MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Solutions

By product

By product

By product

By product

Insurance

Get short-term coverage for occasional exports

Maintain ongoing coverage for active exporters

Learn how credit insurance safeguards your business and opens doors to new markets.

See how portfolio credit insurance helped this Canadian innovator expand.

Guarantees

Increase borrowing power for exports

Free up cash tied to contracts

Protect profits from exchange risk

Unlock more working capital

Find out how access to working capital fueled their expansion.

Loans

Secure a loan for global expansion

Get financing for international customers

Access funding for capital-intensive projects

Find out how direct lending helped this snack brand go global.

Learn how a Canadian tech firm turns sustainability into global opportunity.

Investments

Get equity capital for strategic growth

Explore how GoBolt built a greener logistics network across borders.

By industry

Featured

See how Canadian cleantech firms are advancing global sustainability goals.

Build relationships with global buyers to help grow your international business.

Resources

Popular topics

Explore strategies to enter new markets

Understand trade tariffs and how to manage their impact

Learn ways to protect your business from uncertainty

Build stronger supply chains for reliable operation

Access tools and insights for agri-food exporters

Find market intelligence for mining and metals exporters

Get insights to drive sustainable innovation

Explore resources for infrastructure growth

Export stage

Discover practical tools for first-time exporters

Unlock strategies to manage risk and boost growth

Leverage insights and connections to scale worldwide

Learn how pricing strategies help you enter new markets, manage risk and attract customers.

Get expert insights and the latest economic trends to help guide your export strategy.

Trade intelligence

Track trade trends in Indo-Pacific

Uncover European market opportunities

Access insights on U.S. trade

Browse countries and markets

Get expert analysis on markets and trends

Discover stories shaping global trade

See what’s ahead for the world economy

Monitor shifting global market risks

Read exporters’ perspectives on global trade

Knowledge centre

Get answers to your export questions

Research foreign companies before doing business

Find trusted freight forwarders

Gain export skills with online courses

Get insights and practical advice from leading experts

Listen to global trade stories

Learn how exporters are thriving worldwide

Explore export challenges and EDC solutions

Discover resources for smarter exporting

About

Discover our story

See how we help exporters

Explore the companies we serve

Learn about our commitment to ESG

Understand our governance framework

See the results of our commitments

MyEDC account

Manage your finance and insurance services. Get access to export tools and expert insights.

Economist | Country & Sector Intelligence

In this article:

Since early 2025, the United States has introduced a wave of tariffs—sector-specific duties on goods like steel, aluminum, automotive, copper and forestry products, as well as country-specific tariffs with varying rates. With the U.S. accounting for more than 75% of Canadian merchandise exports, understanding these costs—and what they mean for Canadian businesses—is critical. See our latest Global Economic Outlook for insights on how tariffs are reshaping trade.

While sector-specific tariffs offer few exceptions, country-specific tariffs do. For Canadian exporters, compliance with the Canada-United States-Mexico Agreement (CUSMA) can mean duty-free treatment. Instead of paying a 35% tariff—or 10% on energy and potash exports—the rate drops to 0%.

But here’s the challenge: Tariff schedules are complex, and millions of traded products make it hard to determine what share of exports are truly “tariff-free.”

Determining the share of Canadian exports that avoid U.S. tariffs isn’t straightforward. Different methods produce different results, and the complexity of tariff schedules adds to the challenge.

