MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

Learn how credit insurance safeguards your business and opens doors to new markets.

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

Discover resources for smarter exporting

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Junior associate - Economic and Political Intelligence Centre

In this article:

When people think about exports, they picture containers on ships, wheat in rail cars, or energy products moving through pipelines. But Canada’s trade story is much bigger than goods—it includes services exports and Canadian direct investment abroad (CDIA), which is reshaping global competitiveness.

While more than 75% of Canada’s goods exports typically head to the United States, CDIA is relatively more diversified. According to Statistics Canada, of the $2.47-trillion CDIA stock in 2024, 52% went to the U.S.

One key driver of CDIA is mergers and acquisitions (M&A)—when companies combine or one buys another. These deals help firms expand internationally, enter new markets and strengthen supply chains. Learn how businesses use M&A as a growth tool.

While CDIA reflects Canadian firms investing abroad, the flipside of the coin is foreign direct investment (FDI), which is when foreign companies invest in Canada. Both CDIA and FDI are an important part of international trade and diversification.

According to Global Affairs Canada, investing abroad helps businesses strengthen their presence, enter new markets and access international resources and skills. By the numbers, the U.S. and Canada are significant investment partners.

For decades, CDIA and FDI operated in a stable trading environment. But since the start of 2025, the new U.S. administration has introduced major trade and economic policy changes. What has this done to a specific type of direct investment—M&A?

Research from the National Bureau of Economic Research’s report, Cross-Border Mergers and Acquisitions, suggests that strained trading relationships between countries leads to less M&A activity. It also indicates that companies pursue cross-border M&As to avoid paying tariffs by operating directly within the tariff-imposing country—resulting in fewer exports. Developments since early 2025 have created uncertainty about how companies are responding.

Experts share best practices for managing and mitigating risk when conducting M&As in foreign markets.

To get a sense of how Canadian companies are reacting to the trade uncertainty, we analyzed cross-border M&A trends by counting the number and disclosed value of announced M&A deals between Canadian and U.S. firms.

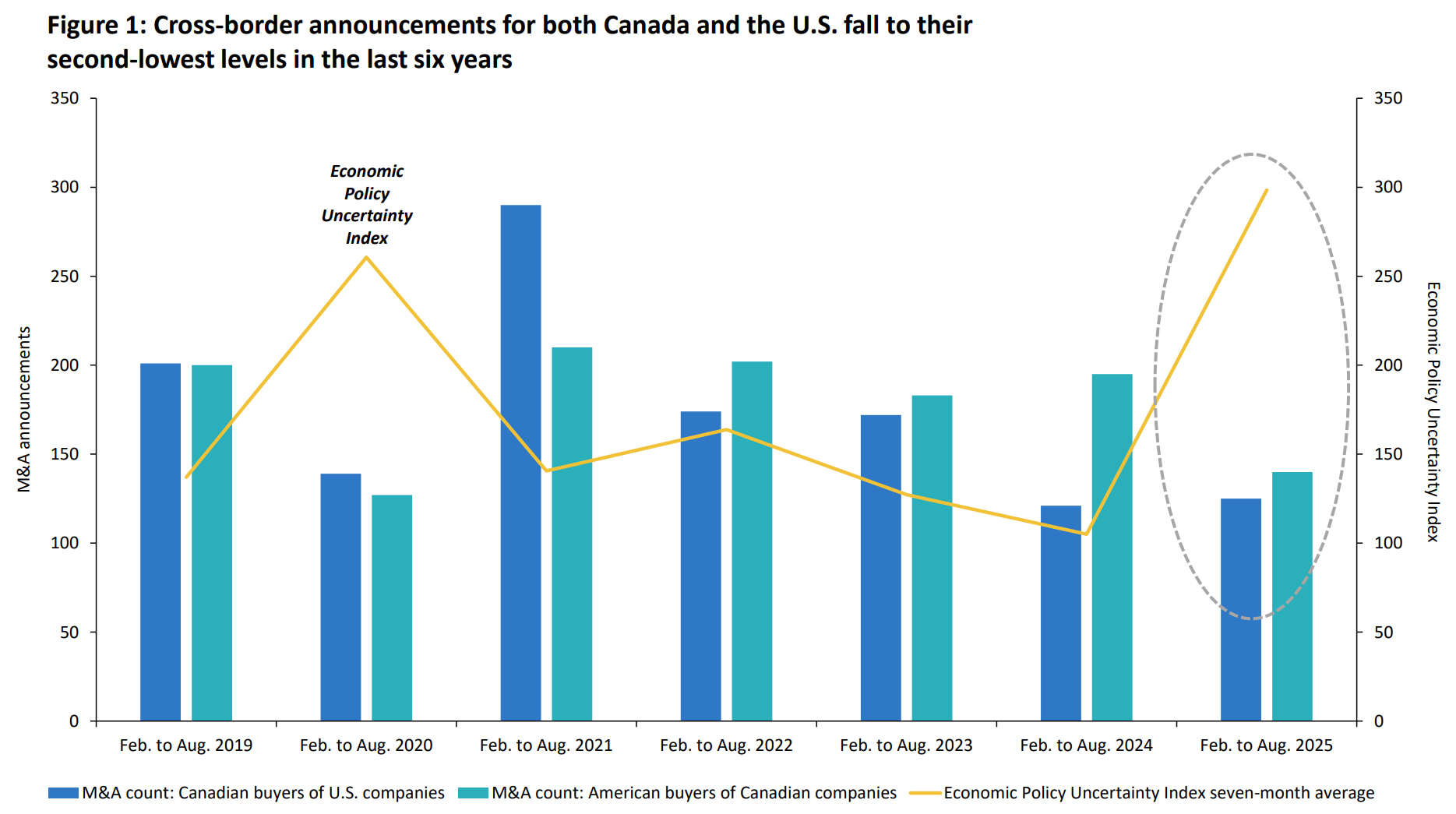

Using data from S&P’s Capital IQ Pro, our analysis covers the period between February and August 2025 and compares that timeframe to the same seven-month window between 2019 and 2024.

While the impact on M&A activity and findings will evolve as more data becomes available, this provides an early look at the influence policy uncertainty and changes may be having. Our analysis shows:

Source: S&P Capital IQ Pro and PolicyUncertainty.com/Haver Analytics

M&A is more than a financial transaction—it’s a strategic tool for global business expansion. Explore how Canadian companies leverage M&A to reach global success and follow a real-world merger with Quebec aerospace company, Adipa International.

The early data suggests that U.S trade and economic policy uncertainty is having an impact on M&A deal activity. However, how much of an impact and how long these changes will persist is unknown. As we get further away from U.S. policy changes and deeper into the term of its administration, it’ll be important to review this data and update assessments in the months ahead.

Although often overlooked in export discussions, CDIA is an important part of Canada’s trade mix. Keeping an eye on trends in M&A and CDIA can show how Canadian companies are navigating an evolving and complex trade environment. To assess your company’s readiness for mergers and acquisitions, read our M&A checklist article.

Export Development Canada (EDC) can help Canadian companies navigate cross-border mergers and acquisitions with expert advice to support global growth. Check out these additional resources:

Stay informed on the Canada-U.S. business environment by contacting your EDC relationship manager or calling 1-800-229-0575.

Junior associate - Economic and Political Intelligence Centre

Canadian exporters face tariffs, trade uncertainty and uneven growth across key sectors

M&As can be an effective market entry strategy for companies that want to grow internationally.

Experts share best practices for managing and mitigating risk when conducting M&As in foreign markets.

Explore the impact of tariffs and learn about support programs and compliance strategies.