Digital trade: What’s in it for Canadian exporters?

Author details

Aya Idihya

Junior associate - Economic and Political Intelligence Centre

In this article:

While stores and ports closed and employees across all sectors worked remotely, the global growth of digital trade dramatically increased during COVID-19. For Canadian exporters, this shift to online services opened new opportunities, reshaping how they reach customers and compete internationally.

In 2022, digitally delivered services accounted for 54% of global services exports, totalling US$3.8 trillion. This segment has grown at an average annual rate of 8.1% since 2005. According to the European Commission, more than 60% of global gross domestic product (GDP) now involves digital transactions. For example, the European Union is currently seeking digital trade agreements with Korea and Singapore, to unlock new opportunities in this fast-growing trade.

Given its growing role in international commerce, it’s a good time to understand what digital services includes and where Canada fits in.

Digital trade refers to all international transactions of goods and services conducted online. This can range from a Canadian business selling jewelry to a customer in France through a website, to a United States company building its online store using a Shopify subscription. It also includes online education—like a student in Morocco taking a course from the University of Toronto—as well as cloud computing, streaming media and software-as-a-service (SaaS) platforms.

This article focuses on digitally delivered services—intangible services transmitted electronically without physical delivery. These are the only digital trade flows consistently tracked at the global level.

Seamless digital trade depends on strong digital infrastructure and supportive policies. The OECD’s Digital Services Trade Restrictiveness Index (DSTRI) highlights five key pillars:

- Infrastructure and connectivity (e.g., cross-border data flow policies);

- Electronic transactions (e.g., legal recognition of e-signatures);

- Payment systems (e.g., access to internet banking);

- Intellectual property (IP) rights (e.g., copyright enforcement, trademark protections); and

- other barriers (e.g., performance requirements, limits on downloading and streaming)

Canada ranked first among OECD countries in 2024 with a score of 0.00, indicating a highly open digital trade environment.

You should also check out

How Canadian exporters can reduce trade risks and successfully enter high-growth European markets.

