COVID-19: Surveying the damage

When the global pandemic hit, essential frontline workers stepped up to address the public health emergency. While economists certainly aren’t “essential”—in the life and death sense—like some other occupations, demand for our services picked up significantly in 2020.

In my Nov. 12 column, I explained how Export Development Canada is leveraging new high-frequency data to improve our tracking of Canada’s economic recovery.

This week, I’ll describe complementary efforts using surveys to quickly capture insights from the on-the-ground experiences of Canadian companies.

Winners and losers

Our latest COVID-19 research panel survey, conducted in October, continues to show the widespread and devastating business impacts of the pandemic. However, it’s not all doom and gloom; there are some encouraging signs of improvement in recent months.

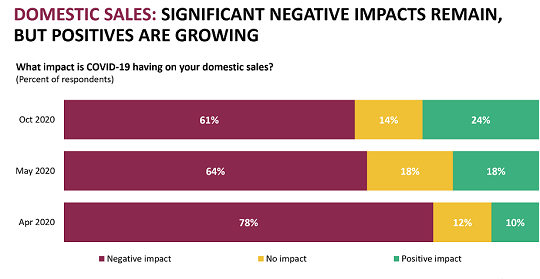

As the recovery continues, the share of Canadian businesses reporting negative sales impacts from COVID-19 keeps falling, while those reporting positive impacts is rising. While the so-called business “losers” still outnumber the “winners” by a large margin, it’s now closer to 3-to-1, rather than the 8-to-1 during the first lockdowns.

This finding demonstrates the highly uneven “K-shaped” economic impacts many economists have highlighted. Some sectors are enjoying robust demand (such as online retail, high-tech, housing and groceries), while others are struggling through prolonged and difficult structural adjustments (brick-and-mortar retail, oil and gas, aerospace, restaurants, entertainment and tourism).

Of the negatively impacted businesses, most now report domestic and export sales declines of 25% or less. This remains a big hit, but is much improved from April when most businesses experienced sales declines of more than 50%.

COVID-19’s staying power

The longer the pandemic drags on, the more expectations adjust. With each successive survey, the sales impacts are expected to last longer. Almost 40% now think COVID-19 will affect their sales for at least another year (i.e., until the end of 2021).

The upshot of longer pandemic expectations is that companies are more confident to place bets on the staying power of strategic adjustments needed to ride new waves. Twenty-two percent say they’ve pivoted their businesses to support the pandemic (up from 16% in April); similar numbers report having new domestic opportunities, or are now considering selling to new export markets (the U.S., Europe and Asia are the top destinations).

Many margins of adjustment

Given this size and pervasiveness of this shock, the adjustment period will be long and difficult for some. Our survey suggests more businesses are laying off workers (39% of respondents have done so temporarily versus 32% permanently). With the potential for structural drops in labour demand for some occupations, rising long-term joblessness is something economists are watching closely with each release of the Labour Force Survey.

Some labour adjustment comes through hours and salaries as opposed to jobs. Almost half (46%) of companies are keeping employees on the payroll, but at reduced hours. Fortunately, outright production stoppages have fallen dramatically.

Some work can be done anywhere, and remote work has really taken off—especially for those with university degrees who spend their days at a computer. Almost half of companies (47%) now have employees working from home. That’s a dramatic increase from before the pandemic. Many of these workers say they’re not planning to return to the office full time when this is over.

Firms are also busy adjusting their supply chains: 14% have changed domestic suppliers, while 11% have changed international suppliers. This remaking of global supply chains is sure to continue, as twice as many businesses are actively considering further changes.

Continued social distancing means companies must step up their online sales capabilities. A full 94% of businesses can now conduct their sales online, up from 83% in April. Of those who can sell online, many (46%) made new investments to improve their existing online presence, while some (10%) had to start from scratch. When enhancing their online presence, businesses report several challenges, including the high cost of adoption, data security issues, determining the right platforms and providing effective customer support.

Key business concerns and challenges

When asked for their No. 1 business concern, reduced customer demand tops our list. Most economists view weaker demand as a bigger worry than bringing back supply. Indeed, business reopenings increased supply, providing a strong boost to growth as we emerged from the first lockdowns. Our survey shows 58% of companies have now partially reopened their physical locations, and 36% have fully reopened. So the stores are mostly back in operation, but will customers return like before COVID-19?

Other top business challenges include employee safety, business survival, retaining employees, and the strength of the overall economic recovery.

Travel restrictions continue to be the top challenge for those expanding their international business. With border closures and quarantine requirements, moving staff across countries has become difficult. Other trade concerns include logistics problems, business and supply chain disruptions, and obtaining reliable market intelligence.

Some good news

The good news is that financing needs are less urgent. This may partly reflect “survivorship bias” (i.e., firms that failed early in the crisis aren’t around to participate in our survey), but many companies say they’ve reached out for supports from governments, financial institutions and others, which has likely helped improve tight cash flows in some sectors. As program eligibility requirements expanded over time, fewer firms report obstacles to getting the help they need. Now 57% say they can operate for at least six months before requiring new funding, up sharply from 25% in April.

Well, those are the key takeaways from our latest COVID-focused survey. Stay tuned for EDC’s Trade Confidence Index in December for an updated assessment of how Canadian exporters are feeling about the near-term outlook, and much more.

This commentary is presented for informational purposes only. It’s not intended to be a comprehensive or detailed statement on any subject and no representations or warranties, express or implied, are made as to its accuracy, timeliness or completeness. Nothing in this commentary is intended to provide financial, legal, accounting or tax advice nor should it be relied upon. EDC nor the author is liable whatsoever for any loss or damage caused by, or resulting from, any use of or any inaccuracies, errors or omissions in the information provided.