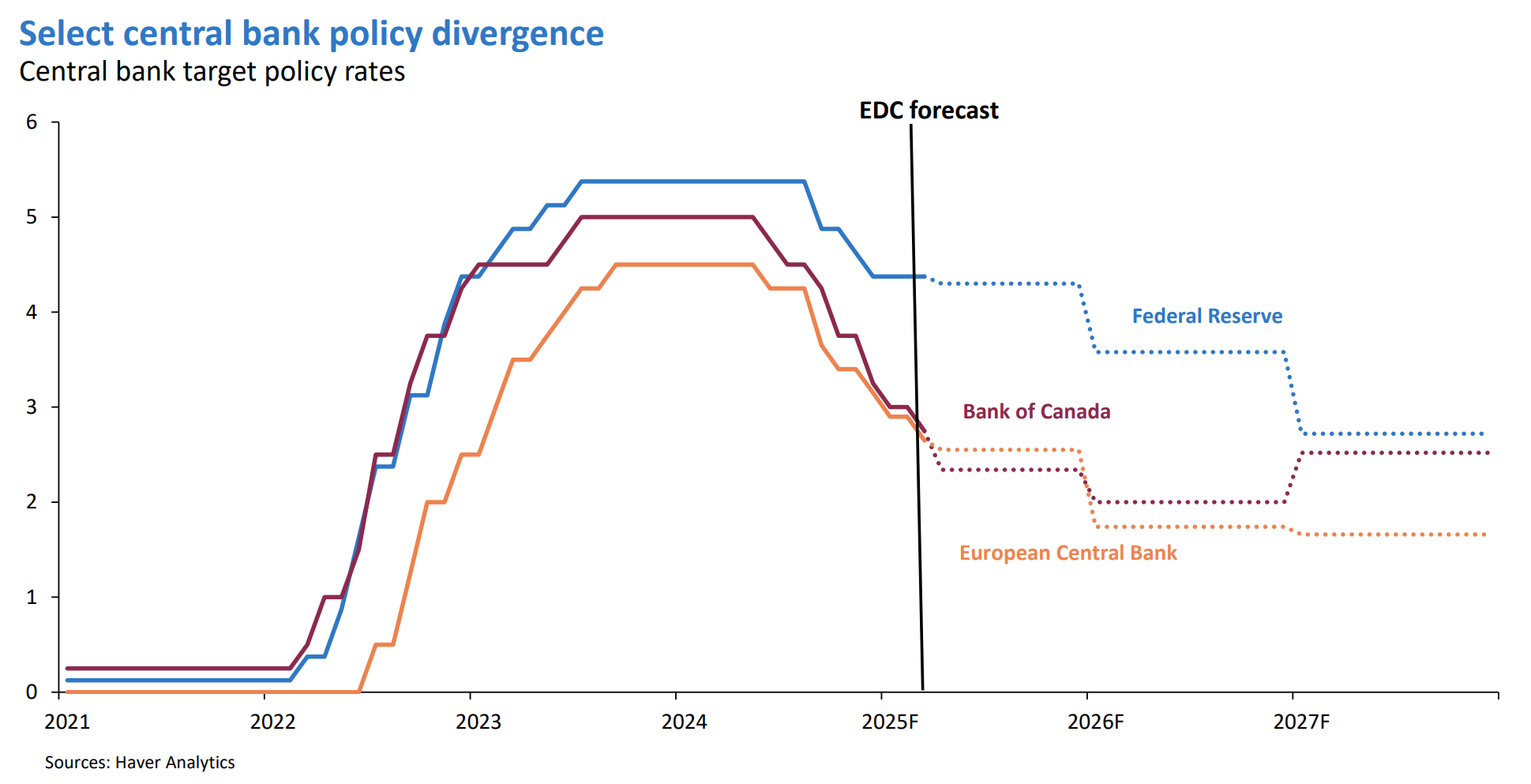

2. Central bank rate divergence and weaker Canadian dollar

Since mid-2024, the Bank of Canada has aggressively cut interest rates, reducing its policy rate from 5% to 2.75% by March 2025. In contrast, the Federal Reserve has maintained its policy rate at 4.33%, leading to a widening spread. Meanwhile, the European Central Bank has also implemented regular rate cuts, with five reductions since June 2024, leaving its policy rate at 2.5%.

