The weaker growth outlook in Canada, combined with expectations that the U.S. Federal Reserve will be cautious about rate cuts amidst policy shifts, will put pressure on the Canadian dollar. We forecast the loonie to average US$0.70 in 2025, with significant volatility throughout the year. Our forecast then calls for the Canadian dollar to average US$0.74 in 2026, as the interest rate differential narrows.

Economic challenges in Europe

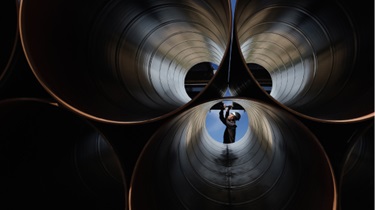

This year, economic growth in Europe will remain sclerotic as the European Union’s (EU) two largest economies struggle to build momentum. The loss of cheap Russian energy following the 2022 invasion of Ukraine continues to weigh heavily on Germany’s manufacturing base. Major industrial companies, including Volkswagen and Thyssenkrupp, have announced plans for mass layoffs and reduced investment. This, along with Chinese weakness and policy uncertainty following the collapse of Chancellor Olaf Scholz’ governing coalition, will restrain Germany’s outlook. We forecast growth of just 0.2% in 2025, before a modest recovery of 1.3% in 2026.

Political turmoil in France and challenges in passing a new budget will hurt consumer confidence and business conditions. We expect the French economy to grow by 0.4% in 2025 and 1.4% in 2026. Italy also faces disputes within its ruling coalition, linked to its budget process and an elevated deficit and debt-to-GDP ratio.

China’s growth prospects

As one of the world’s largest economies, China’s outlook significantly influences global conditions. Despite several rounds of monetary policy loosening and targeted stimulus measures, China’s economy continues to struggle due to the property market crisis.

Consumer and business confidence remain weak, and the country has flirted with deflation. Policy-makers have leaned heavily on manufacturing and exports to support growth, but this strategy will face headwinds in the coming year. We forecast China to grow by 4.5% in 2025 and 4.2% in 2026.

And then there’s America. Compared to other major economies, the U.S. economy is proving very durable. While the labour market is cooling, it remains resilient, with wage growth outpacing inflation. Unemployment remains low, and consumers, although not fully recovered from two years of high inflation, are confident enough to borrow to support their spending. Business investment, supported by several pieces of legislation, remains strong. While the strength of the U.S. dollar in 2025 will dampen exports, we forecast the U.S. economy to grow by 2.2% this year and 2.1% in 2026.

Continued momentum in the U.S. economy, along with an inflation rate that’s cooled but remains stickier than desired, means that the Federal Reserve will be more cautious than many of its peers in its rate-cutting cycle.

We forecast U.S. inflation to average 2.1% in 2025 and 2% in 2026. This will see the Fed take until the second half of 2026 to reach its target level. This slower path to neutral will support the exceptional U.S. dollar, putting pressure on other major currencies.

The bottom line

As we move into 2025, the global economy is being pulled in two directions. With the exception of the U.S., much of the world will face challenging economic conditions.

We expect global growth of 3.1% this year, followed by a still below-potential 3.2% in 2026. One additional space where the U.S. is expected to be an exception is on the policy front, including regulatory, fiscal and trade policy, and in its adherence to global trade norms and conventions. Given the considerable amount of policy uncertainty on the horizon, we expect the volatility of recent years to persist.

This week, special thanks to Ross Prusakowski, director of our Country & Sector Intelligence team.

As always, at EDC Economics, we value your feedback. If you have ideas for topics that you’d like us to explore, please email us at economics@edc.ca and we’ll do our best to cover them.