Six top trends to watch in 2022

As we kick off a new year in a world still reeling from the pandemic, Canadian companies need to remain adept at switching gears in order to rapidly respond to customer demands. While significant challenges remain, businesses should reflect on the takeaways of 2021 when monitoring the key trends that could impact their export strategies. As COVID-19’s Omicron variant causes another wave of serious global infections, this could lead to a shortage of workers, higher prices and more slowdowns, and exacerbate pressure on already stressed-out supply chains—possibly jeopardizing the strength of the recent economic recovery.

Here are six top trends EDC Economics will be watching in 2022.

1. COVID-19 and the emergence of new variants

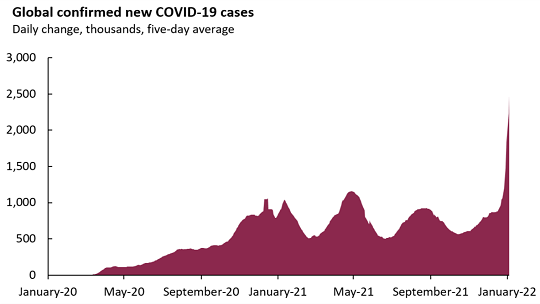

There’s no doubt that COVID-19 continues to disrupt the global economy, even though the game-changing vaccines are now widely available. The Delta and Omicron variants have kept case numbers high and are now the dominant strains of transmission. Developed markets were able to vaccinate their populations earlier than those in the emerging markets, but we’re still seeing a surge in cases, particularly in Europe, due to the new variant. Countries reimposed public health restrictions to curb the pandemic’s fourth wave and continue to distribute booster shots. Nonetheless, about 50% of the world population is fully vaccinated against COVID-19—a significant milestone of progress compared to March 2020. But as long as COVID-19 remains prevalent, disruption is evident, though it shouldn’t reverse the progress made to date.

2. Inflation risks

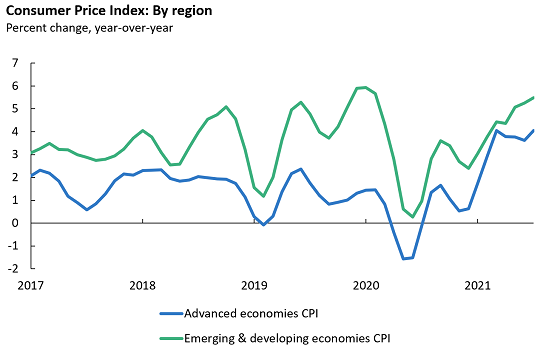

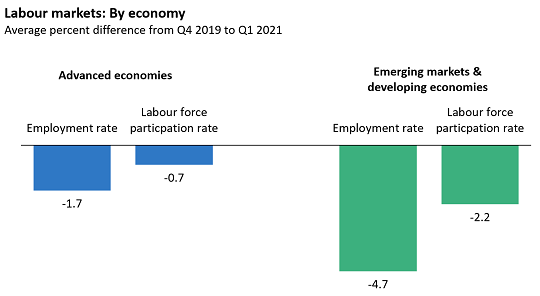

Central banks across the world continue to closely monitor inflation risks. As the economic recovery brings employment and output back to pre-pandemic levels, the need for a pandemic-level stimulus lessens. The recovery throughout 2021, and the rise in consumer spending, resulted in supply bottlenecks leading to rising inflation pressures in both advanced and developing economies. As cases rise, consumers shift away from spending money on services toward goods, which drives up demand for inputs and causes pressure on supply chains. These effects are likely to persist into 2022, causing most central banks to acknowledge the likelihood of high inflation for longer. Along with a nearly recovered labour market, central banks across the developed world have hinted towards fast-forwarding their rate hike schedule to rein in prices.

