MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

Learn how credit insurance safeguards your business and opens doors to new markets.

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

Discover resources for smarter exporting

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Since the beginning of the pandemic, Export Development Canada (EDC) has regularly surveyed our research panel to collect timely insights into how the COVID-19 crisis is affecting Canadian businesses. Here’s what we learned in the fourth release of our survey.

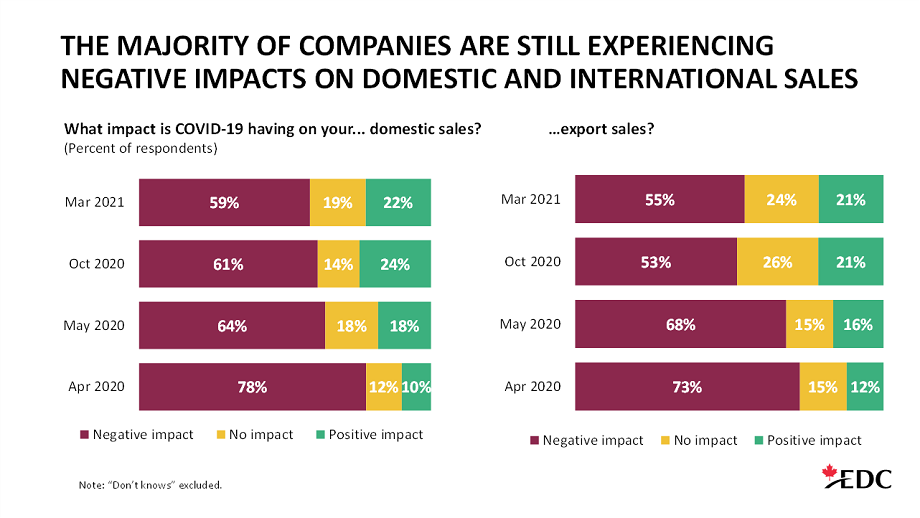

The majority of companies surveyed continue to report negative impacts of the pandemic on both their domestic (59%) and export (55%) sales. This represents progress since early in the pandemic, but we’re clearly not out of the woods yet, as roughly 70% of respondents expect these sales impacts to persist into 2022.

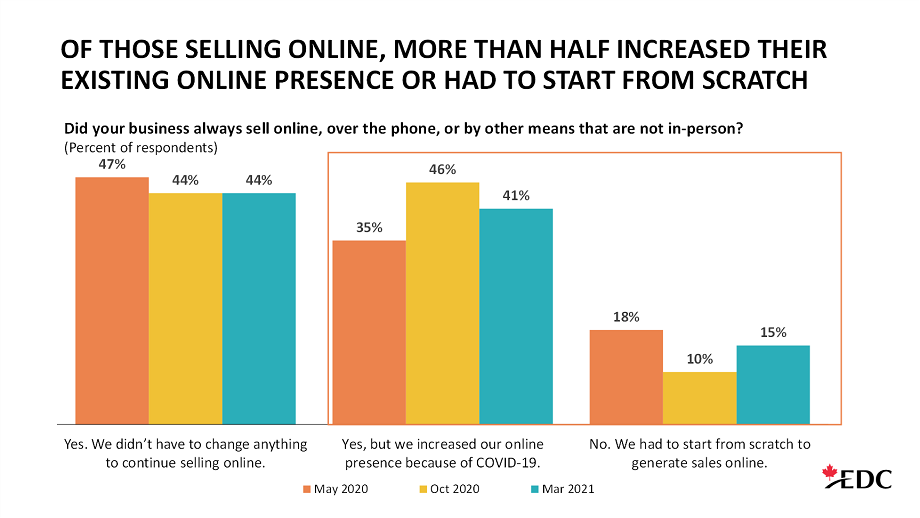

Since the first lockdowns more than a year ago that forced many companies to close and consumers to stay home, we’ve seen a significant number of companies (56%) improve and adapt their online sales capabilities. In previous surveys, we noted that companies that had better online capabilities were better able to avoid large sales declines. That said, this transition hasn’t necessarily been easy for all companies. Key challenges cited in our survey include:

We were relieved to see that overall business concerns have fallen relative to our past surveys. Nonetheless, the leading worries remain reduced customer demand (12%) and employee safety (8%).

