A recent survey conducted by EDC shows that Canadian companies are adopting new business strategies to deal with the potential fallout of NAFTA. Our Trade Confidence Index is conducted twice a year, where we survey about 1,000 companies to gauge their expectations for the future, as well as their views on emerging issues of importance such as NAFTA. This survey provides insights not readily available in traditional trade statistics.

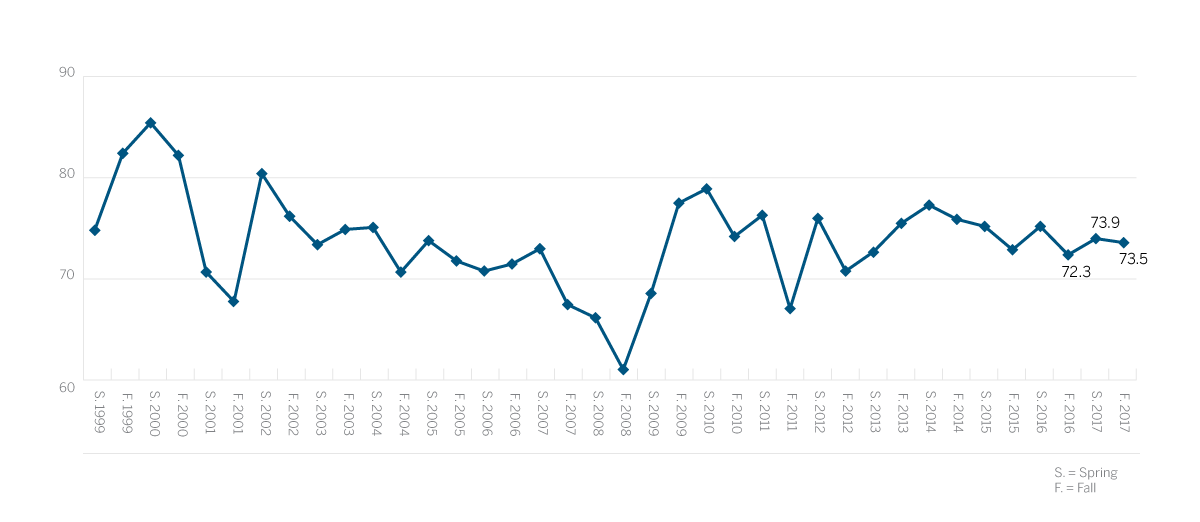

Our most recent survey, conducted last October, found that despite elevated trade policy uncertainty and soft export performance of late, EDC’s overall Trade Confidence Index has held up surprisingly well. It was down only slightly compared to the Spring, with most companies saying they expect conditions to remain the same or improve in over the next six months.

Despite this generally positive outlook, almost one-quarter of respondents said that NAFTA talks have had a negative impact on their domestic operations, and are choosing to respond in different ways.

Since NAFTA talks began in August, progress has been made in several areas such as agreeing on provisions for small- and medium-sized enterprises, customs and trade facilitation and digital trade. Nonetheless, the parties remain far apart on key topics that the United States view as critical to rebalancing NAFTA such as dispute settlement, a sunset clause and auto content rules. In a recent statement, U.S. Trade Representative Robert Lighthizer remained, “concerned about the lack of headway”.

With the sixth round of talks coming back to Canada on January 23rd, and an ambitious timeline to conclude negotiations fast approaching, how worried are Canadian companies about their global sales prospects heading into 2018, and how are they responding to the heightened uncertainty?

The survey shows that companies are considering three strategies:

- Moving part of their operations to the U.S.

- Diversifying to non-U.S. markets

- Adopting a ‘wait and see’ approach

About 6% of the companies surveyed report that they are considering moving part of their operations to the U.S. to avoid border disruptions. Much of this remains talk at this point, but clearly some businesses are considering contingency plans, and this issue keeps resurfacing in our conversations with Canadian companies. So far, there’s only been a few examples of companies restructuring their operations, but this is something to watch closely should the Canada-U.S. border situation worsen.

