Canada’s critical minerals strategy: Building a sustainable future

Author Details

Janet Wilson

Senior international trade writer

In this article:

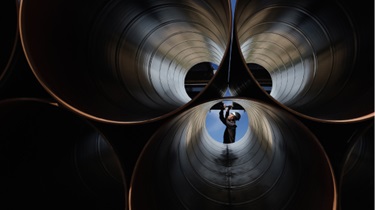

Canada is sitting on a goldmine of critical minerals—essential to the energy transition—and positioning itself as a global leader in sustainable mining and mineral processing.

These minerals are the building blocks of clean technologies—from electric vehicles to wind turbines and semiconductors—and global demand is surging.

At Export Development Canada (EDC), Al Pritchard is helping lead the charge to ensure Canada’s critical minerals strategy is not only ambitious, but actionable.

Al Pritchard, director of EDC’s Sectors and International Advisory team.

From geophysics to supporting Canada’s critical minerals strategy

Pritchard’s journey to EDC began in the field—literally. A geophysicist by trade, he spent 12 years at Ottawa-based Sander Geophysics (SGL), leading airborne surveys for petroleum and mineral exploration across every continent, including Antarctica. His work supported major mining companies, junior and intermediate exploration firms and global government agencies to map the Earth’s subsurface, ultimately accelerating the discovery of critical minerals.

After leading SGL’s global operations and completing an MBA, Pritchard joined EDC in 2017, bringing deep industry knowledge to the Global Trade team. “They were looking for someone with both a business background and industry experience,” he says.

He quickly advanced to a director role on EDC’s Sectors and International Advisory team and the Business Connections Program, which fosters opportunities between Canadian companies and international clients in several sectors, including mining, forestry and infrastructure. Two years ago, he and his team began developing EDC’s critical minerals strategy, engaging with stakeholders across the ecosystem.

Looking ahead to 2026, Canada’s critical minerals strategy will unfold against a shifting global economy. To stay competitive, understanding the global economic outlook is essential.

You should also check out

With growing risks, Canadian companies face new challenges. EDC’s Global Economic Outlook offers insights to help you make better business decisions.

Canada’s vast geological footprint gives it access to a wide range of critical minerals—including lithium, nickel, cobalt, copper and rare earth elements.

“We have many of the minerals needed for the energy transition, and we’ve built a reputation for doing mining the right way,” says Pritchard.

Although permitting timelines remain a challenge, Canada is a global leader in sustainable mining. “International partners are looking to Canada as the solution. If we can solve the issues of raising capital and shortening permitting timelines, Canada is often the first choice for critical mineral projects,” he says.

In 2022, the federal government launched its $3.8-billion Critical Minerals Strategy to position Canada as a global supplier of choice. The plan covers the entire value chain—from exploration and extraction to manufacturing and recycling. On Nov. 4, the 2025 federal budget introduced major new investments and initiatives to advance this strategy as part of Canada’s economic transformation.

“As we support the growth of Canada’s critical minerals projects, EDC is keen to work with international partners to accelerate development. Given our long history of supporting the sector, EDC is well-positioned to lead debt financing for Canadian critical minerals projects,” he says.

“It’s not just the extraction of ore—Canada’s strategy is also focused on midstream processing and manufacturing through collaboration with global allies,” Pritchard says. “EDC and the Government of Canada are working to support the build of a mid-stream processing industry here to create a fully integrated value chain.”

In 2023, Canada’s minerals and metals sector contributed $117 billion directly to gross domestic product (GDP), with an additional $42 billion in indirect contributions—for a total of $159 billion.

On the other hand, Canada’s domestic processing footprint remains small, and the economics of processing projects are complex. But EDC is committed to helping bridge that gap.

Globally, the Top 5 mineral producers by volume are China, the United States, Russia, Australia and India. “China is a dominant force and far ahead in developing a critical minerals supply chain,” says Pritchard. “They control 95% of the world’s processing capabilities in certain minerals. Countries are taking notice and are starting to deploy tactics to mitigate this supply-chain concentration risk.”

