Canada-U.S. trade still a driver for automotive sector

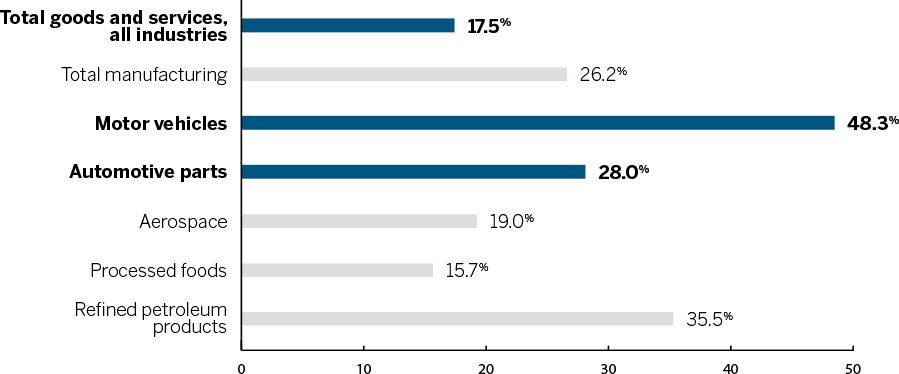

U.S. Content in Canadian Exports to the U.S. (%)

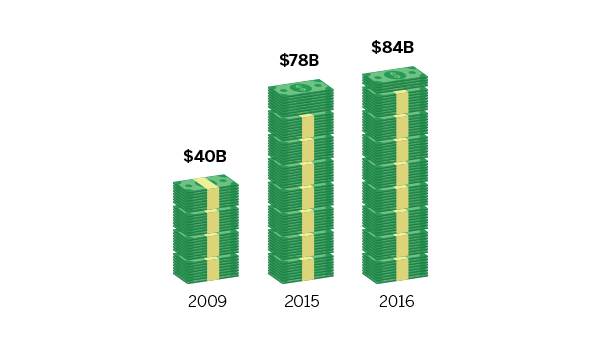

U.S. Trade in Automotive Parts

Fasten your seatbelts for revved-up demand

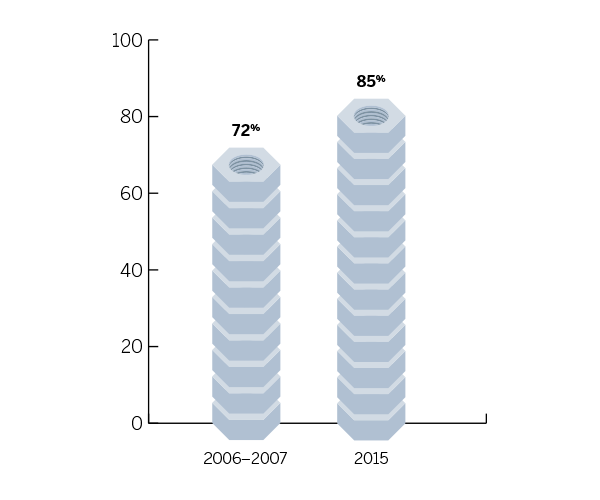

Steering in the right direction with diversified supply chains

Sales may hit the brakes if an import tax is implemented

Many buyers already are stretched to the limit, as dealers increasingly rely on seven-year and sometimes even eight-year loans to help…