Encouraging are signs that some Canadian firms are responding with a proactive and ambitious approach, looking to diversify their sales and investments into non-U.S. markets. For these companies, Canada’s new trade deal with the European Union, CETA, which provisionally came into force in September 2017—and the increased momentum in Europe’s economy—are coming together at the right time.

Survey questions on CETA suggest that Canadians are focusing on the key markets of Germany and France, and to a lesser extent, the United Kingdom, Italy and Spain. Some are developing and tailoring new products and services specifically to the European market, while others are looking to take advantage of cheaper inputs due to lower tariffs.

Finally, there’s a third group of Canadian companies taking a more conservative approach. For now, they plan to do nothing before a new NAFTA outcome is realized, while others are delaying planned investment and hiring. In these latter cases, if the NAFTA talks are positively resolved in the near-term, then we can expect a rebound in economic activity in Canada as these plans are put back in play.

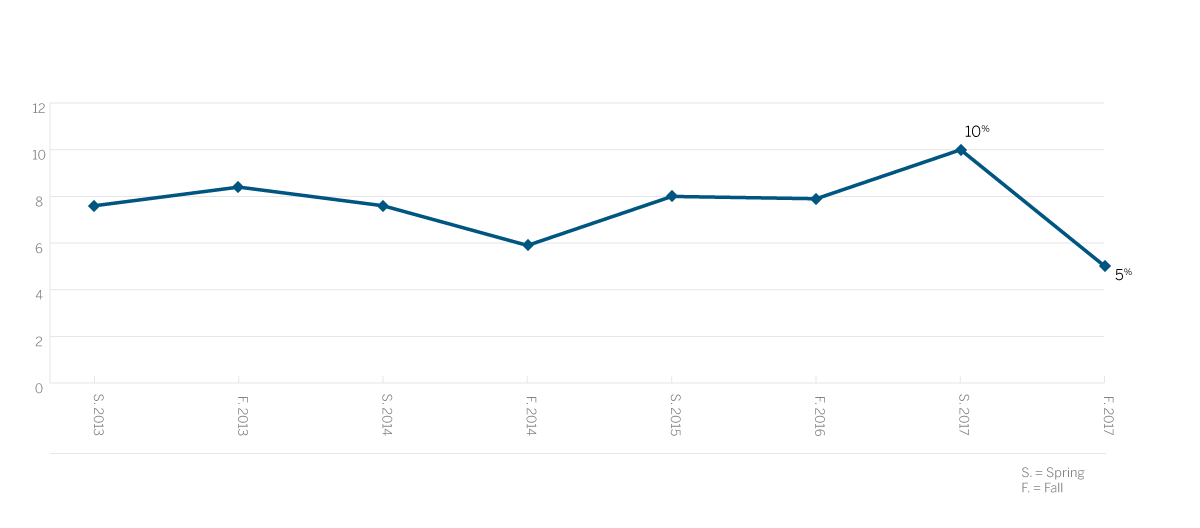

Looking at survey results over the longer term reveals some preliminary evidence suggesting slower growth in Canadian export capacity and interest. Specifically, since 2015, progressively fewer companies have reported that they have started exporting to new countries in the previous two years, and fewer are planning to do so in the next two years. While this trend isn’t definitive, it is concerning and something that we will monitor closely. Perhaps not surprisingly, there was a significant drop in the number of current Canadian companies planning to start exporting to the U.S. in the next two years. If recent signals from the U.S. government are dissuading some from entering this critical market, and if this pattern was sustained, there could be negative longer-term consequences. The U.S. has long served as a key training ground for Canadians, and one that’s not easily replaced.

Of those current Canadian exporters planning to export to new markets in the next two years, per cent who are planning to export to the US.

On a more positive note, there’s a silver lining to the uncertainty surrounding NAFTA. This high-profile trade debate may be the catalyst needed to help push more Canadian firms to diversify their international operations into new markets beyond the United States. At EDC, we’ve long been advocates of diversification. We know it’s a proven approach to expand sales and spread risk.