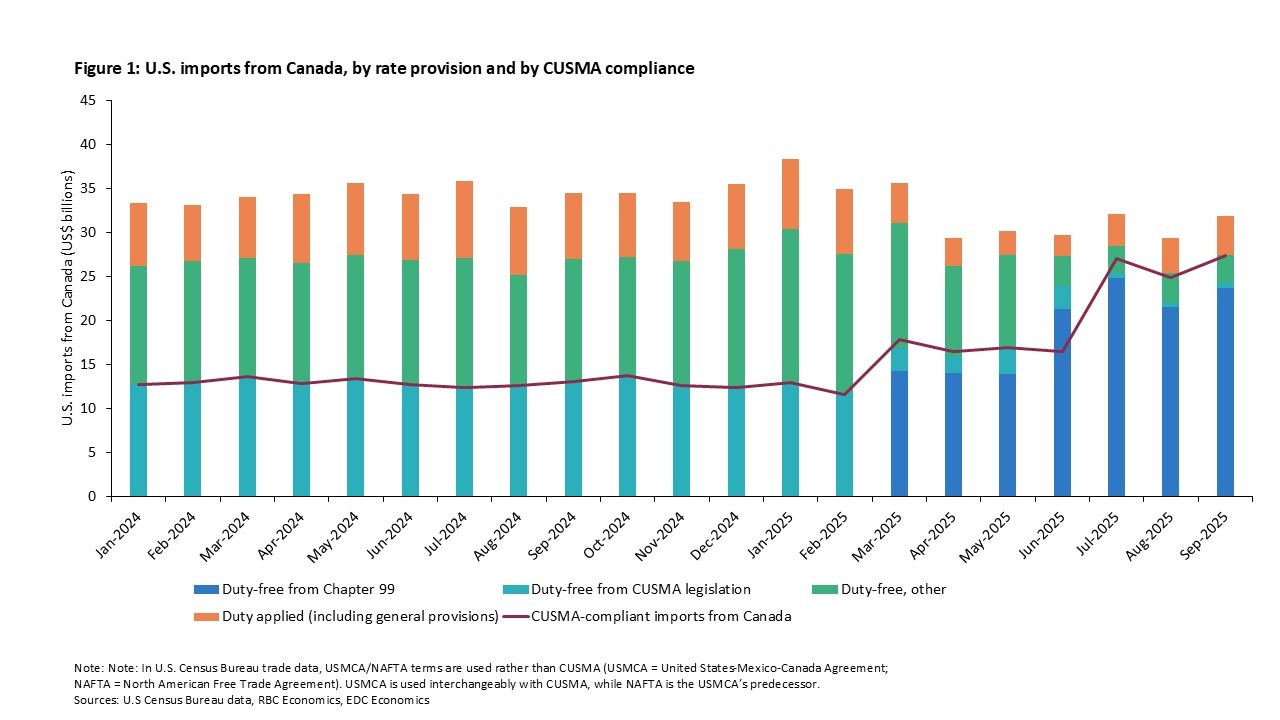

One approach is to analyze U.S. Census Bureau data to identify the tariff rate provisions applied to Canadian exports. These provisions translate into specific duty rates, including duty-free treatment. For example, an RBC Economics analysis, Canada’s trade balance swung back to a surplus in September, found that 86% of Canada’s exports to the U.S. in September 2025 were duty-free.

Another way to measure this is by looking at CUSMA compliance. As of September 2025, nearly 86% of Canada’s goods exports to the U.S. met CUSMA rules, according to U.S. Census Bureau data.

Both approaches suggest Canadian exports are largely tariff-free—but the underlying numbers don’t always match (Figure 1). In 2024, for instance, 38% of U.S. imports from Canada were CUSMA-compliant, while 78% were considered duty-free. Before 2025, many Canadian exporters benefited from exporters didn’t seek preferential treatment under CUSMA or low tariffs under Canada’s most-favoured nation (MFN) status. But after U.S. trade policy changes in 2025, those advantages disappeared, making CUSMA compliance essential to avoid steep tariffs.

While CUSMA compliance has been increasing, interpreting tariff data is far from simple. For example, the tariff rate provision labelled “duty-free from legislation (i.e., USMCA/NAFTA)” (equivalent to duty-free from CUSMA legislation) barely appears in trade data. As of September 2025, Canadian exports to the U.S. totalling above US$486 million were reported under this rate provision—compared to US$27.4 billion listed as CUSMA-compliant.