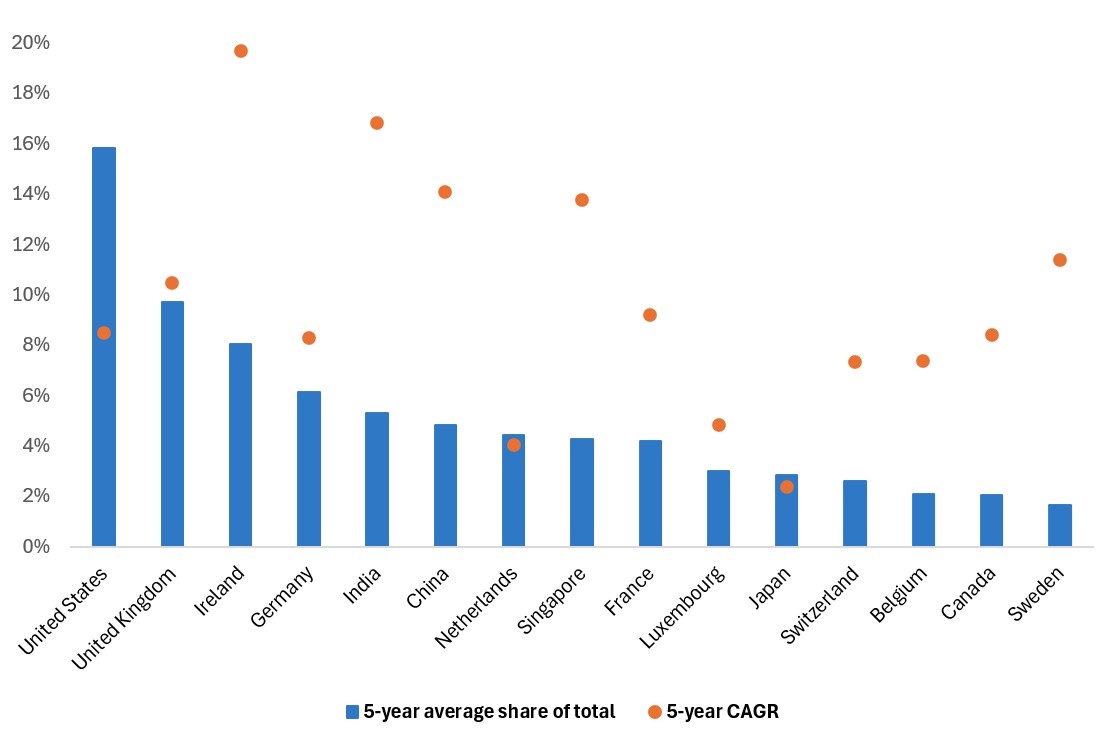

The United States leads with 16% of global digital services exports, followed by the United Kingdom (U.K.) at 10%, Ireland at 8% and Germany at 6%. India and China are quickly gaining ground, each holding a 5% share.

Ireland is the fastest-growing exporter, with a five-year compound annual growth rate (CAGR) of 20%, driven by foreign investment and tech-friendly policies and business conditions. India follows with 17% growth, then China at 14%, the U.K. at 10% and both the U.S. and Germany at 8%.

What are the biggest categories of digitally delivered services exports?

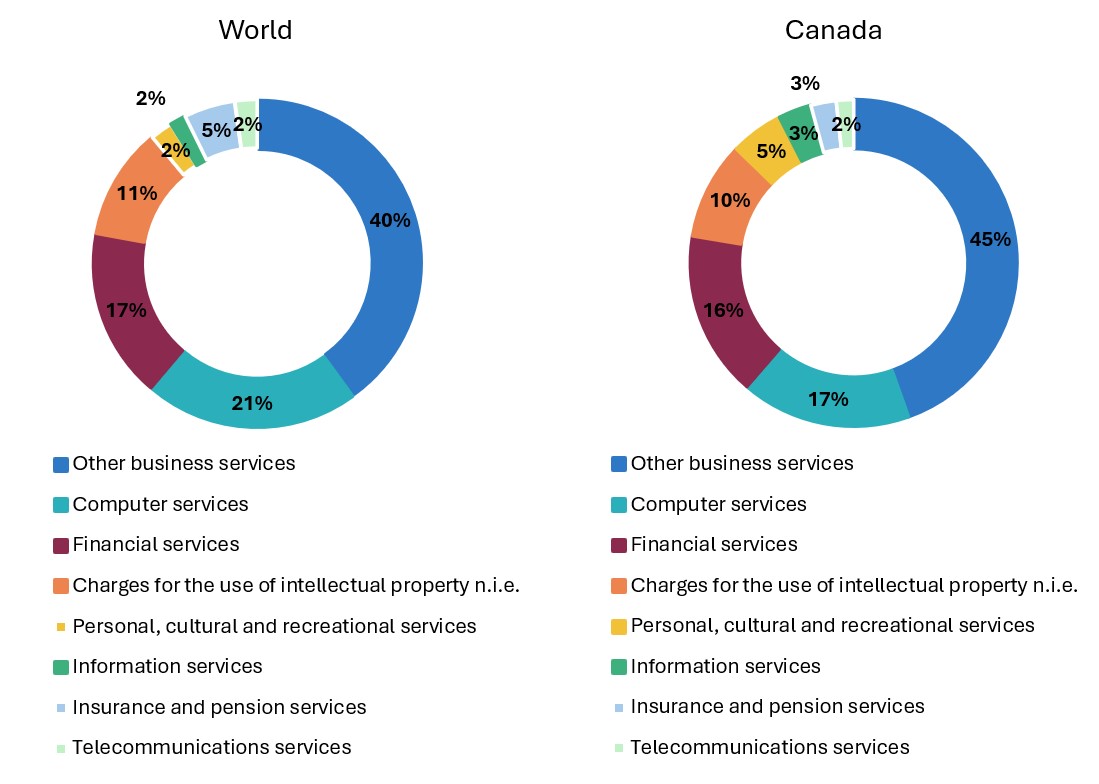

Beyond who’s trading, what’s being traded also matters. In 2024, nearly 40% of global digitally delivered services exports fell under the category of “other business services,” which saw a five-year CAGR of 12%. This broad category includes:

