usual: +/- 9.1% with a 95% confidence interval.

EDC’s survey was conducted from April 9 to April 17, 2020. During that time, various COVID-19 containment measures were in place in Canada and abroad, including restrictions on non-essential business operations, shelter-in-place advisories, school closings and travel restrictions.

As the world takes drastic actions to contain the spread of COVID-19 to save lives, initial indicators are showing these necessary lockdowns are hitting the global economy hard. As an Export Development Canada (EDC) Research Panel study shows, few companies have been left unaffected.

Globalization is evolving, not reversing, as technology and trade keep the world connected.

Keep track of the international markets that matter to your business. Get the latest financial and macroeconomic information for both developed and emerging markets.

EDC’s Top 10 global risks reveal rising geopolitical, trade and economic threats for exporters in 2026.

With growing risks, Canadian companies face new challenges. EDC’s Global Economic Outlook offers insights to help you make better business decisions.

Canadian exporters face tariffs, trade uncertainty and uneven growth across key sectors