Trade and customs compliance experts point to a surge in U.S. imports from Canada under Chapter 99 duty-free provisions—the CUSMA exemption to country-specific tariffs. While this reflects higher compliance, it’s not always captured accurately in official data. Further, a high share of “tariff-free” exports can mask the real costs Canadian businesses face.

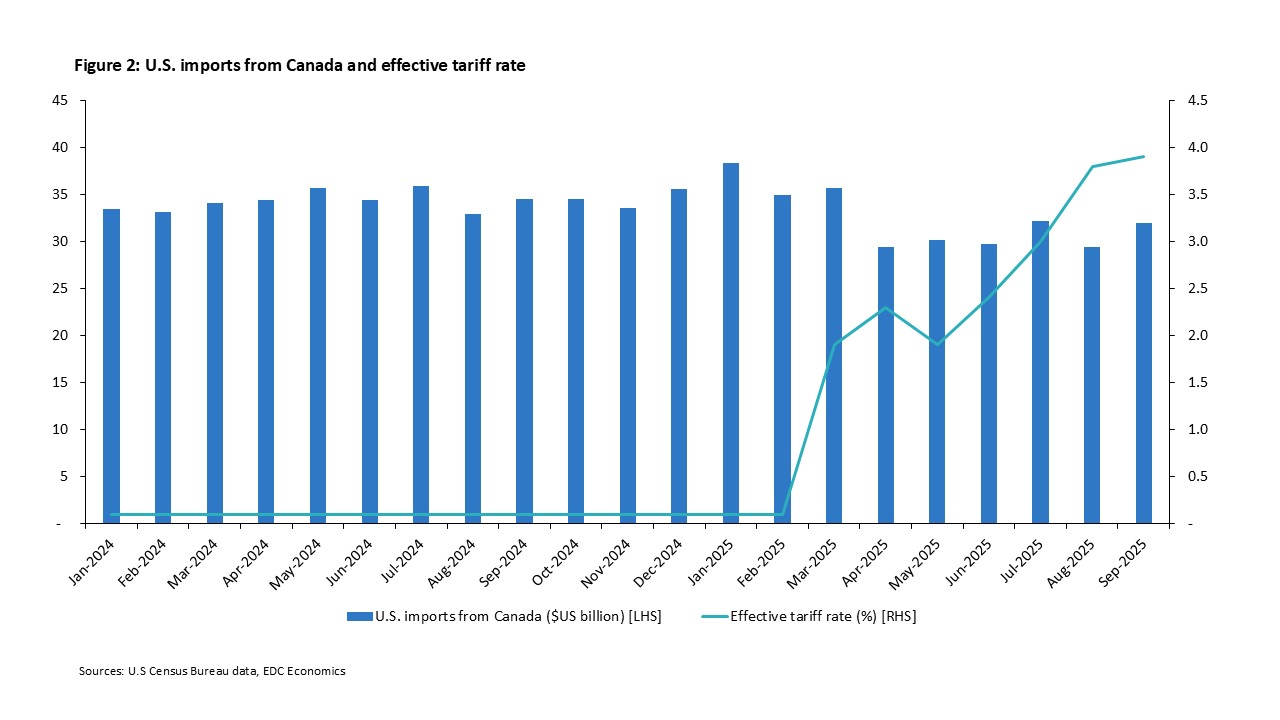

A clearer way to gauge the cost of U.S. trade policy changes is by calculating the effective tariff rate—estimated duties paid as a share of total U.S. goods imports from Canada. This measure reveals the potential economic impact of tariffs (Figure 2).