- research and development services;

- professional and management consulting services;

- technical and trade-related services; and

- employment services.

These services are often high-value and knowledge-intensive, making them a strong fit for Canada’s expertise-driven economy.

Computer services made up 21% of global exports, growing at a five-year CAGR of 18%. This includes software development, IT support and cloud-based solutions—areas which Canadian companies are increasingly competitive.

Financial services accounted for 17%, with a CAGR of 7%, reflecting the global demand for digital banking, fintech platforms and online investment tools.

Intellectual property (IP) services represented another 11%, though growth was slower at 3%. This category includes royalties, licensing fees and other IP-related transactions.

These are high-value sectors where Canada already has a strong presence, offering opportunities to expand its footprint in the global digital economy.

Canada’s position in digitally delivered services exports

In 2022, 54% of Canada’s commercial services exports were delivered digitally, according to Statistics Canada. Among the Top 15 countries by five-year average exports of digitally delivered services, Canada ranked 14th globally, with just more than 2% of the global share and a five-year CAGR of 8%.

Breaking it down by category:

- Other business services—including technical and consulting services—made up 45% of Canada’s digitally delivered services exports, with a five-year CAGR of 8%.

- Computer services accounted for 17%, growing faster at a 12% CAGR.

- Financial services represented 16%, with a CAGR of 9%.

- Intellectual property (IP) made up 10%, growing more slowly at 3%.

In terms of trading partners, 60% of Canada’s digitally delivered services exports in 2023 went to the United States, followed by the United Kingdom at 5%. Key European markets included Germany (3%), Ireland (2%), and France (2%). Ireland had the fastest five-year CAGR at 13%, followed by the U.S. at 8%, the U.K. at 5%, Germany at 4%, and France at 2%.

