MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

Learn how credit insurance safeguards your business and opens doors to new markets.

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

Discover resources for smarter exporting

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Canada’s newest trade deal has been in the works for a long time. Are you looking for new customers? This may be a chance to grow your sales outside of Canada.

In this article:

Are you looking for new customers? Canada’s latest trade deal could make it easier for your business to sell to half a billion people.

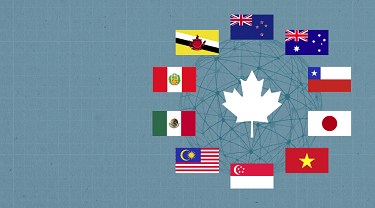

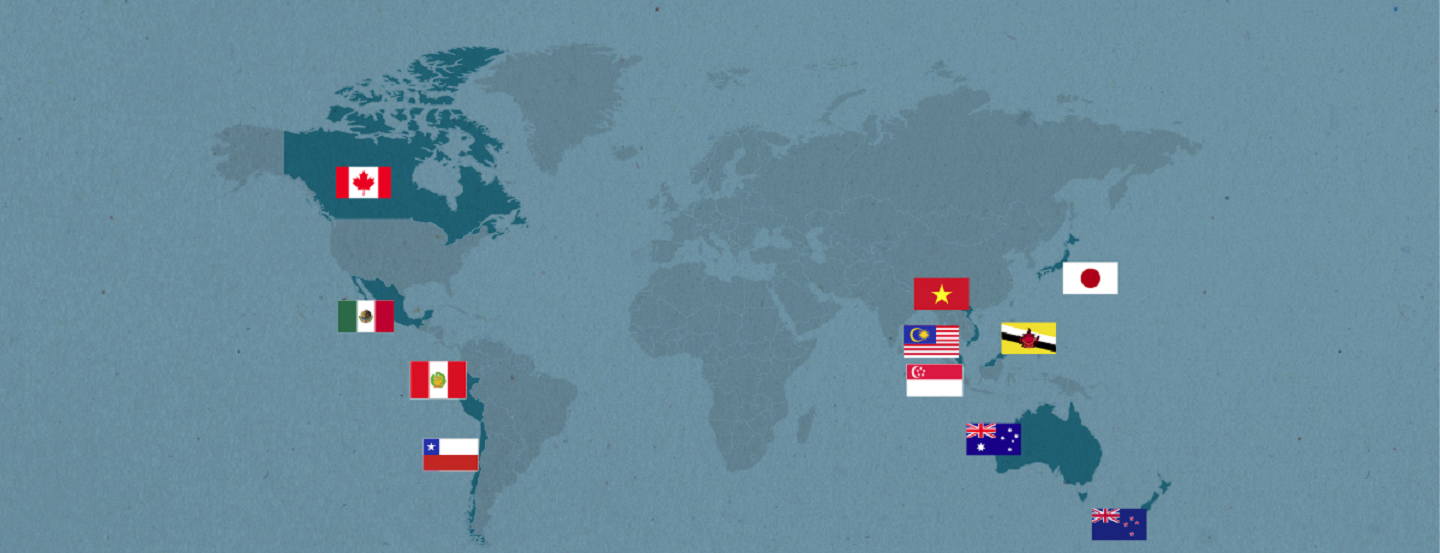

These 11 countries represent 13.5% of global GDP and 495 million customers.

Canada has free trade deals with some of the countries. Mexico is a partner of the North American Free Trade Agreement (NAFTA). Chile and Canada have had a free trade agreement for more than 20 years.

Seven trade partners under the CPTPP are new.

Canadian businesses looking for international customers may want to keep an eye on our new trade partners. The 11 countries that signed the CPTPP have a combined population of 495 million. That’s a lot of potential new customers!

On March 8, 2018, Canada and ten countries signed The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), previously referred to as the TPP.

Free trade agreements like the CPTPP can:

There’s been a lot of buzz about the CPTPP creating opportunities for business in Asia. Japan, Malaysia, Vietnam and Singapore are expected to be fans of Canadian pork and beef. With trade restrictions removed, Canadian farmers and food manufacturers that sell to customers there will be treated almost like local businesses.

For Mark Agnew, director of international policy at the Canadian Chamber of Commerce, access to the Asian market is what’s most exciting about the CPTPP. Japan represents the biggest win. Canadians, he says, have long-wanted preferential access.

Growing markets such as Malaysia and Vietnam also show promise, says Agnew.

Agnew sees the public procurement opportunities available to Canadian companies as an attractive opportunity. Canadian firms – in construction, consulting and engineering, for example — can bid alongside local firms for work on public projects in CPTPP countries.

Whatever you sell, free trade agreements like the CPTPP can make day-to-day business transactions run smoother.