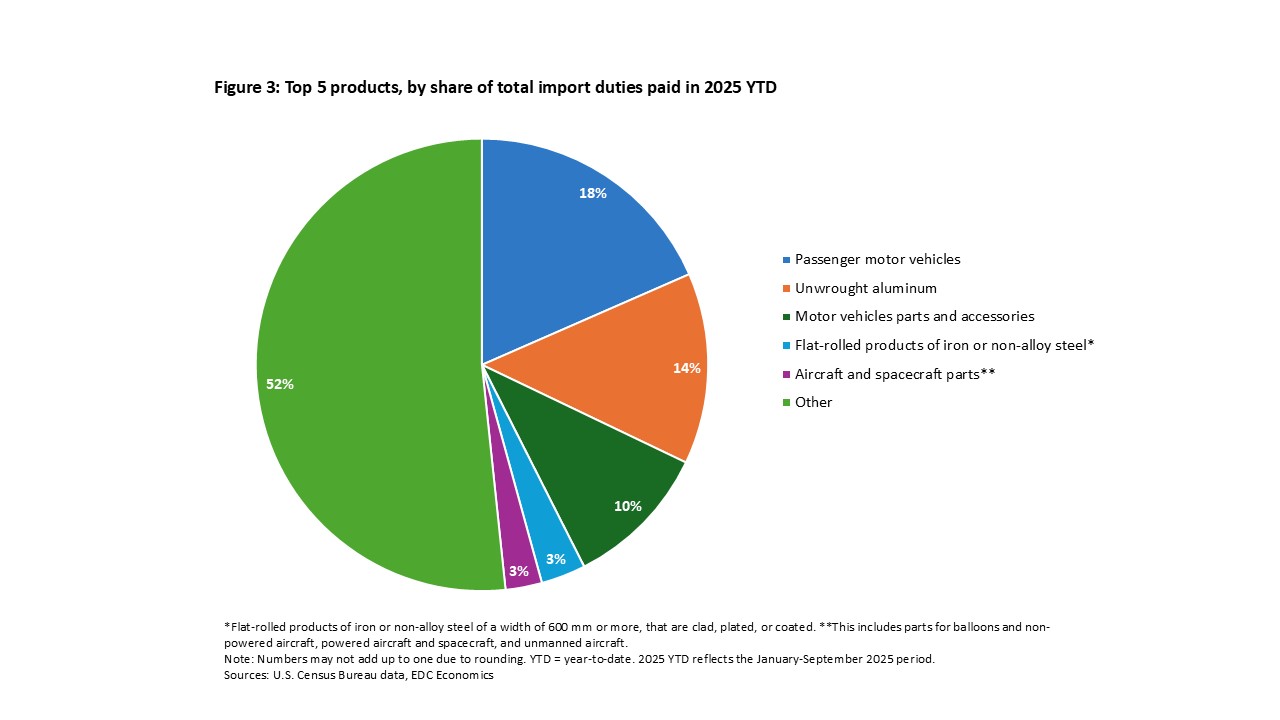

Before the 2025 tariff hikes, the effective rate was close to 0%. By September 2025, it had climbed to 3.9%. At the same time, overall U.S. imports from Canada fell—September imports dropped 7.7% (US$31.9 billion) year-over-year, and January to September exports were down by 5.4% compared to the same period in 2024. While 3.9% may sound modest, the sector-level pain is significant: An estimated US$6 billion in duties were paid year-to-date (YTD), with only five products accounting for 48% of the total (Figure 3).

Focusing only on the share of “tariff-free” exports can obscure the bigger picture. CUSMA exceptions help many companies navigate a challenging environment, but the growing effective tariff rate shows that costs are mounting—especially in sectors like metals and automotive. Understanding these dynamics is critical for Canadian companies to adapt and for EDC to provide targeted support.

Additional resources

Ready to navigate tariffs and strengthen your export strategy? Explore these EDC resources for expert guidance and practical tools.

Canadian firms adapt cross-border M&A amid U.S. economic and trade policy uncertainty.

Get the insights you need to plan your export strategy with confidence—backed by the latest economic trends.

Insights and analysis from EDC on navigating the U.S. business environment