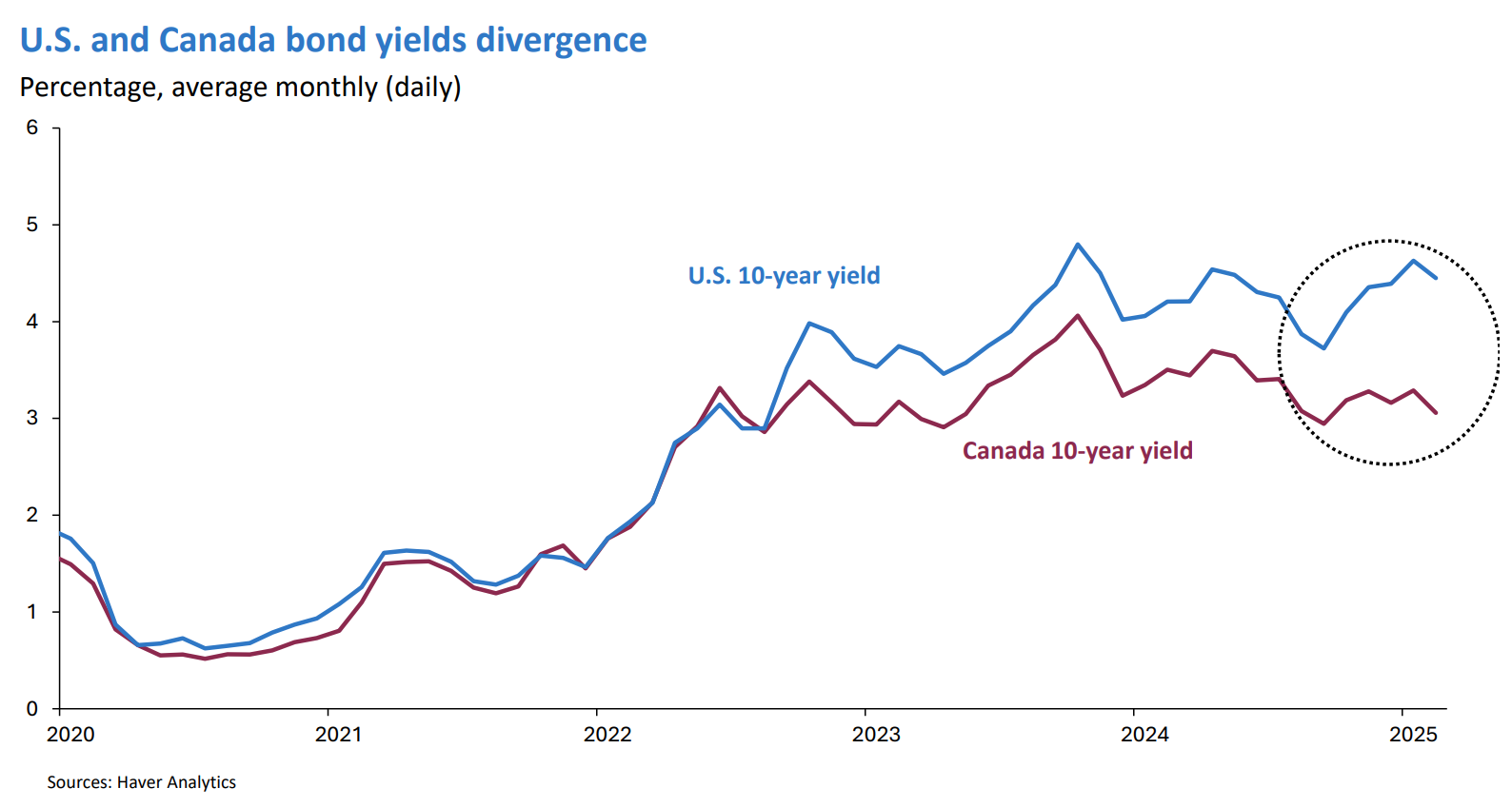

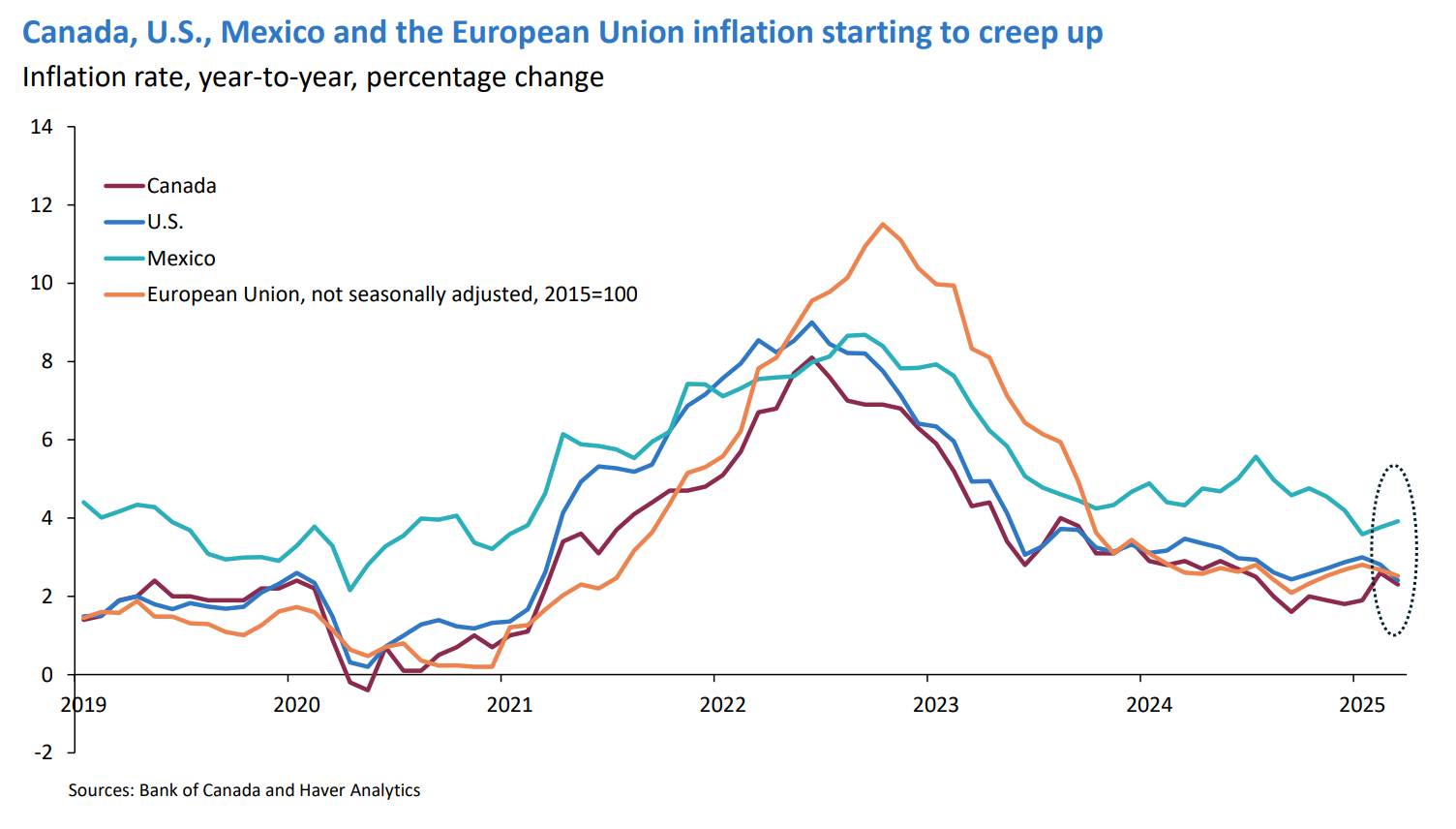

These major central banks, which previously moved policy in lockstep, are now adjusting rates at varied paces. The U.S. has loosened its policy rate much slower compared to Canada, leading to a gap in the 10-year bond yield. This gap implies a weakening effect on the Canadian dollar. A weaker currency can cause inflation due to higher import costs from the U.S., significantly impacting business decisions, investment flows and the domestic economy.

