Spiking COVID-19 cases threaten Canada’s recovery

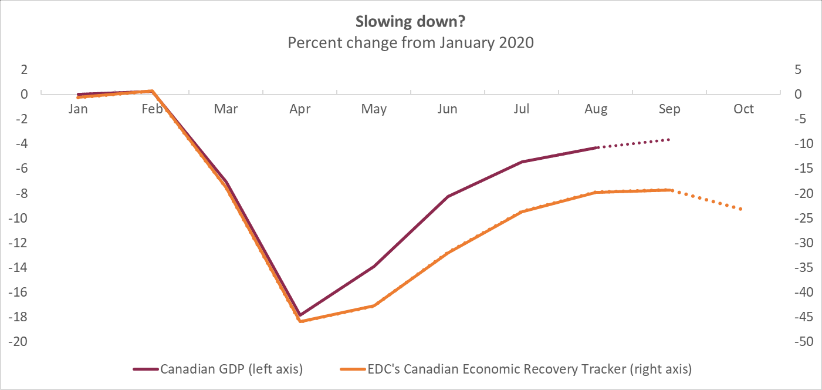

A second wave of COVID-19 cases and stagnation across other indicators is pushing Export Development Canada’s economic recovery tracker into reverse. This monitoring tool provides an early warning sign of what may lie ahead when official gross domestic product (GDP) statistics are released. Momentum has clearly slowed, and fourth-quarter growth will be much weaker than the bounce-back enjoyed in the third quarter. But will it remain positive? Let’s hope our tracker is pulling a false alarm, that the second wave of the virus is soon contained, and that economic momentum gets moving in the right direction.

Note: Dashed lines represent “flash estimates.”

Sources: Export Development Canada and Statistics Canada.

COVID-19: Entering a third phase

According to EDC’s Canadian Economic Recovery Tracker (CERT), Canada might be nearing a critical turning point in the third economic phase of this global pandemic.

The first phase, in March and April, featured a sudden stop in economic activity, and a major shift to working and shopping online. This period was marked by the initial spike of COVID-19 cases and widespread government restrictions imposed across much of the world, to contain the virus. With many businesses shutdown and people largely confined to their homes, economic activity plummeted at the fastest rate ever recorded. With personal mobility limited and people fearful of contacting the virus, there was also a rapid shift toward a more digital world.

The second phase was the reopening rebound, which occurred over the summer. Unprecedented government support was coming through for households and businesses, and as the first wave of the virus came under control, lockdowns were eased. Some businesses reopened physical locations (often at reduced capacities) to complement their virtual storefronts. As we learned more about the virus, hygiene improved and mask wearing became common, which allowed for safer in-person commercial interactions. Consumers ventured out of their houses, increasing mobility. Now past their initial pandemic shock, people started adjusting, creating new routines, and making purchases they delayed during lockdowns. The economic rebound was sharp—much faster than most expected—but only partial.

As predicted in EDC’s Global Economic Outlook, “fast didn’t last.” Now Canada is in a third, slower growth recovery phase, with a long, uncertain and highly uneven situation across sectors. In September, a second wave of COVID-19 cases in Canada began to accelerate. Some health restrictions were reimposed, but unlike the first wave response, they’ll likely do less economic damage for two reasons. First, they’re much more targeted to specific hotspots and activities. Second, we’re not starting to socially distance, we’re continuing to do it. Since we’ve been through this drill before, another economic sudden stop is unlikely. Many are adapting to “business as unusual.” A fortunate 2.4 million Canadians, who didn’t previously do so, are working from home because of the pandemic.

The key question now isn’t whether growth will slow; it already has. Instead it’s whether growth will stall completely and turn negative? Indeed, several forecasters expect negative growth in Europe in the fourth quarter in countries where the strictest lockdowns are being reimposed. The Bank of Canada now puts Canada’s growth at under 1% at annual rates in Q4.

Improving our tools

This “three-phase” narrative has only become clearer over time. We’re all learning as we go, and hindsight is 20/20. What businesspeople really care about is where we are right now — and even better, where we’re going. That’s why early in the pandemic, EDC developed the CERT. A key problem for forecasters and policymakers is that official statistics are often months out-of-date by the time they’re released, a perennial problem made worse in a global pandemic.

We’re effectively driving a car, by looking out the rear-view mirror. Fortunately, big data advances provide new tools and produce faster, better high-frequency indicators—many of which we could only dream of using during the Global Financial Crisis. Some of these series, like daily COVID-19 case counts and government stringency indices, weekly credit card spending and more, are quite new. This experimentation is all about improving our understanding of the economy, and trying to go from the rear-view mirror to a real-time dashboard.

Statistics Canada has also upped its game, providing “flash” estimates of GDP a month earlier than their previous practice, among other notable advances.

The CERT’s latest reading, a turning point?

In our Nov. 6 CERT release, we continue to push the bound of what we can see by distilling a diverse set of indicators. The results are sobering. Unfortunately, the CERT’s slide, which began in September, is continuing into October. The growing second wave of COVID-19 cases, which has been breaking records in recent weeks, is by far the biggest factor dragging down our tracker. But the stagnation and outright reversal of activity picked up by the CERT, also reflects plateauing progress in financial markets, and modest backtracking on flights, personal mobility, and consumer confidence.

The goods news is that for now, equity markets and consumer spending remain strong, freight activity continues to grow, and labour market indicators (such as hours work and online job postings) are healing, although they remain below pre-pandemic levels.

For now, let’s hope the second wave of this virus is soon contained; that our tracker is pulling a false alarm; and that reimposed restrictions have only a modest restraint on the most-affected sectors, so Canada’s economy can record positive growth in the fourth quarter, as our long recovery continues.

This commentary is presented for informational purposes only. It’s not intended to be a comprehensive or detailed statement on any subject and no representations or warranties, express or implied, are made as to its accuracy, timeliness or completeness. Nothing in this commentary is intended to provide financial, legal, accounting or tax advice nor should it be relied upon. EDC nor the author is liable whatsoever for any loss or damage caused by, or resulting from, any use of or any inaccuracies, errors or omissions in the information provided.