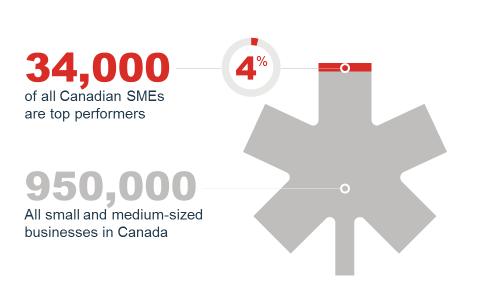

Only 4% of all Canadian SMEs are considered high performers. What sets these highly competitive businesses apart?

To find out, BDC analyzed data from 950,000 Canadian businesses with annual revenues of less than $100 million.

Top-performing companies are defined as companies that see faster growth in their annual sales than their peers in the same sector while remaining more profitable.

These businesses saw their average annual sales grow by 22%, compared to 1% for other companies. Average profits reached $520,000 compared to $42,000 for lower performers.

They also tend to be larger than other SMEs. Only 3% of companies with annual sales below $2 million are top performers, compared to 8% of companies with annual sales above $2 million.

1. They are more productive.

Becoming a top competitor starts with being more efficient, by doing more with less.

Top-performing companies watch their costs and work smarter—which means that they generate more money and at the end of the day they have more money left to invest strategically in their business.

They have higher sales per employee, their profit margins are higher and their operating expense to sales ratio are lower.

2. They invest more in innovation and people

Higher productivity enables top performers to not only be more profitable and increase their chances of survival, but also to improve their growth prospects. Increased productivity helps them generate greater profitability, and the additional revenue can then be reinvested in the business.

They invest in intangible assets. These assets are what makes their businesses unique and help them grow. They refer to all non-monetary and intangible assets held by a company, including:

- Human capital: skills, knowledge and qualifications

- Organizational capital: patents, intellectual property, management processes and systems, and data

- Relational capital: brand image, customers, partners and reputation

And they invest more in their people.

Average compensation per employee divided by average compensation for the sector is $26 per hour for top performers compared to $22 per hour for other companies.

3. They export more

Finally, top-performing SMEs are more likely to export, regardless of their size. In fact, 100% of top-performing businesses with revenues above $10 million in sales are exporters.

Top-performing, exporting SMEs also appear to diversify their export markets more. As a result, they are less dependent on a single export market and are better able to manage any associated economic and political risks.

Well, it all depends on the size of your business.

Small businesses with less than $2 million in annual sales should focus on growth and try to exceed $2 million in sales.

By growing your business, you will achieve economies of scale and productivity gains that will help you generate greater profits, which can then be reinvested. These reinvestments will create a virtuous cycle of improvement and help you become more competitive. Larger businesses have greater resources, generally have a stronger foundation and are better positioned to export.

Mid-sized businesses with between $2 million and $10 million in annual sales should invest more.

Invest in machinery and equipment, particularly in information and communications technology, as well as in intangible assets, such as patents and employee training. These investments will help you become more competitive, innovative, and enable you to seize new opportunities in an economy that is increasingly automated, digitized and interconnected.

Large businesses between $10 million and $100 million in annual sales should expand even more internationally.

The most successful large businesses earn a greater share of their revenue in foreign markets. By diversifying your foreign markets, you will reduce economic and geopolitical risks.

Find out more by reading the complete study, Built for Performance: Strategies Used by Canada’s Leading SME’s.