China’s EV dominance: What it means for Canada’s emerging industry

Author Details

Karicia Quiroz

Economist | Country & Sector Intelligence

Gabriel Vermette

Senior country risk associate | Economic and Political Intelligence Centre

In this article:

Since 2008, China has rapidly become a global automotive export powerhouse, reshaping the competitive landscape with its strategic pivot to electric vehicles (EVs). Today, China is the world’s leading EV producer and exporter—despite producing more than it consumes domestically.

With cheaper Chinese EVs flooding global markets, rising U.S. trade tensions and slowing EV demand, Canadian automakers face growing uncertainty. Still, long-term global and North American demand is expected to rise, offering some support for Canadian EV production and exports.

According to the International Energy Agency (IEA), China produced 12.4 million EVs—battery (BEVs) and plug-in hybrids (PHEVs)—in 2024, accounting for 70% of global output. Of those, 1.25 million were exported, nearly 40% of global EV exports. China’s EVs are the most affordable in the world, with nearly two-thirds priced below conventional vehicles.

China’s early-mover advantage and aggressive industrial strategy helped scale its manufacturing capacity. Between 2009 and 2023, China invested US$230.9 billion in EV-related policy, according to the Center for Strategic & International Studies (CSIS). This spending “fundamentally altered the playing field” between China and other global producers.

China is a leader in EV battery production—a critical component that represents up to 40% of an EV’s cost. Its dominance in lithium iron phosphate (LFP) battery technology, which is cheaper than the nickel-manganese-cobalt (NMC) batteries common in western markets, gives China a significant cost advantage.

Going further upstream, China leads in refining EV battery minerals globally. In 2024, China refined 80% of the world’s cobalt supply, 61% of lithium and 30% of nickel, according to Wood Mackenzie, a global research and consultancy firm. This refining capacity is a key enabler for China’s battery industry, allowing for cost-effective, large-scale production and reducing reliance on external suppliers.

Despite its global success, China’s domestic EV market is facing headwinds. With 129 EV brands competing and state-led support fuelling overproduction, prices and profitability have declined. To offset this, Chinese EV manufacturers are ramping up exports—raising concerns about “dumping” in key markets, like the European Union (EU)—China’s top export market.

According to United Nations Commodity Trade (UN Comtrade) data on China’s EV (passenger BEVs and PHEVs) exports:

- In 2024, China’s EV exports to the EU fell 10% year-over-year (YOY) to nearly US$13 billion, partially due to rising trade tensions and impending EU tariffs of up to 35% on Chinese battery electric vehicles imports. Still, the EU remained China’s top export destination, accounting for 32% of total EV exports in 2024.

- China accelerated exports to emerging markets, like Brazil, where EV exports rose 94% YOY to nearly US$3 billion in 2024, ahead of Brazil’s reintroduced EV tariffs—starting at 10% in 2024 and rising to 35% by 2026.

- To lower the negative impact from EV tariffs in export markets, China also increased its exports to other markets in 2024. For example, exports to Mexico quadrupled from US$332.7 million in 2023 to US$1.3 billion in 2024, while exports to the United Arab Emirates (UAE) rose 94% YOY to US$1.6 billion.

As China’s EV exports expand and global trade dynamics shift, Canada’s automotive sector must navigate a more complex and competitive environment. The following section explores how these developments are affecting Canada’s EV transition and broader automotive landscape.

Read Export Development Canada’s (EDC) Global Economic Outlook for additional insights on how tariffs and trade tensions are shaping global economies and sectors.

You should also check out

With growing risks, Canadian companies face new challenges. EDC’s Global Economic Outlook offers insights to help you make better business decisions.