For companies trying to expand their international business, cross-border travel restrictions remain the top challenge, cited by 40% of respondents and unchanged from our last survey. This likely reflects not only the explicit government restrictions on all non-essential travel, but also the need for quarantine periods for those employees who’ve managed to successfully cross the border for work purposes.

Concerns about supply chain disruptions increased, as did connecting with customers. During our survey period, there was the high-profile, six-day blockage of the Suez Canal, and reports of growing shortages of semiconductor chips, among other issues, with rising costs to transport cargo.

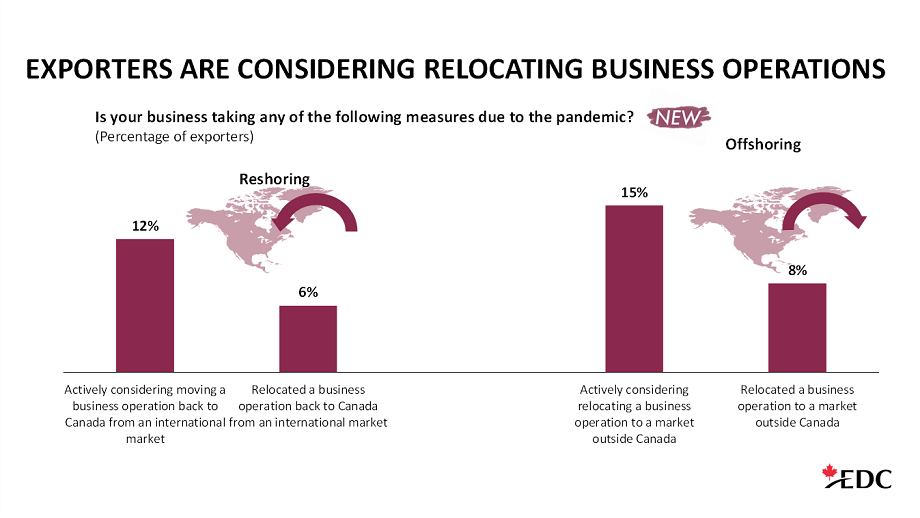

We found that nearly one-third of respondents are considering relocating business activities, with 8% and 6% having already offshored and reshored some production activities, respectively.

As companies remake their supply chains, our new survey question found that 18% of companies have added new suppliers, in an effort to diversify their supply chains, while around 10% made changes within existing domestic and international suppliers.

