E-commerce grocery platforms deliver growth across the Indo-Pacific

Author details

Susan Redding

Senior international trade writer

An increasing number of consumers in the Indo-Pacific buy their groceries online. How can Canadian agri-food companies leverage this trend to grow in the region? Learn how online shopping is transforming the retail food landscape in countries like Indonesia, South Korea, India, Japan and China, creating a pipeline of opportunity for exporters.

In this article:

- Mobile commerce and COVID-19 power digital adoption

- A customer-rich environment draws global interest

- Leading online grocery companies in the Indo-Pacific

- Benefits of marketplace platforms

- Made in Canada stands out in crowded markets

- How to start selling your products on Asian e-commerce sites

- Canadian food and beverage products in demand

- 5 tips for succeeding in Indo-Pacific e-commerce

While open-air food markets and small shops are part of the cultural fabric across the Indo-Pacific, many shoppers in the region visit Western-style supermarkets and chain stores when it’s time to stock the pantry. Recently, consumers in the Indo-Pacific have also embraced online shopping for their grocery needs, lured by the convenience, low prices, availability of global brands, and massive selection of fresh and packaged food that can be delivered to their door with a few clicks.

E-commerce in Asia and the Indo-Pacific is highly competitive, with both local and global players vying for market share. To stay ahead, companies are constantly innovating and expanding their product portfolios. Canadian agri-food producers can take advantage of the growing demand to enter these promising markets by offering unique, high-quality foods to fill the platforms’ endless shelves.

But market entry requires careful planning and understanding of local consumer behaviours, regulatory nuances, and market dynamics, along with strong partnerships in Canada, your target market—and everything in between. This article explores the state of the e-commerce grocery sector in the Indo-Pacific and strategies for Canadian agri-food exporters to succeed in the channel.

Two converging factors supercharged e-commerce growth in the Indo-Pacific over the past five years:

1. The rise of m-commerce: Throughout most of Asia and the Indo-Pacific, e-commerce is actually mobile commerce (m-commerce), with transactions occurring on mobile apps rather than websites. Over the past decade, smartphones and affordable mobile data democratized internet access across Asia, putting the internet at the fingertips of hundreds of millions of users in previously underserved areas. Approximately 70% of the population across Southeast Asia is online, with significantly higher percentages in Singapore (96.9) and Malaysia (96.8). About 140 million Indonesians and 800 million people in India now have internet access. Those numbers are expected to keep growing.

2. COVID-19 public health restrictions: During the global pandemic, strict lockdowns in many Indo-Pacific countries closed stores for months at a time, forcing consumers to change their shopping routines overnight. Online ordering and grocery delivery became a necessity. Once restrictions lifted, it became apparent that the behaviour shift was permanent, as shoppers came to appreciate the benefits of grocery shopping online. Consumers in some markets, like India, still prefer to stop by their local market for fresh produce but increasingly buy packaged food and household items online.

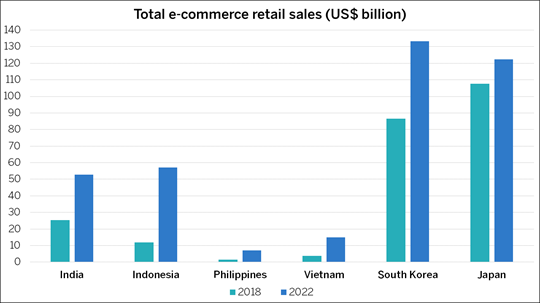

E-commerce grew significantly between 2018 and 2022 in many Indo-Pacific markets. Source: Euromonitor.

E-commerce companies in the Indo-Pacific have built on these trends with innovations that make online shopping convenient and remove barriers to purchasing such as cash-on-delivery, e-wallets, online bank transfers, and other options suitable for customers who don’t have a credit card.

Vendors are also quick to respond to changing online behaviour. For example, many m-commerce companies have embraced social commerce and allow customers to order through messaging apps, meeting their customers where they are online, rather than driving them to a separate website. With these new consumer habits and enabling technologies in place, the prospects for the continued growth of online grocery shopping is strong.

According to Joy Rankothge, Export Development Canada’s (EDC) chief representative for South Korea, the pace of digital innovation in Asian e-commerce is much faster than in North America.