EDC’s decades of experience in mine finance are proving invaluable. “We’re using our expertise in financing more traditional commodities, like copper and gold, to support higher-risk critical mineral projects,” says Pritchard.

Critical minerals projects often involve new technologies, operate in high-risk jurisdictions, or are led by junior developers.

“While many financial institutions have divested their mining expertise, EDC’s support has remained strong, especially with project and corporate finance solutions,” he says.

One example is Torngat Metals’ Strange Lake Project, one of the largest heavy rare earth deposits outside of China, located in Northern Quebec. It secured a $110-million bridge loan from EDC and an additional $55 million from the Canada Infrastructure Bank.

“Torngat’s Strange Lake Project shows how we leveraged our mining expertise to support a strategic critical minerals project for Canada. Torngat is an example of how EDC is helping Canada’s Critical Minerals strategy come to life,” Pritchard says.

Once operational, the project will employ approximately 450 workers, with a focus on Indigenous recruitment from Quebec and Labrador. Torngat Metals plans to develop an open-pit mine and concentration plant in Nunavik, a single-lane access road to Labrador and a separation plant. This marks the first time EDC has financed an early-stage mining project, reflecting its commitment to responsible development and Canada’s Critical Minerals Strategy.

EDC also supports suppliers and service providers to the global mining industry. “Canadian companies are developing cutting-edge technology to support sustainable critical minerals mining projects both in Canada and globally,” says Pritchard. “The mining industry is an excellent adopter of clean technologies, and EDC is supporting global deployment by connecting Canadian technology developers to global mining companies that follow best-in-class ESG (environmental, social and governance) practices. Sustainable mining isn’t a nice-to-have—it’s essential for long-term success and Canada has the expertise to make this happen.”

To execute Canada’s Critical Minerals strategy, EDC collaborates closely with federal partners like Natural Resources Canada (NRCan), Global Affairs Canada and Innovation, Science and Economic Development Canada (ISED), as well as international buyers and associations. “We work closely with partners in Canada and abroad and our clients to ensure the solutions we deliver meet their needs,” Pritchard says.

EDC’s International and ECA Relations team emphasizes collaboration among export credit agencies (ECA), particularly for large-scale, high-risk critical mineral projects. These initiatives often benefit from co-financing and risk-sharing among ECAs, especially in challenging jurisdictions.

In 2024, EDC hosted a critical minerals roundtable and supported a followup session in Ottawa with G7 countries and other invited ECAs. EDC also hosted the Berne Union conference in October. The Berne Union, a leading global association for export credit and investment insurance, has convened roundtables with G7 ECAs to explore collaboration opportunities.

Beyond financing, EDC plays a leadership role in convening allied ECAs to share challenges, opportunities and lessons learned—through formal bodies like the Mineral Security Partnership (MSP) ECA network and ongoing dialogue facilitated by the Berne Union.

That leadership role, grounded in deep sector knowledge, is something Pritchard continues to build on as EDC sharpens its focus on domestic capabilities and global partnerships.

“We want to support the buildout of a global critical minerals value chain and do it with like-minded countries,” says Pritchard. “It doesn’t all have to be in Canada, but it has to build resiliency in the global supply chain and ultimately benefit the Canadian economy.”

EDC supports a range of core sectors and subsectors to help strengthen the Canadian economy and develop our domestic capabilities, including agri-food, energy transition, critical minerals, digital industries and advanced manufacturing and cleantech.

“This is a very dynamic, quickly changing environment. Our critical minerals strategy isn’t static; we have to adapt to ensure that EDC continues to play a pivotal role to support the strategy,” he says.

“It’s an exciting time. Everyone is finally realizing what the mining industry has always known—that mining is critical for Canada’s long-term economic success.”