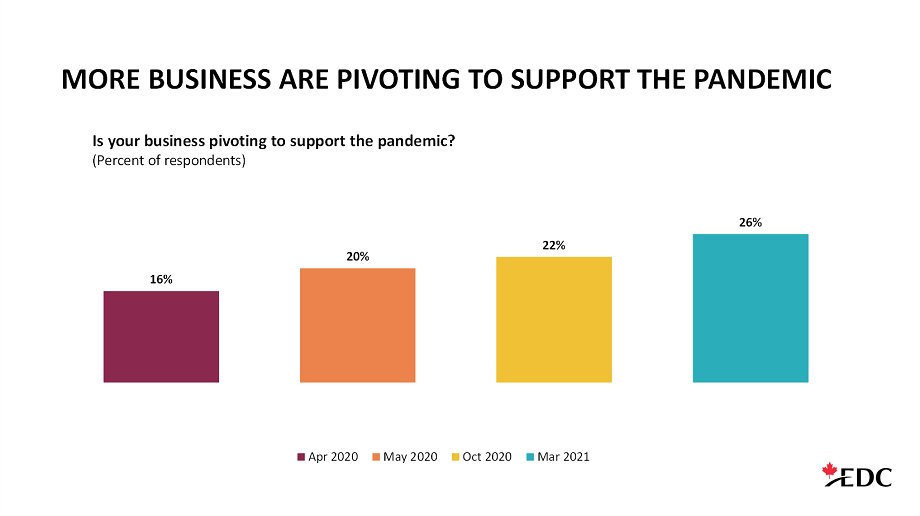

Despite the persistent negative sales impacts and disruptions, it wasn’t all bad news. We found that almost half of businesses (48%) plan to expand in the next year. More companies are finding new domestic opportunities (25%) and international opportunities (19%) from the economic situation around COVID-19. And with continued adaption to the new “business as unusual,” an increasing share—now 26%, up from 16% last April—are pivoting to support the pandemic.

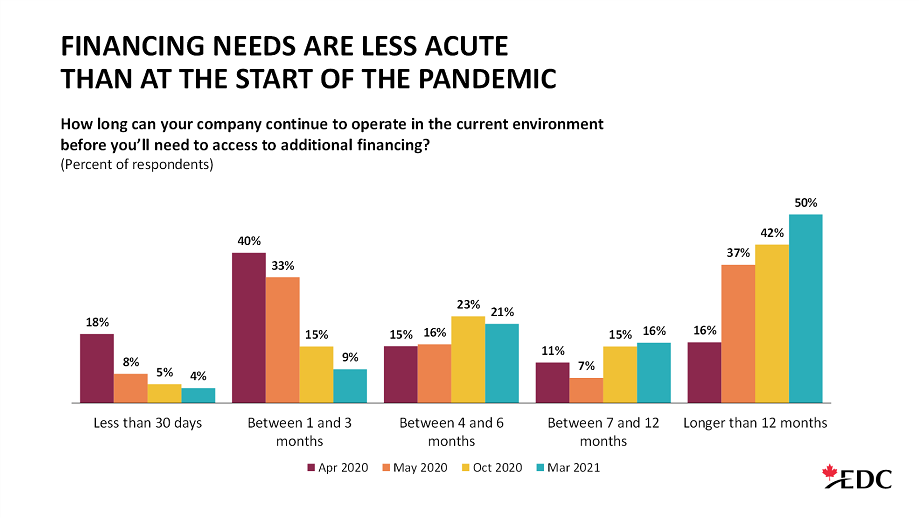

Unprecedented monetary and fiscal support from the Canadian government appears to have been effective at helping companies with their financial challenges. We found that 50% of the companies surveyed can operate for more than a year before needing additional financing—up significantly from 16% last year.

While the pandemic, and therefore, the global economic outlook, continue to evolve, opportunities and challenges for Canadian businesses are shifting as well. The negative impact on sales due to the pandemic are expected to last until 2022, but we’re also seeing more companies expanding their operations, while many are pivoting and finding new domestic and international opportunities.

COVID-19 has greatly accelerated the shift to online activities and we found that Canadian companies have improved their online sales capabilities, although these adjustments have been challenging. The high-level challenges for Canadian businesses have shifted from acquiring financing early in the crisis, to now managing supply chain disruptions and diversifying suppliers. As Canadian businesses continue to adapt to the pandemic and associated uncertainties, one thing is clear: “While we can’t direct the wind, we can adjust our sails.”

Stephen Tapp

Deputy Chief Economist

Export Development Canada

Jennifer Topping

Senior Customer Experience & Research Manager

Export Development Canada

The EDC Research Panel’s January survey highlights the challenges imposed by the global pandemic.

This snack manufacturer was hit hard by COVID-19, but rallied with the help of RBC and EDC.

Discover Canadian tariffs on U.S. goods, CUSMA review and EDC support for managing trade risks.

Global growth stabilizes but faces ongoing policy shifts, tariffs and geopolitical uncertainty.

Keep track of the international markets that matter to your business. Get the latest financial and macroeconomic information for both developed and emerging markets.

Tariffs and inflation weigh on growth in the U.S., Canada and Mexico in 2026.

With growing risks, Canadian companies face new challenges. EDC’s Global Economic Outlook offers insights to help you make better business decisions.