Trade agreements streamline paperwork, says Motria Savaryn-Roy, an economist with Export Development Canada’s Economic and Political Intelligence Centre. The CPTPP will make Canadian trade rules and investments more transparent to exporters, she says.

There are pros and cons to every free trade agreement. Canadian businesses selling internationally often grow faster in markets when there’s a free trade deal in place. But Canada’s newest trade partners also have access to our markets.

On the one hand, prices on things we buy from overseas will be lower. On the other hand, it could mean increased competition for Canadian businesses here at home.

The Chamber of Commerce sees opportunities for Canadian businesses in processed food, agriculture, and machinery and equipment, says Agnew.

Check out the following list to see the opportunities and challenges of the CPTPP in your industry.

Economic impact assessments suggest Canada’s auto exports will increase slightly as a result of the deal, with a modest estimated net gain in production of $206 million. Global Affairs Canada further states that the CPTPP will support diversification by giving Canadians preferential access to several markets in the Asia-Pacific.

Canada’s auto sector lobbied against the CPTPP, as some of its members are concerned about how the deal will affect new NAFTA rules.

Canada’s exports of metals and minerals — which includes iron and steel, aluminium, nickel and petroleum products — to CPTPP countries average $6.8 billion per year. For steel products, Canadian businesses currently face steep tariffs, such as 20 per cent in Malaysia and 40 per cent in Vietnam. Those tariffs, and other smaller ones in countries such as Japan (6.3 per cent) will be eliminated after a phase-out period of 10 years. Australia’s tariff of five per cent will be eliminated after four years..

The Canadian Steel Producers Association is, however, concerned about a negative impact because of the erosion of rules of origin related to the automotive sector. It also fears associated reduced steel demand.

Government analysis shows dairy imports to Canada may increase by $135.1 million as a result of the market access given to the other CPTPP members. It also foresees an increase of $3.5 million in exports. In addition, Global Affairs Canada maintains its commitment to Canada's supply-management system.

“If I needed one word to describe the merits of the deal, I would choose stability,” says Gary Stordy, public relations manager for the Canadian Pork Council. “Our producers are export-oriented. When we look at global markets and facilitating access, trade deals play a large role. CPTPP secures one of our primary markets — Japan is a billion-dollar market for us. We project an annual increase of more than $600 million thanks to the CPTPP through reduced tariff access and a competitive position over other global pork exporters such as the EU and U.S.”

Canadian beef producers expect positive outcomes from the CPTPP. “We compete in export markets with the U.S. and Australia. Agreements like CPTPP, which have the ability to level the playing field in terms of tariff rates and quotas, are very important to us,” says Ron Glaser, vice-president of corporate affairs at Canada Beef. “Even a change of a few percentage points in those areas can have a big impact on sales.”

Asia is a key market for Canadian beef, says Glaser. Having preferential access to Japan, Vietnam and Singapore is a boon.

There is lots of room for Canadian aerospace growth under the CPTPP, says Jim Quick, president and CEO of Aerospace Industries Association of Canada. Some of the trade deal partners are “emerging aerospace economies,” he says.

“Singapore and Vietnam are working very hard to develop their own aerospace sector,” says Quick. “That gives us an opportunity to get a leg up on some of our competitors there. We had existing relationships with Australia and Japan. This will strengthen those.”

"In Chile and Peru, we know some of our members that do modified aircraft want access to those countries. Any further access into markets is always a good thing,” he says.

The deal proves promising for Canada’s information and communications technology (ICT) sector.

“With free-trade agreements, one often sees strong trading relationships will first become even stronger,” says Nevin French, vice-president of policy at the Information Technology Association of Canada. “Companies with existing overseas relationships are able to grow these in the markets where they are already present. Later on, we’ll see the new markets take off.”

“Japan, Malaysia and Australia are exactly the right countries for Canadian companies to target. They’re all excellent ICT markets — tough ones, but worthwhile,” says French.

<Interactive Map to go here!>

Part 3 of 3 in series

Part 1 of 3 in series

Access Asian markets with Canada's newest trade deal, the CPTPPGet the latest on Canada’s new free trade agreement, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). It’s a trade deal with 10 countries bordering on the Pacific Ocean, including Japan, Malaysia, Peru and Mexico.

Learn about key sectors, market trends, and how EDC supports Canadian businesses expanding to Europe.

An EDC economist helps you understand the different country risks at play.

With EDC’s support, this chemical analysis and measurement company has taken on international contracts from all over the world.

See how the heavily integrated supply chain between the Canada-U.S. automotive industries benefit both sides of the border.

“Keep calm and trade on” appears to be the motto for these Canadian companies, as they reveal their strategies for dealing in the U.S. market.