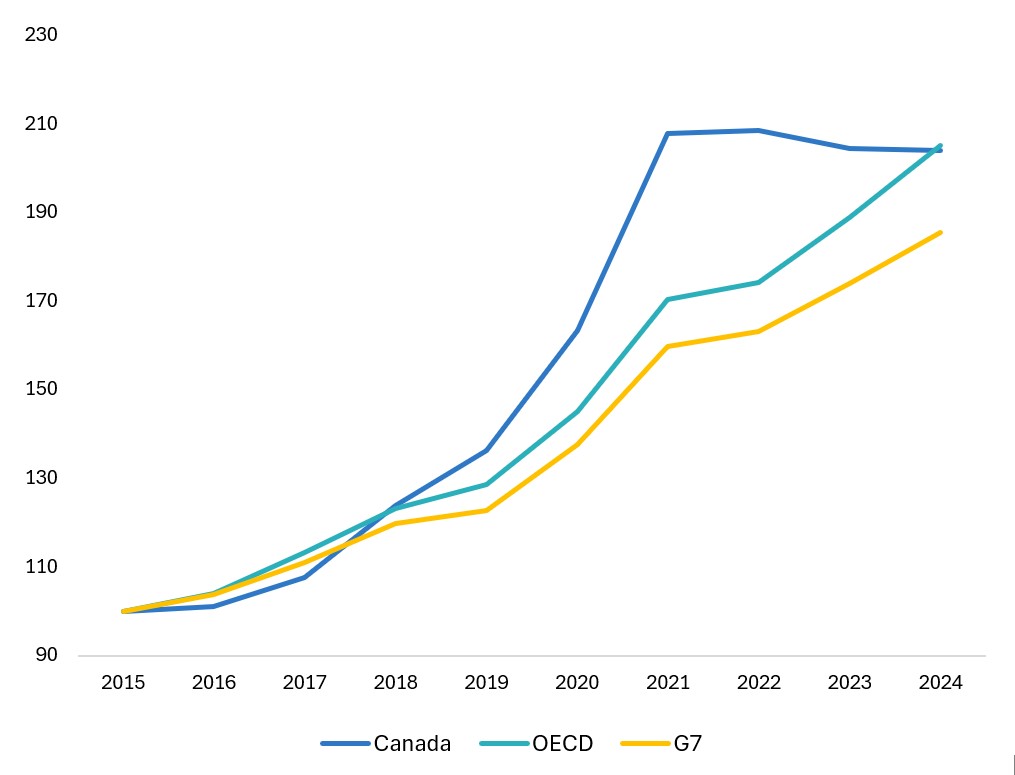

In the past decade, Canada’s digitally delivered services exports have grown faster than both the OECD and G7 averages. Using an index with 2015 as the baseline (2015 = 100), Canada’s exports more than doubled by 2021, outpacing its peers.

Growth was driven primarily by other business services and computer services, which surged between 2018 and 2021—likely due to increased global demand for remote services during COVID-19. Major Canadian firms, like Shopify, were among the Top 10 companies that prospered from the pandemic, boosting exports in these categories. While Canada’s growth has since levelled off, OECD and G7 growth continues.

Digital trade faces rising regulatory risks

Despite strong momentum over the past decade, digital trade faces growing headwinds. The evolving geopolitical landscape is reshaping how technologies that power digitally delivered services—such as AI models, cloud infrastructure and cross-border data flows—are developed and deployed. Countries are increasingly asserting sovereignty over data, IP and digital infrastructure, which could lead to fragmented digital ecosystems.

Rising protectionism also poses risks. Export controls on key components could hinder international co-operation and limit access to advanced tools, particularly for small- to medium-sized enterprises (SMEs) and traditional sectors. This could slow innovation and productivity gains.

AI and generative technologies unlock new export potential

At the same time, AI-driven productivity offers new opportunities. G7 countries are generally well-positioned in terms of data infrastructure, research and development and sector-specific standards. However, if access to digital infrastructure and services becomes restricted to geopolitical allies, global inequality could deepen and the diffusion of digital capabilities may be constrained.

Large language models (LLMs), central to the rise of generative AI, are already transforming the global economy. Sectors such as banking, high-tech and retail could see hundreds of billions of dollars in added value. Banking, alone, is projected to reach $200 billion to $340 billion annually if all GenAI use cases are implemented. Overall, GenAI could contribute between $2.6 trillion and $4.4 trillion to the global economy across 63 use cases. These capabilities position Gen AI as a powerful driver of productivity and growth in digitally delivered services exports.

For Canadian exporters, the opportunities are significant. Canada is well-positioned to lead in the global digital economy by leveraging its strengths in education, immigration and innovation. With the right adjustments to retain IP, govern data and scale domestic tech companies, Canada can become a global hub for digitally delivered services exports.

How EDC can help

As digital trade continues to evolve, EDC is committed to helping Canadian exporters stay competitive and seize new opportunities in the global digital economy. Whether you’re scaling a SaaS platform, diversifying into new markets, or navigating cross-border data regulations, EDC offers:

- Market insights to help identify global opportunities and assess digital trade readiness

- Financing and insurance solutions tailored to digital-first business models

- Connections to international buyers and partners through EDC’s global network

- Advisory services to help manage risks related to IP protection, data governance and regulatory compliance

To contact an EDC export advisor, visit our Export Help Hub and sign up for MyEDC account.

You should also check out

With timely insights and analysis from our experts, Export Development Canada can help you enter new markets, grow your business and reduce risks with confidence.