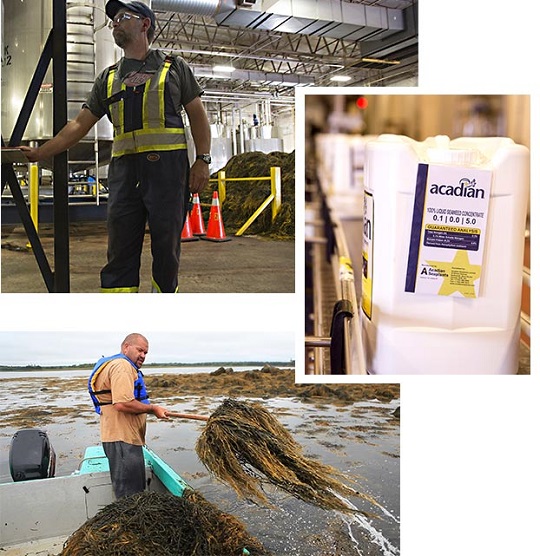

Acadian Seaplants Limited (ASL) is a biotech company and the largest independent manufacturer of marine plant products of its type in the world.

Marine plants have become an increasingly popular key ingredient in many food and household products such as beer, ice cream, chocolate milk and toothpaste, as well as in agricultural products such as animal feeds, crop biostimulants and other commercial products.

The company started out as a small-scale, seasonal seaweed harvester and eventually grew to open manufacturing plants in Nova Scotia, New Brunswick, Prince Edward Island, Ireland and Scotland.

Acadian Seaplants was an export company from the beginning. The company realized that the big markets for their class of products required them to export to grow its business, first to the U.S. and Japan, and then farther afield.

“In the early stages, we would identify potential customers and go visit them,” says President and CEO, Jean-Paul Deveau. “As we grew, we were able to hire employees based in those countries, and today we export to more than 80 countries and have employees in Canada, the U.S., Mexico, Chile, Brazil, Colombia, India, China, South Korea, Ireland, Scotland and Japan.”

However, along with the benefits of international growth came challenges. These included the risk of nonpayment, a need for financing for expansion, and currency fluctuations.