-

Solutions

-

-

By product

-

By product

-

By product

-

By product

-

Insurance

Trade credit insurance

Select Credit InsuranceGet short-term coverage for occasional exports

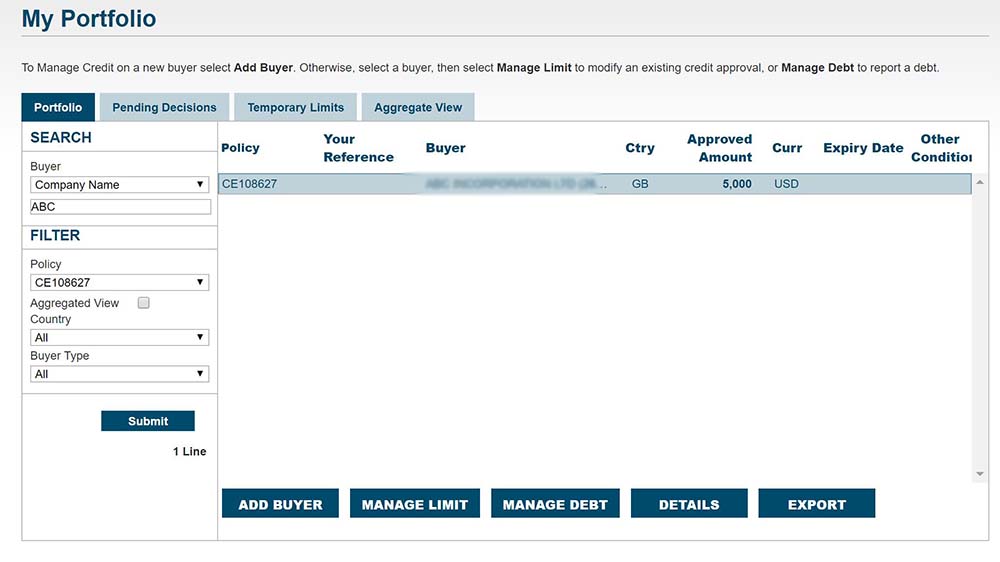

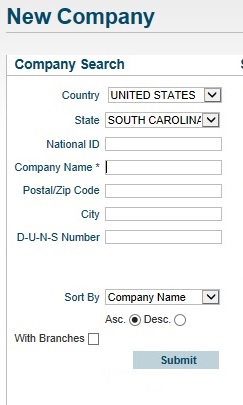

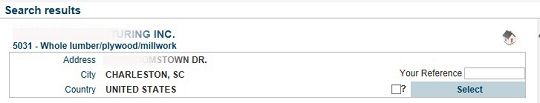

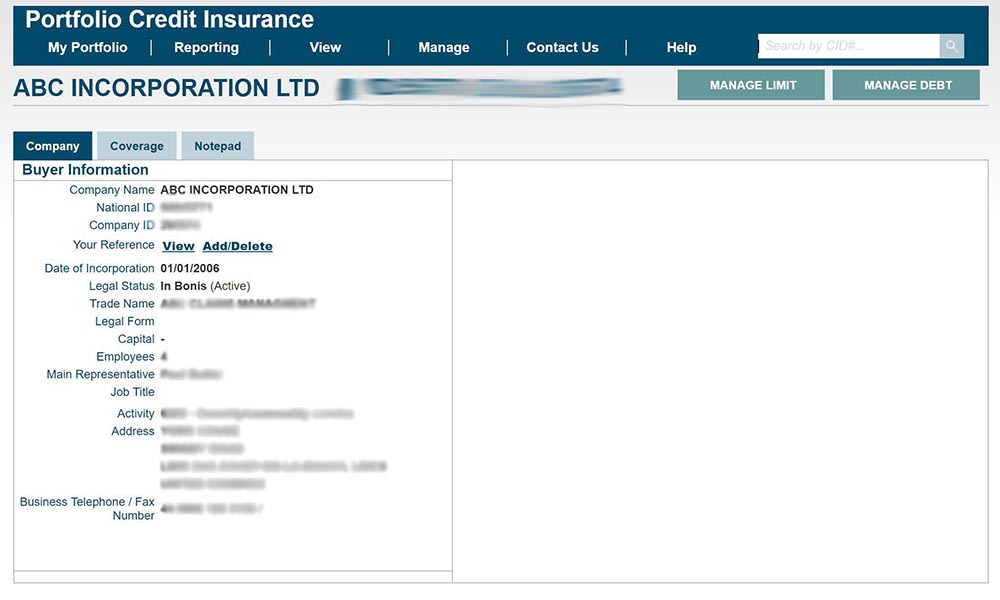

Portfolio Credit InsuranceMaintain ongoing coverage for active exporters

Featured

Insure your exports

Insure your exports

Learn how credit insurance safeguards your business and opens doors to new markets.

Coulson Aviation’s growth

Coulson Aviation’s growth

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Guarantees

Export Guarantee ProgramIncrease borrowing power for exports

Account Performance Security GuaranteeFree up cash tied to contracts

Foreign Exchange Facility GuaranteeProtect profits from exchange risk

Trade Expansion Lending ProgramUnlock more working capital

Featured

Clarius grows globally

Clarius grows globally

Find out how access to working capital fueled their expansion.

Loans

Export financing loans

Direct LendingSecure a loan for global expansion

Buyer FinancingGet financing for international customers

Structured and Project FinanceAccess funding for capital-intensive projects

Featured

Taste of Nature expands

Taste of Nature expands

Find out how direct lending helped this snack brand go global.

Miovision’s sustainable path

Miovision’s sustainable path

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Equity investments

InvestmentsGet equity capital for strategic growth

Featured

GoBolt scales sustainably

GoBolt scales sustainably

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

Cleantech leaders 2025

Cleantech leaders 2025

See how Canadian cleantech firms are advancing global sustainability goals.

Business Connections Program

Business Connections Program

Build relationships with global buyers to help grow your international business.

-

-

Resources

Popular topics

In the spotlight

Market diversificationExplore strategies to enter new markets

TariffsUnderstand trade tariffs and how to manage their impact

Risk managementLearn ways to protect your business from uncertainty

Supply chain resilienceBuild stronger supply chains for reliable operation