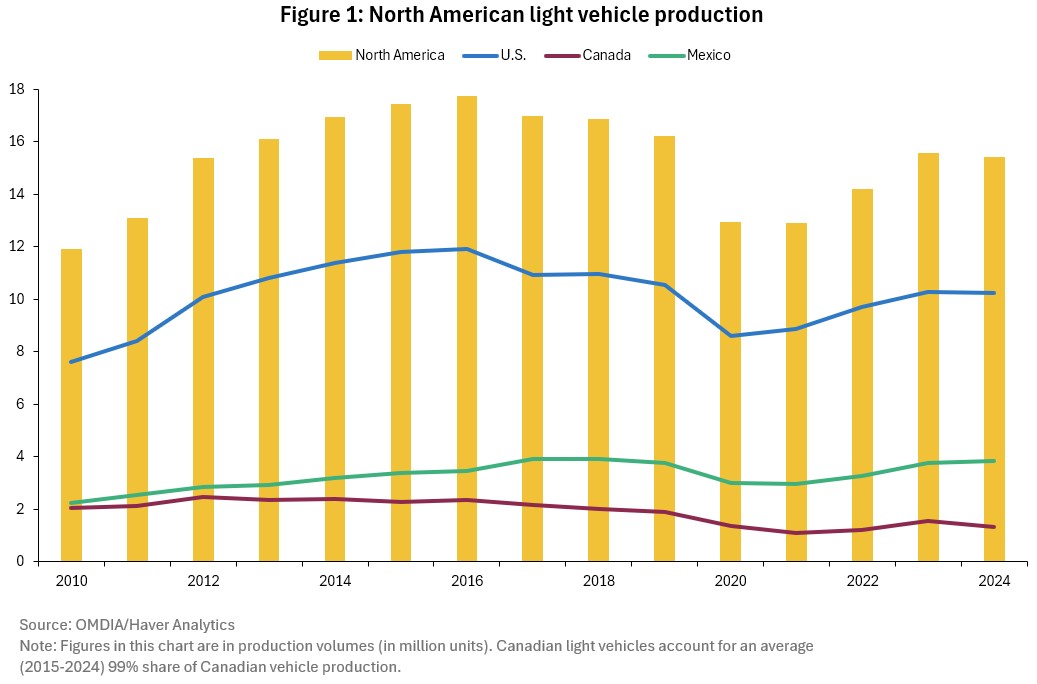

Canada’s automotive sector is grappling with declining production, shifting supply chains and the global transition to EVs. Over the past decade, Canadian light vehicle production (cars and light trucks) fell from 1.9 million units in 2019 to 1.3 million units in 2024, in contrast to more resilient production growth in the U.S. and Mexico (see Figure 1).

EV adoption is also expected to slow in Canada and the U.S., with U.S. EV uptake projected to decline in the fourth quarter of 2025 and early 2026. This slowdown is largely attributed to the expiry of U.S. EV policy supports and weakening consumer demand. Interestingly, U.S. EV sales set a record in the third quarter of 2025,with 438,487 electric vehicles sold—up 29.6% YOY—according to Cox Automotive.

However, this surge was largely driven by buyers rushing to purchase EVs before the Sept. 30 expiry of the U.S. federal EV tax credit, a policy described as a “key catalyst for EV adoption.”