“Canadian companies will need to learn to adapt to an environment where consumer behaviours and trends change virtually overnight. Working with a local partner to sharpen your knowledge about e-commerce go-to-market strategies and the evolving landscape can help a lot,” Rankothge says.

E-commerce grocery businesses can scale quickly in the Indo-Pacific because there are lots of people in relatively small areas. The region’s population density allows the platforms to offer customer-friendly services such as same-day (or even same-hour) delivery, free shipping, and no minimum order requirements. Unlike Canada, where distance and lower population densities can make it challenging to offer these services for food products, they can be provided profitably in Indo-Pacific markets.

The immense potential of online grocery retailing in the Indo-Pacific has caught the attention of agri-food companies and global food retail giants. In 2018, Walmart paid US$16 billion to acquire a 77% stake in Flipkart, a leading Indian e-commerce company, and upped the ante in 2023 with a US$1.4-billion buyout of Flipkart’s minority owner. Amazon has a large presence in Japan and is growing in India and Singapore.

But many of the top players in the region’s highly competitive and innovative e-commerce grocery space are homegrown, and tailor their business model and offerings to the local market. While these platforms may be unfamiliar names in Canada, they offer several advantages to Canadian food and beverage exporters selling into the Indo-Pacific, including far greater market penetration, visibility and product listing at a lower cost than traditional retail platforms.

- Southeast Asia: Lazada, Shopee, Grab

- Japan: Rakuten, Amazon Fresh

- South Korea: Gmarket, Coupang Fresh

- India: BigBasket, Amazon Fresh, Blinkit

- China: Alibaba, JD, Taobao

In addition to the major players, each country has its own ecosystem of e-grocery services, including apps that connect customers to small local shops for deliveries.

Agriculture and Agri-Food Canada (AAFC) offers detailed information about e-commerce for Canadian food and beverage companies in key global markets, including the Indo-Pacific. This research can help you understand the nuances of each market and determine which ones are a good fit for your products.

Internet use across Asia is primarily app-based, and shoppers browse, order and pay for goods on their smartphones. In contrast to Western markets, where consumers often shop on a brand’s website, Asian e-commerce is driven by marketplace platforms that integrate a huge array of brands, categories and services on one app. Platforms like Tmall, Rakuten and Lazada allow individual brands to set up sites and customize their content, while offering customers a standard set of policies and benefits that build trust.

In a webinar for MyEDC subscribers, Peter McMath of WPIC Marketing and Technologies, a digital commerce agency focused on Asia, explained a key benefit of these platforms for businesses:

“Marketplaces have played a crucial role in de-risking purchases for consumers. By offering policies like seven-day, no-questions-asked, money-back guarantees, they build trust and encourage consumers to buy from unfamiliar brands. This presents a unique opportunity for Canadian companies to enter these markets with the backing of these popular and respected platforms.”

In addition to the trust provided by the platforms, Canadian food and beverage companies can build confidence with consumers by leveraging AAFC’s Canada Brand program, which is strengthening Canada’s reputation as a trusted supplier of food and beverage products in the Indo-Pacific. It emphasizes the quality, sustainable, innovative and diverse food products Canada brings to the table.

“The global pandemic changed the way in which business is conducted, from the increase in e-commerce use to the ways in which products are promoted to consumers around the globe. Canada has a great reputation for providing high-quality food products, and by refreshing our national brand to be more digitally optimized ensures our companies can remain competitive in today’s digital business environment,” says Lauren Donihee, executive director of market development at AAFC.

“We’re giving our industry an international stage to showcase their trusted, sustainable and innovative products, and collectively we are better equipped to show the world… food is in our nature,” Donihee says.

The Canada Brand program offers registered members access to a suite of marketing tools designed to raise the profile of, and help differentiate, Canadian agri-food products from the competition. It’s open to Canadian companies that have a role in producing, promoting or supporting Canadian agriculture, food and seafood products. It includes free access to branding graphics, photography, messaging on Canada’s advantages and digital marketing assets. AAFC and partners also utilized the brand in various global market development initiatives to help promote the sector at large.

AAFC now has two e-commerce and digital marketing campaigns in Japan and Vietnam, featuring a year-long showcase of Canadian products on the largest e-commerce grocery platforms in each market.