Sector

Agri-foodAccess tools and insights for agri-food exporters

Mining and metalsFind market intelligence for mining and metals exporters

CleantechGet insights to drive sustainable innovation

InfrastructureExplore resources for infrastructure growth

Export stage

By export stage

Start exportingDiscover practical tools for first-time exporters

Grow your export businessUnlock strategies to manage risk and boost growth

Expand your global presenceLeverage insights and connections to scale worldwide

Featured

Strategic pricing for exporters

Strategic pricing for exporters

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Global economic outlook

Global economic outlook

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Market insights

Indo-Pacific market intelligenceTrack trade trends in Indo-Pacific

Europe market intelligenceUncover European market opportunities

U.S. market intelligenceAccess insights on U.S. trade

Global market searchBrowse countries and markets

Expert analysis

EDC EconomicsGet expert analysis on markets and trends

Trade MattersDiscover stories shaping global trade

Global Economic OutlookSee what’s ahead for the world economy

Country Risk QuarterlyMonitor shifting global market risks

Trade Confidence IndexRead exporters’ perspectives on global trade

Knowledge centre

Digital tools

Export Help HubGet answers to your export questions

Company InSightResearch foreign companies before doing business

InListFind trusted freight forwarders

EDC | FITT Lite Learning SeriesGain export skills with online courses

Content library

WebinarsGet insights and practical advice from leading experts

PodcastsListen to global trade stories

Success storiesLearn how exporters are thriving worldwide

Case studiesExplore export challenges and EDC solutions

TradeInsightsDiscover resources for smarter exporting

-

About

Our impact

Who we areDiscover our story

What we doSee how we help exporters

Who we supportExplore the companies we serve

Our commitments

Responsible tradeLearn about our commitment to ESG

Organizational governanceUnderstand our governance framework

Corporate reportsSee the results of our commitments

Featured

-

Search

Search

-

Log in or sign up

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

- Contact Us