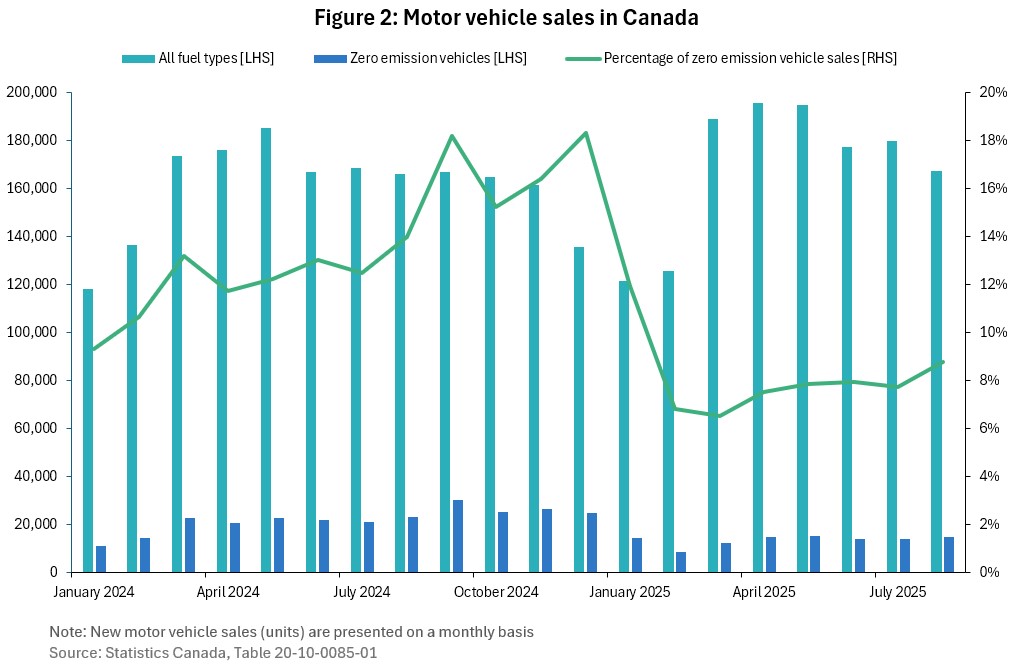

In Canada, Statistics Canada reported that 44,084 zero emission vehicles (ZEV) were sold in the second quarter of 2025, marking a 32% decline compared to the same period a year earlier. As of this writing, July and August 2025 figures indicate a continuing downward trend, with YOY drops of 34% and 37%, respectively, in ZEV sales (see Figure 2).

Project delays, cancellations and restructuring have exposed the fragility of Canada’s automotive industry amid the EV slowdown and uncertain U.S. trade environment. With 93% of Canadian motor vehicles and parts exported to the U.S., the sector is deeply tied to American policy. Any U.S. policy changes—like the recent expiry of the U.S. federal EV tax credit—will have ripple effects across Canada.

While Canada has certain opportunities in the EV battery supply chain given its abundant reserves of EV battery minerals (e.g., cobalt, lithium, nickel, graphite), the U.S.’s uncertain trade and EV policy environment will cloud this outlook in the short and medium term.

For Canada to better capitalize on its EV battery minerals advantages, investment in getting more mines to production and domestic refining and processing will be essential. While well-positioned as a supplier of raw critical minerals, scaling up refining capacity is crucial to capturing more value and reducing reliance on foreign processing.

Although U.S. developments will likely negatively impact Canada’s short- and medium-term EV outlook, the Canadian long-term EV outlook remains cautiously optimistic. The IEA expects electric cars to take 40% of all car sales by 2030, and with North American automakers continuing to invest in EVs for the long term (e.g., Ford’s recent US$5 billion investment in EVs and EV batteries), this implies potential long-term opportunities for Canada.

Electric mobility could also account for 61% of Canada’s transport sector’s gross domestic product (GDP) and 58% of the sector’s employment by 2040, based on Electric Mobility estimates. Importantly, Canada’s EV battery industry is poised for long-term growth, supported by abundant EV battery minerals and major battery manufacturing investments (e.g., Volkswagen’s PowerCO battery gigafactory in St. Thomas, ON).

Further developments in mineral-rich regions such as Ontario’s Ring of Fire and increased government efforts in advancing major projects in critical minerals extraction and refining will provide further support for Canada’s long-term competitiveness in the EV battery supply chain.

EDC offers a range of solutions to support Canadian companies in their global expansion—from market intelligence to strategic business connections. Our sector-focused teams bring deep expertise and local knowledge to help exporters navigate international markets.

You should also check out

With timely insights and financial analysis from our experts, Export Development Canada can help you enter new markets, grow your global business, and reduce risks with confidence.