Currency exchange risk: How to handle the ups and downs during COVID-19

Even at the best of times, currency exchange is one of the biggest risks Canadian businesses face when buying and selling internationally. Yet, many companies do nothing about it, believing it’s all out of their control.

I realize this head-in-the-sand approach is simply wishful thinking. Business owners know a fluctuation in the exchange rate can cost them—they just secretly hope it’ll be in their favour.

But with the impacts of the COVID-19 pandemic sending exchange rates on a roller-coaster ride, companies are realizing there’s a hidden danger to not managing their currency exchange risk—even if the gamble pays off. With the current global market, there’s never been a more critical time to build a foreign exchange policy for your business, and to work with your financial institution and Export Development Canada (EDC) to manage the risks.

To help you during this pandemic, EDC is introducing new initiatives and streamlining processes to provide the help you need—faster, easier and at a lower cost. See below for more details. Meanwhile, it helps to understand why you need to manage exchange rate risks, and how to build and execute your company’s exchange rate policy.

Why are exchange rates so important to exporters?

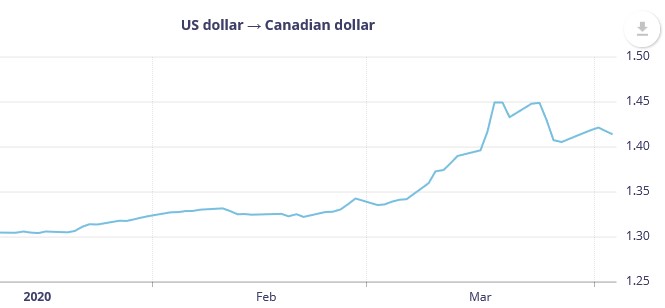

An exchange rate is the value of one country's currency in relation to another’s. For example, as of March 27, it cost $1.41 Canadian to buy one U.S. dollar, and $1.56 to buy one euro (€). The challenge for those who sell internationally is that currency values between countries are in a constant flux. During the pandemic, that flux is amplified even more, as you can see in this graph from the Bank of Canada (BOC.)

Why does this matter? Say you sell some equipment for 100,000€ to your customer in France and give them 90-day terms. Your expectation is that at the current exchange rate ($1.56 Canadian for one euro), you’ll receive the equivalent of $156,000 in Canadian funds or more when the bill is paid.

But what if the value of the euro drops during that time from $1.56 to $1.40 Canadian? Now, you’ll only receive $140,000. It’s easy to see how the risk of fluctuating currency exchange rates can diminish or even decimate your profits.

But wait a minute, you may be thinking, what if the euro’s value goes up to $1.66? Then, you’ll gain an extra $10,000! That makes it tempting to do nothing about the risk, or assume that sometimes you’ll win, sometimes you’ll lose, and it’ll all even out in the wash.

The hidden cost of ignoring currency exchange risk

There are many things that can influence the value of a nation’s currency, including inflation, interest rates, its economy, the balance of trade between countries, and political instability. But the reality is that you have no control over any of these things—an exchange rate can fluctuate at any time, and sometimes drastically like we’ve seen during this pandemic.

Failing to manage that risk can hurt your business, even if you sometimes come out the winner in the exchange rate gamble. Never knowing what loss or gain you’ll take from fluctuating exchange rates means your company is constantly operating in a sea of uncertainty.

For smaller companies, especially, you can’t be sure what your profit will be for each transaction or how much cash flow you’ll have to fulfil the next contract. The cost of that uncertainty is huge. It means your company could be less competitive and may grow at a slower pace due to inadequate cash flow to fulfil contracts and pursue new opportunities—not to mention the personal stress that taking such a risk can bring.

You should also check out

In this volatile market, safeguard your bottom line while keeping assets liquid with tools like EDC's FXG.

How to manage currency risk

To help you manage foreign exchange (FX) risks, there are two types of hedging instruments in the FX market: FX forward contracts and FX options.

Forward contract: A forward contract locks in an agreed-upon exchange rate for a transaction, which isn’t necessarily what the exchange rate is right now, for a specific date in the future. This can be a good plan if a currency’s value is expected to fluctuate considerably. But it’s important to note that on the agreed-upon date, the financial institution is obligated to purchase the foreign currency from you, and you’re obligated to provide it. The added risk here is that if your customer is late with your payment—or doesn’t pay— you’re still obligated to the financial institution and will typically have to pay a penalty if you can’t provide the currency on time. Forward contract is by far the most widely used instrument by Canadian exporters.

FX options: Unlike an FX forward contract, an FX option doesn’t commit you to buy or sell a given amount of foreign currency on a specific future date. Instead, it gives you the right (but not the obligation) to do so, at an exchange rate guaranteed in the option contract. FX options are therefore highly flexible. They protect you against FX risk while retaining the possibility of profiting from favourable movements in the exchange rate. The drawback is that, contrary to FX forward contracts, you must pay an upfront premium to purchase the option. However, financial institutions have developed various hedging instruments composed of sales and purchase options, such as FX collars, FX tunnel, FX forwards plus, etc. Some of these products require no initial cash outlay.

Bypassing the need for collateral with EDC guarantee

To provide FX solutions, financial institutions require collateral. For the world’s major currencies, the rule of thumb is typically (pre-COVID-19) 10% of the volume of your contracts. So, if you have $1 million in forward contracts, you’ll typically be required to put up $100,000 as collateral in an account with your financial institution. That means your money will be tied up when you could be using it to complete contracts or grow your business.

To get around this, EDC can provide a Foreign Exchange Facility Guarantee (FXG) to your financial institution.

How does an FXG work? Simply put, it allows your business to mitigate foreign exchange risk without locking up your capital. It does that by enabling EDC to provide a guarantee to your financial institution, so there’s no longer any risk to them and no need for you to put up collateral.

Managing currency risk give you three key benefits:

- Predictability of margins: Fluctuations in exchange rates can be a challenge to budget upfront costs or revenues in foreign currencies. You can secure your exchange rate at the outset without putting up capital and protect your margins.

- Facilitate budgeting: Locking in the rate in advance will give you a comfort zone when determining your product or service prices, and increase the accuracy of your cash-flow forecasts.

- Easier access to opportunity: Your borrowing capacity is not constricted, keeping more liquidity in your business to go after more contracts.

New measures to help manage exchange risk during COVID-19

Right now, EDC is adjusting its focus and solutions to help you with your challenges during the pandemic. For the FXG, that means the following:

- We’ve lowered our FXG fees by 30%. While this reduction was already in progress and isn’t linked to COVID-19, it will, no doubt, help during this difficult time.

- We’ve postponed the payment of your FXG fees. From now until September 2020, payment of new FXG fees will be paused for six months, giving some short-term relief to your business.

- You can set up, all in one place, an FXG to cover all of your foreign exchange contracts—current and future—and even those booked before implementation, for existing and new customers.*

- The FXG guarantee will be effective immediately upon receipt of the offer letter signed by your financial institution.

- For existing customers, new streamlined underwriting procedures will speed up the process. Unless you request a significant increase of more than 25% or a limit beyond $2 million, your request will be reviewed as soon as possible with the information already on hand.

- Your financial institution must ensure the limit of the guarantee in place is sufficient. If not, quickly request an increase to EDC. FXG fees will apply for the increase, payable within six months.

Building a foreign exchange policy

At the same time, don’t wait to develop or update your foreign exchange policy. Understanding FX solutions is a great first step to managing your currency exchange risk, and developing a foreign exchange policy will benefit your company even more. To get started, you can reach out to your financial institution to leverage their expertise.