If you earmarked 2020 as the year to expand your business into the United States, COVID-19 may have delayed those plans. For those already doing business there, they likely faced a litany of challenges and yet two simple facts remain: the U.S. is our largest trading partner—and likely always will be—and “business as unusual” must go on.

Despite the ongoing border restrictions between our two countries and COVID-19’s unprecedented social and economic global impacts, there are signs of hope for better days ahead for Canada-U.S. trade.

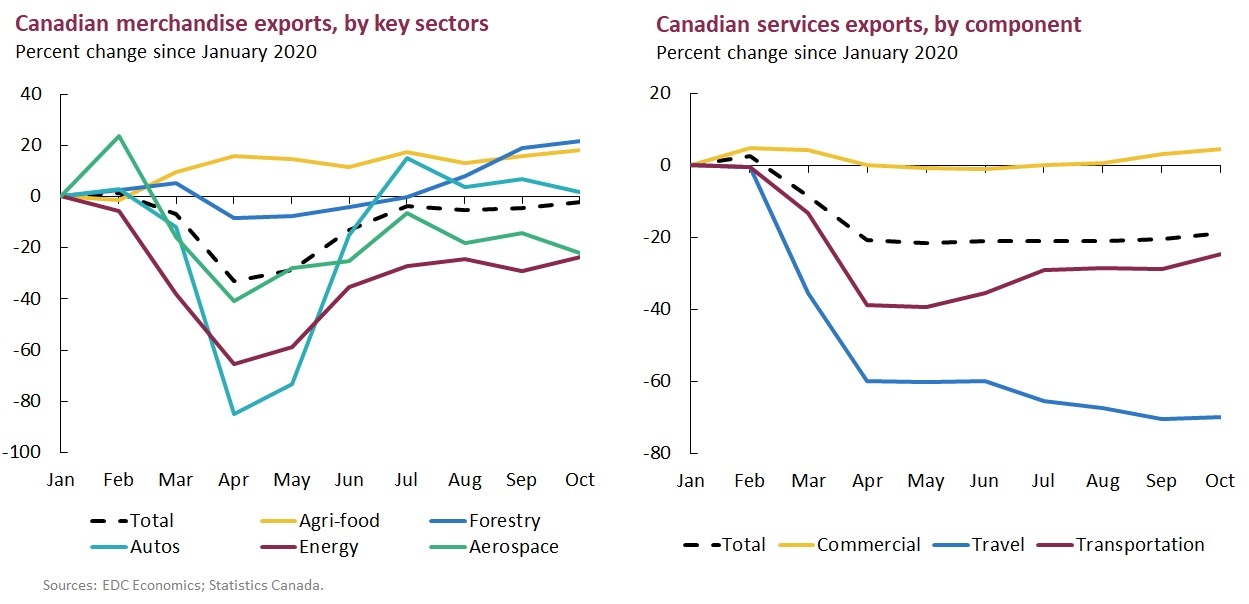

“The U.S. economy has performed quite well in 2020, all things considered,” says Stephen Tapp, deputy chief economist at Export Development Canada (EDC). Pointing to a number of key indicators during a recent webinar on the U.S. economic outlook, Tapp was cautiously optimistic: “Despite rising COVID-19 caseloads, there’s a growing sense that the worst part of the economic hit is now behind us. For most businesses, 2021 should be noticeably better than 2020.”

Rising optimism is being driven by promising vaccine news, including an anticipated initial rollout scheduled in the coming months. Still, the COVID-19 numbers are alarming, with daily confirmed cases spiking for a third time, and hospitalization rates higher now than during the first wave in March and April.