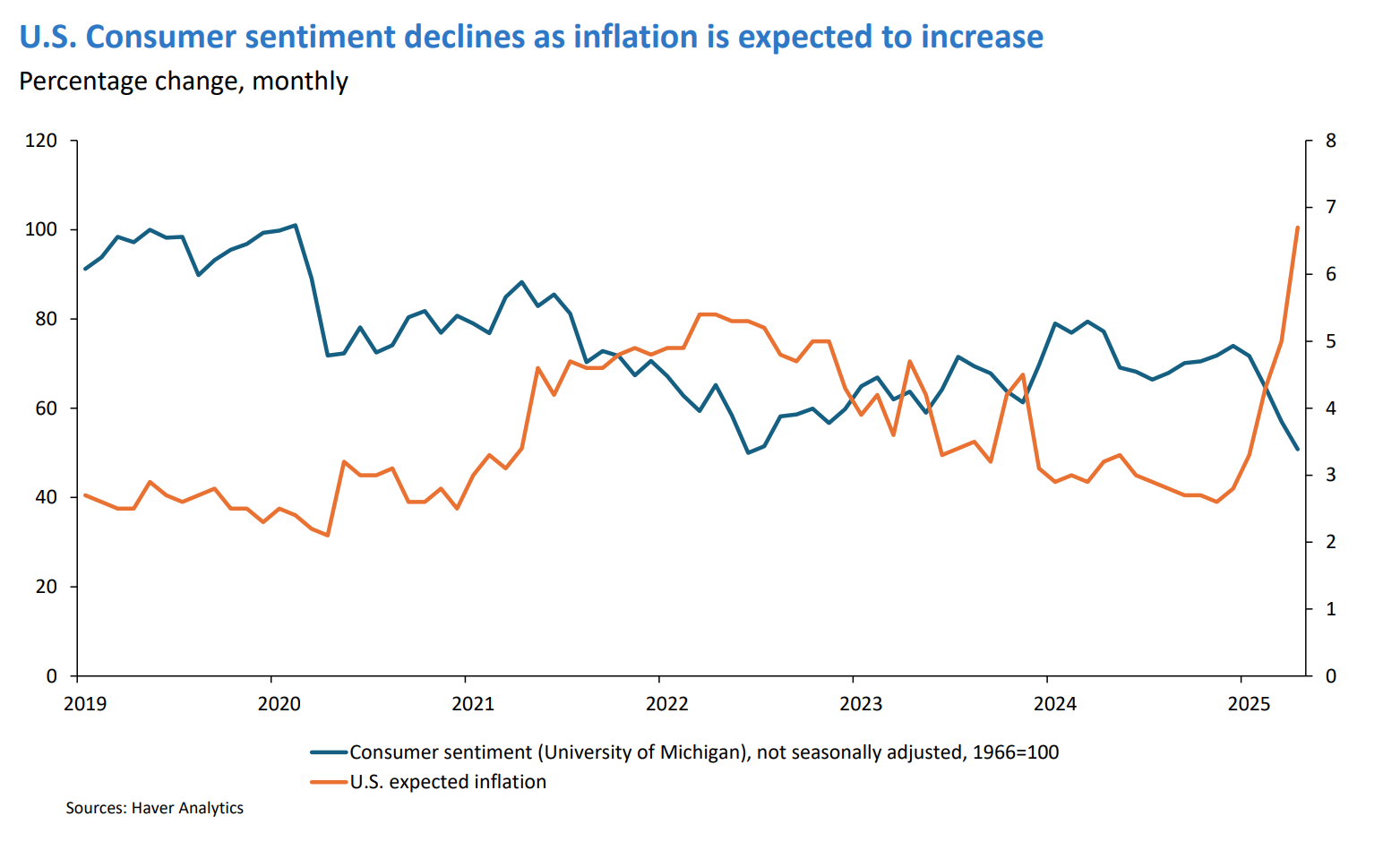

The divergence in interest rates reflects differences in overall economic conditions. Canada’s economy has slowed significantly in the face of interest rate increases and weak domestic conditions. In contrast, the U.S. has continued to see strong consumer sentiment and spending, driving solid performance in U.S. real gross domestic product (GDP) growth.