MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

Learn how credit insurance safeguards your business and opens doors to new markets.

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

Discover resources for smarter exporting

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

This blog provides highlights from an EDC Economics’ report about our biannual Trade Confidence Index survey.

Canadian exporters have a strong financial interest in correctly anticipating future demand for their goods and services. That begs the question: Are their collective expectations helpful in predicting the nation’s future exports? To answer that, the EDC Economics team constructed a simple statistical model and found that our Trade Confidence Index (TCI) can help predict future Canadian exports.

For more than 20 years, EDC has surveyed 1,000 Canadian companies twice a year to assess their confidence in global trade. These companies are either exporting or planning to export in the next two years. The survey asks businesses for their outlooks on domestic and international sales, economic conditions in Canada and across the world, and global business opportunities. The answers to these questions provide EDC with a unique insight into Canadian trade, enabling us to respond quickly to emerging trends.

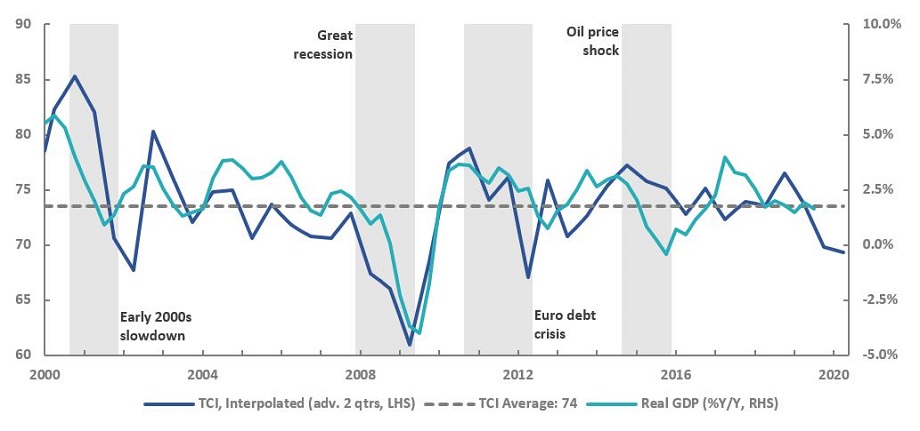

In our 2019 year-end survey, the TCI fell to its lowest level in almost a decade. The decline in confidence likely reflected the intensifying United States-China trade dispute and a slowdown in the global economy. We found that protectionism remained a persistent concern and a key challenge for Canadian exporters. These findings suggest that Canadian exporters keep up with global developments and respond to them accordingly. In fact, when we chart the TCI against Canadian output growth, we can see that the TCI tracks overall economic activity.

Sources: EDC Economics; Haver Analytics

In Chart 1, we’ve shifted the TCI forward by two quarters to show that it does a pretty good job of forecasting Canadian gross domestic product (GDP). The TCI is focused on Canadian trade, which is why it diverges away from GDP at certain points. For example, exporters were quite worried about the European debt crisis, which could have impacted European demand for Canadian goods. We saw a sharp drop in the TCI around this time, but it didn’t have a strong impact on Canadian GDP.

On the other hand, when oil prices collapsed between 2014 and 2016, Canadian GDP growth took a hit. But exporters weren’t as worried, and this reflects the fact that our survey is sent out to a representative sample of exporters across various industries. Broadly, the demand for Canadian goods, outside of oil, wasn’t impacted by the price collapse.

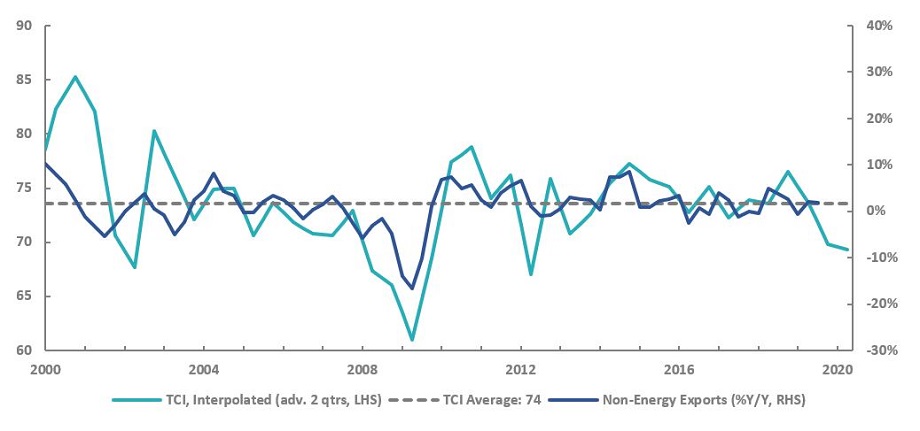

Sources: EDC Economics; Haver Analytics

In Chart 2, we’ve overlaid the TCI on Canadian non-energy exports growth—the year-on-year percentage change in Canadian exports, excluding exports of energy products. The TCI tracks export growth well, with a correlation coefficient of 0.64. This means there’s a positive relationship between the TCI and future export growth. Therefore, Canadian exporters are quite good at anticipating future demand for their products.

EDC Economics constructed a simple statistical model of future export growth. When we added the TCI to the model, we found a significant improvement in the model’s accuracy. We used the TCI to predict the Canadian goods, services, and non-energy exports. In each case, including the TCI significantly improved the model’s performance. See our research report for details on our methodology and our complete results.

This work suggests that Canadian exporters should keep a close eye on the TCI. It can let them know how other Canadian companies are feeling, and what to expect in the future. Most importantly, it can help them anticipate future demand for their goods and services, so that they can make better business decisions.

Register to unlock access to international insights, webinars, and resources that help you mitigate risk and grow your business.

Register now Log In

Arlene Dickinson shares insights on agri-food exports, risks and growth opportunities in Indo-Pacific markets.

Canada’s critical minerals strengthen Germany’s energy transition and industrial resilience.

Canadian firms adapt cross-border M&A amid U.S. economic and trade policy uncertainty.

With EDC’s support, this chemical analysis and measurement company has taken on international contracts from all over the world.

After accessing EDC Portfolio Credit Insurance, the environmental company saw sales grow by 60% and now exports to every continent