MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

Learn how credit insurance safeguards your business and opens doors to new markets.

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

Discover resources for smarter exporting

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

In this blog post:

The one-year anniversary of Canada’s trade agreement with the European Union is fast approaching. On September 21, 2017, the Comprehensive Economic and Trade Agreement (CETA) provisionally came into force, and among other things, significantly lowered tariffs. For instance, before the deal only one quarter of Canadian goods qualified for duty-free access to the EU; now almost all do (98%).

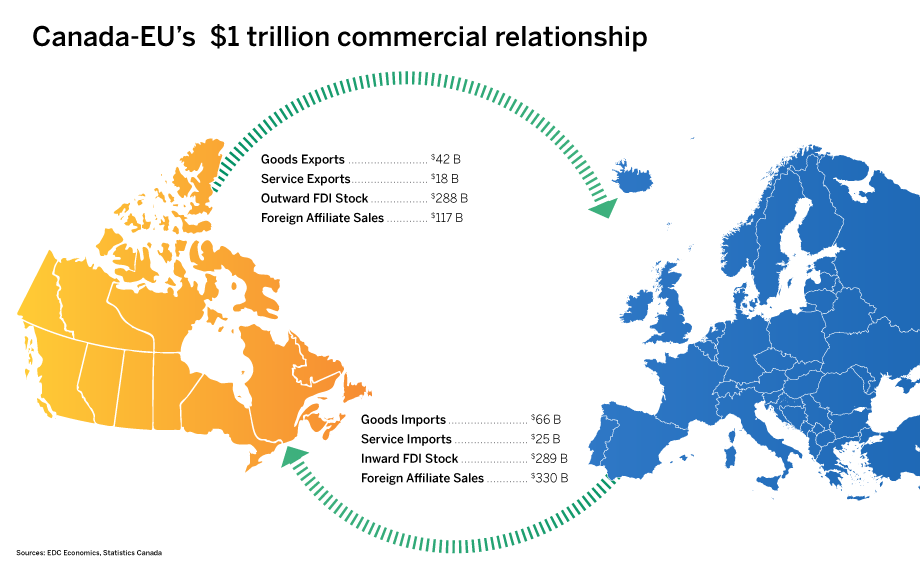

This is one of Canada’s most ambitious trade agreements, and it’s not just about tariffs. While it established 21st century standards for trade in goods, it also addressed services, non-tariff barriers, investment, government procurement, labour, the environment, and regulatory cooperation. CETA is also a big deal, covering one of Canada’s most important commercial relationships internationally — worth over a trillion dollars! The European Union is Canada’s second-largest trading partner, after the United States. It accounts for 30% of Canada’s international investment, 26% of foreign affiliate sales activities, and 11% of our two-way trade.

CETA came into force at an opportune time. Canada’s diplomatic relationship with the United States has been tested under Donald Trump’s presidency. With the renegotiation of the North American Free Trade Agreement (NAFTA) and the imposition of tariffs on steel and aluminum products, Canadian businesses are seeking to diversify their trade and investment beyond the United States.

In the fall of 2017, as CETA was coming into force, our Trade Confidence Index surveyed 1,000 Canadian exporters about how they were responding to new opportunities. About one-quarter (26%) said that, because of the deal, they were paying more attention to the European market. Almost one-fifth (18%) said they were developing new products, services or production processes to start selling to Europe.

Those intending to sell in Europe cited Germany, France, the United Kingdom, Italy, and Spain as their top five target markets. Fifteen per cent told us they were increasing their production to expand existing export volumes to Europe. And finally, 11% said they were looking to start using, or use more, imported inputs from Europe.

Canada’s two-way merchandise trade with the European Union is worth almost $110 billion annually.

It’s too early into the life of this new trade agreement to make any definitive statements about possible impacts on trade flows. So far, we haven’t detected any noticeable increase in Canada’s overall exports to the EU. But there are early reports that trade-intensive locations, such as the Port of Montreal, (Canada’s second largest port behind Vancouver), has enjoyed an 8% increase in inbound container traffic in the first seven months of 2018, relative to last year, with most of this additional traffic coming from Europe.

Digging into high-frequency trade data shows that, relative to last year, the largest gains in Canadian exports to the EU have been:

On the Canadian import side, the largest gains thus far have been:

There’s still much work to do to realize the full gains in these and other categories. Looking ahead, we will track whether new investments are supporting increased production capacity.

International services trade between Canada and the EU is worth roughly $45 billion, or close to 30% of total bilateral trade annually. The United Kingdom is currently the biggest EU destination for Canadian services, representing about one-third of Canada’s total service exports. France and Germany are also noteworthy markets.

The stock of two-way foreign direct investment (FDI) is worth over $575 billion. Canada’s investments in the EU represent 26% of our overall outward investments, while inward FDI from the EU is worth about 35% of the total in Canada.

Most FDI flows between Canada and the European Union involve three countries: the United Kingdom, Luxembourg, and the Netherlands. Here it’s useful to keep in mind that some investments effectively flow through countries, like Luxembourg and the Netherlands, which may not be the ultimate owner or controlling country of the underlying business operations.

There are subtle differences in the direction of flows. For example, in 2017, the top destinations for Canadian FDI into the EU were: the United Kingdom (36% of the total book value), Luxembourg (27%), and the Netherlands (11%). Canadian capital investments in Europe often focus on finance and insurance sectors, as well as real estate, rentals and leasing.

In the same year, the top sources for European FDI into Canada were: the Netherlands (32% of the total), Luxembourg (17%), United Kingdom (16%) and Switzerland (14%). European investments in Canada are primarily in the manufacturing and wholesale trade industries. (It’s unclear how much of these investments in Canada are tied to supply chains, whose final downstream market is the United States).

Foreign affiliate sales, an important and often-overlooked part of this relationship, were worth almost $450 billion in 2015. As with the investment statistics just discussed, there are nuances in the interpretations. It’s instructive that Statistics Canada has recently made efforts to distinguish the “ultimate” country of the foreign affiliates, (i.e., the owner), from the “immediate” country, (i.e., the country where the money came from at its last international entry point).

This distinction matters. More “immediate” foreign affiliate revenues flows through the Netherlands and Luxembourg than the “ultimate” country of control for business activities. The biggest foreign affiliate revenue generators from European activities in Canada are the U.K., Germany, the Netherlands, France and Italy.

Canadian foreign affiliate sales were strongest in the U.K. (30% of the total); Germany (12%); Sweden (7%); France (7%); and Austria.

The importance of the U.K. to Canada’s relationship with the EU stands out in these statistics. At this point, it’s unclear what the outcome of the U.K.’s withdrawal from the EU will be, and what the new rules of commerce will be — both between the U.K. and the EU, and between the U.K. and Canada.

In a webinar marking the first anniversary of the Canada-Europe trade deal, find out why CETA is your introduction to 500 million EU customers:

Which emerging markets are the best fit for your business? Take the quiz to see which countries our economists recommend to meet your needs.

From homecooked meals to exotic global tastes, discover the key trends shaping the food industry

Learn about key sectors, market trends, and how EDC supports Canadian businesses expanding to Europe.

An EDC economist helps you understand the different country risks at play.

With EDC’s support, this chemical analysis and measurement company has taken on international contracts from all over the world.

“Keep calm and trade on” appears to be the motto for these Canadian companies, as they reveal their strategies for dealing in the U.S. market.