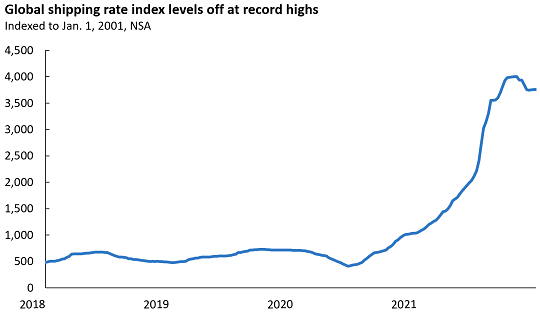

3. Stretched supply chains tested by the consumer

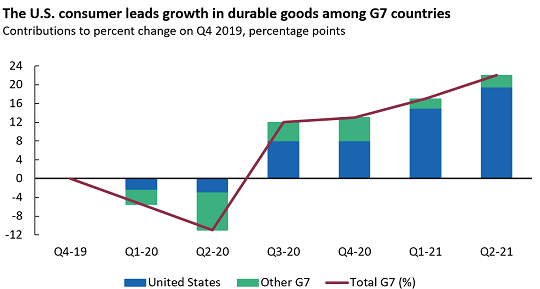

A surge in fiscal stimulus from governments around the globe gave great power to consumers everywhere. This was particularly true in the United States where the substantial fiscal payments gave a significant impetus to spending on consumer durables, which consequently contributed to the global economy. The U.S. consumer accounted for nearly 20% of spending on durable goods in Q2 2021. The auto industry sector is under tremendous pressure as the global semiconductor shortage continues to wreak havoc and is behind record high prices for new and used cars. This large force of demand pushed supply chains to react swiftly after a year of being idle. Shipping prices took off and severe delays at key ports grew stronger. Supply is very fragile, but not insufficient to meet global demand. We’re facing abnormally strong demand, which has launched the global economy into overdrive. Consequently, delivery times in Asia, Europe, and North America continue to rise.

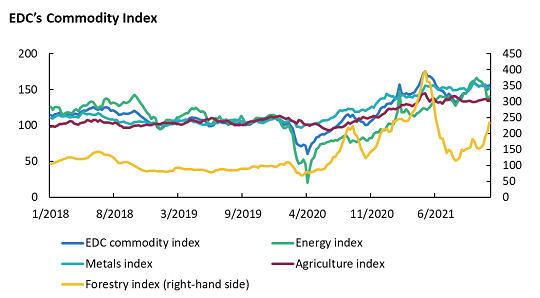

4. High prices leading growth in commodity exports

Various global supply constraints have made it difficult to keep up with recovering demand for commodities across the board, making much of the export growth seen in the past year tied to higher prices. Strong demand for lumber during the initial lockdown in 2020 grew as the global housing market picked up steam. Later in the year, natural gas shortages in Europe drove prices upwards. After historic crude oil supply cuts in 2020, the rise in oil production couldn’t keep up with the rebound in transportation activity. This trend continues. As the impact of the supply bottlenecks ease, much of the outlook for 2022 is tied to an expected price correction.

You should also check out

EDC interactive tool offers economic insights on Canada’s Top 75 trading partners.

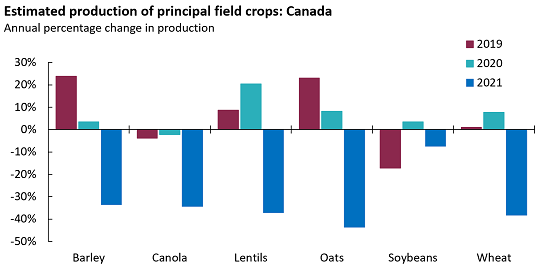

5. Extreme weather conditions will impact agriculture exports

While Canadian agriculture exports benefited from higher prices in early 2021, the outlook for 2022 is dampened by recent extreme weather conditions, particularly for crops. During the 2021 growing season, Prairie farmers struggled with one of the worst droughts in Canadian history, causing crop production for our top agricultural exports to nosedive. Compared to 2020, production across all principal field crops decreased by 29%. 2021 production levels are closely tied to this year’s potential export level. With such a drastic drop in production levels, export markets will have to contend with the gap in supply in 2022.

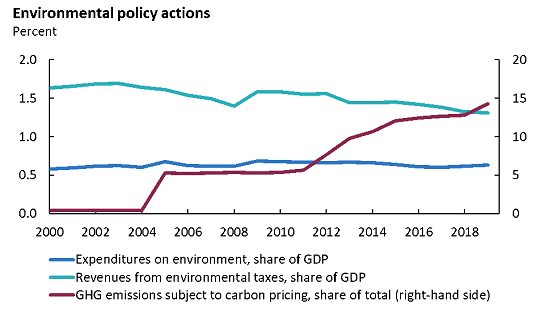

6. Climate change commitments

Climate change dominated headlines throughout 2021. COP26, the United Nations Climate Change Conference, which was attended by more than 120 world leaders and about 30,000 delegates, shone a spotlight on the alarming ineffectiveness of past actions toward meeting previous climate targets. With rising greenhouse gas emissions, monitoring the summit’s recent deals on ending deforestation and phasing out some forms of fossil fuels will be critical. Commitments on carbon neutrality, set with ambitious deadlines, will play an important role in policy, investment and infrastructure.

While progress was made in 2021 despite COVID-19, risks to the outlook remain. Canadian businesses should continue to monitor the global economic environment. As always, do your research and look to diversify your export markets.