Many Asian marketplace apps are closed ecosystems that have an application process for brands hoping to sell on the platform. But this step shouldn’t be a barrier.

“Most Indo-Pacific e-commerce sites will provide Canadian companies with a list of trusted partners to work with you on the process,” explains Ashley Kanary, EDC’s director for global agri-food.

Kanary says your partner can also advise on which e-commerce transaction and fulfillment model is right for your product and your business:

- Domestic e-commerce: Goods are imported into the country before being sold to a local consumer or business. This model enables faster shipping and lower customer quotas but can involve more paperwork upfront.

- Cross-border e-commerce: In general, goods are warehoused in a free trade zone and imported by the customer.

Partnerships are also critical after you’re set up to sell. As Ruzan Desai, EDC’s regional manager in India, explains, “It’s imperative for Canadian companies to have a local partner in the food space to enable last-mile delivery, as well as ensuring the quality of food with cold storage and cold supply chains.”

Leveraging your existing relationships with global food retailers can be an effective and efficient way to start exporting to new markets. If your company doesn’t have these connections, EDC can facilitate introductions to key players in your target market through our strategic relationships with market leaders such as Tata (Big Basket) and Reliance in India.

As part of EDC’s Indo-Pacific strategy, we’re also building our relationships in other Indo-Pacific markets, and Canada’s trade ecosystem can connect you with more opportunities and help you understand the e-commerce landscape in your target market.

Shelf-stable and packaged foods are ideal for e-commerce, but fresh produce and meat are also sold on Indo-Pacific grocery platforms. Products that require trust and transparency in ingredients tend to perform well in Asia and the Indo-Pacific. It’s imperative to understand dietary preferences in your target market and ensure your products match local expectations, including:

- Green dot: Packaged food in India is marked with a green dot if it’s vegetarian and egg-free, and a brown triangle if it’s not. As many Indians follow a lacto-vegetarian diet, foods that can earn the green dot are preferable for the market.

- Halal: In Muslim-majority countries such as Indonesia and Malaysia, this certification is essential. Canadian exporters must research the regulations in your target market and ensure your products meet the requirements to be certified halal.

- Organic: Health-conscious consumers across the region look for the “certified organic” label. Canada has organic equivalency arrangements with Japan, South Korea and Taiwan, which simplifies the import process for those countries.

1. Budget carefully for market entry, considering expenses such as localized marketing, product-related costs, localization, platform fees, regulatory costs, warehousing, payment processing, customer service and taxes.

2. Identify local partners and/or intermediaries who can provide access to storage, cold supply chains and home delivery of your goods. Plan to visit the market to solidify relationships with your partners.

3. Be prepared for compliance and registration requirements for food and beverage products in your target market. Consult the Trade Commissioner Service (TCS) and AAFC for information on exporting food to your target market, and create a MyEDC account to connect with an EDC trade advisor for answers to specific questions.

4. If non-payment is a possibility, protect your receivables with EDC Credit Insurance.

5. Once you’ve done your market research, consult with the TCS to seek opportunities, contacts and other key information about doing business in your target market.

Market-specific insights

While China is the undisputed global leader in e-commerce, other markets in the Indo-Pacific offer excellent opportunities for diversification and growth.

Japan: The third-largest e-commerce market globally (behind China and the United States), online sales are expected to hit more than US$131 billion annually by 2025. Rakuten dominates the Japanese market with around 100 million users.

Southeast Asia: Indonesia is forecast to represent about 50% of the e-commerce market in Southeast Asia by 2025, due to the growing middle class and increasing internet access. But markets, like Thailand, the Philippines, Malaysia, and Vietnam, are also growing rapidly. Lazada is emerging as a leader in the region.

South Korea: Per capita, South Korea has the highest e-commerce spending in Asia, as consumers have fully embraced online shopping for a wide range of goods, including groceries. The market is led by domestic companies, like Coupang, Naver and G-Market.

India: India is the seventh-largest e-commerce market in the world, and growing fast. BigBasket, Amazon (which has a dedicated Canada store), Blinkit (formerly Grofers) and Flipkart (Walmart) are the major e-grocery platforms.

Ready to sow the seeds of global growth for your company?

Connect with EDC and watch your agriculture and agri-food business flourish on the international stage. Answer some questions about your company and learn more about how EDC can help your company plan, connect and fuel your global expansion.