Confidence matters when it comes to economic outcomes. Confident consumers are more likely to buy big-ticket items, like cars and houses, while self-assured business owners are more apt to make investments to expand their productive capacity. But if you lack confidence, you’re more wary of taking risks and making decisions.

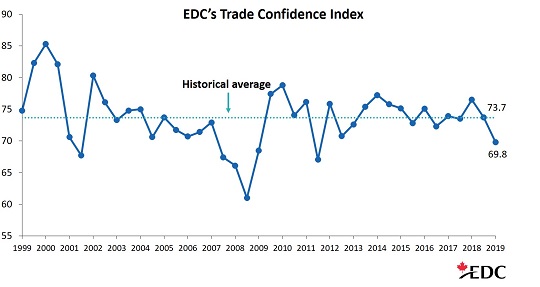

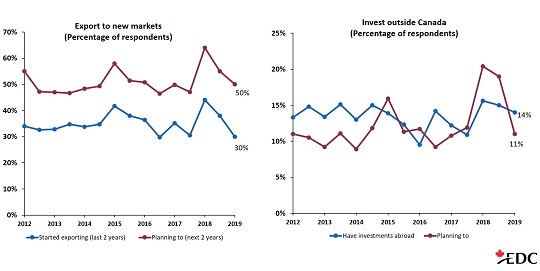

An Export Development Canada (EDC) biannual survey tracks confidence with a focus on a unique group of businesses in Canada: those that are currently exporting or want to export. Since they have money riding on global economic developments, these companies offer a valuable perspective.

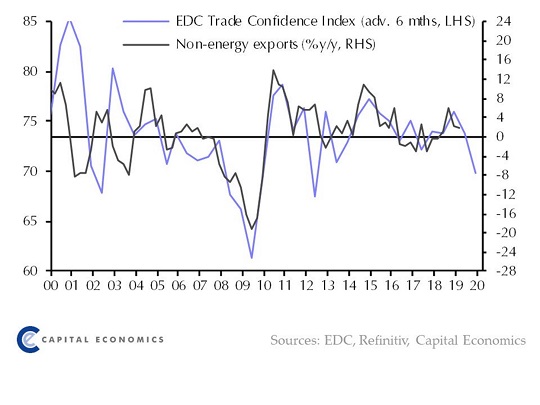

EDC surveys 1,000 of these companies in our Trade Confidence Index (TCI). The TCI is a forward-looking survey that captures insights not available in traditional statistics. We gauge exporters’ expectations for the future, their evolving global strategies, and their views on emerging issues.

Canada’s economy depends heavily on international trade to support our living standards, so the TCI is an informative economic indicator. Given recent trade turbulence, the latest results are particularly noteworthy.