Managing business and export risk

As you identify potential markets, it’s important to have country risk on your radar and. to conduct a thorough evaluation of each market. Knowing your risks allows you to plan for them

Chapters

Know your market - Country risk

In this chapter

As you identify potential markets, it’s important to have country risk on your radar and to conduct a thorough evaluation of each market. Knowing your risks allows you to plan for them—through insurance, hedging and other risk management activities. With a plan in place, your company will know exactly how to respond if a risk scenario presents itself once you are in the market.

Country analysts define country risk as the overall risk, in a certain country, that a situation or event could prevent you from getting paid or from delivering on a contract. Worst-case scenarios may cause a company to lose assets and inventory or to have human resources stranded in another country.

For some markets, country risk requires higher returns to justify taking the risk. Be sure to do a risk-return analysis for any new market you investigate. Understanding this risk allows you to prepare alternative scenarios so you’re prepared for a range of possibilities—and so you have contingency plans in place to deal with them.

Be sure to include country risk in your risk management plan.

There are 5 main types of country risk. Asking the right questions can prepare you to do the level of country risk assessment needed before deciding whether to enter that market. This is also an important exercise in strategic management. The answers will help guide your business decisions related to the market.

Political Risk

Changes in national or state governments—or even policy changes by a long-sitting government—can negatively impact how you do business in a country or region. To identify your political risks, ask yourself these questions:

- What is the political situation in the country? How might it affect your industry?

- What type of government leadership exists?

- Are the country’s tax laws, fiscal policies, trade tariffs and import/export policies likely to support business success?

- How peaceful is the country?

- Is a national election coming soon?

- Can the government take away potential profits? (see the Index of Economic Freedom)

- Does the country have foreign investment restrictions in place?

- Does bribery or corruption influence government decisions? (see the Corruption Perception Index)

- How will Canada’s legislation on foreign corrupt practices affect your business dealings in the market?

Financial (or economic) risk

Achieving your corporate goals depends on cash flow and access to working capital. If important financial supports falter in an overseas market, you will need to react quickly. Identify your in-market financial risks by asking:

- Is the country’s economy stable or volatile?

- What are the country’s exchange rates? Do they tend to fluctuate?

- Do the country’s monetary and fiscal policies support international businesses?

- Will your customer pay when your invoice comes due?

- How will a rise in the inflation rate affect your operations and your customers’ buying power? How will it change supply and demand in the country?

Social risk

Social risk refers to the socio-economic factors that can affect your business in an international market. Look carefully at social and cultural changes taking place in the country—and examine the trends and patterns influencing society. Ask yourself these questions:

- How important is culture in the market and how might it affect your business?

- Is the country’s middle class thriving, emerging or non-existent?

- Is unemployment high and disposable income low?

- Are corruption and bribery rampant?

- Does the government support or ignore women’s rights? Health and education? The environment?

- Does the country encourage or enforce socially responsible business practices, such as creating job opportunities for the local labour force or minimizing the displacement of citizens?

Legal risk

As an exporter, your company will sign contracts governed by the laws and policies set in your chosen market. Identify your legal risks by asking:

- What laws regulate your industry in the market?

- How would changes in legislation related to your industry impact your business?

- How might the country’s consumer laws, labour laws or safety standards affect your venture?

- How will your contracts be structured, in which language and how will issues be resolved?

Environmental risk

While you can’t influence the climate or weather in your target market, you can prepare for it. That’s why it’s important to know if your export market sits in an earthquake zone or deals with regular flooding. Ask yourself these questions to identify your environmental risks:

- What environmental concerns are relevant to your industry?

- How will the country’s climate, geographic location and weather affect your business?

- How will climate change impacts influence your industry?

- What environmental offsets does your business need to consider?

LEARN MORE

This guide covers many of these country risks in greater detail:

- Chapter 3 deals with political risk, including legal risk

- Chapter 4 covers financial risk

- Chapter 5 addresses cyber risk, or technological risk

When you do business in international markets, especially in emerging markets, there’s always an element of risk. Country risks flow along a continuum from:

- Common (anticipated): A customer cancels a contract or does not pay.

- Serious (unanticipated): A national government changes its foreign investment rules in ways that threaten your business interests and assets in the country.

Even markets you know well, such as the United States, carry risks such as non-payment. Beyond preparing a risk management plan, there are other concrete steps you can take to mitigate your risk:

Do your research

Your export strategy is the first step to preparing for a new market. Make sure to conduct extensive market research to evaluate the country and confirm that it’s the right fit for your business. The following resources will help you assess the market and the country risk:

- The Trade Commissioner Service’s (TCS) market reports are available by region, country and industry sector free of charge. The U.S. Commercial Service also has a wide range of country commercial guides. EDC’s Economic Insights newsletter will help you identify opportunities and risks of doing business abroad by reporting on indicators and trends that could affect your business decisions.

- EDC’s market entry advisors in Canada can help you find the right people to connect with in the export markets that interest you.

- EDC’s country portal provides risk information on almost 200 markets

- Trade commissioners, located in 161 cities in Canada and abroad, are available to provide guidance, identify qualified leads and offer on-the-ground contacts in your chosen markets.

EXPERT INSIGHT

When researching potential markets, consider investigating countries or regions with which Canada has signed a free trade agreement or a foreign investment and promotion agreement. Canada is a signatory to 91 different trade and investment agreements. Each opens doors and opportunities for you to grow internationally while ensuring reduced (or no tariffs), a safe investment climate and/or other incentives to encourage trade and investment.

Get to know the market

Visit

Take the time to visit the market as often as you need. Get to know the country, its business climate, its culture and its people. Meet decision makers and potential business partners. Before you go, enlist the support of a translator to translate your corporate and marketing materials into the local language.

You might also need to book an interpreter for your visits to the market. The trade commissioners in Canada’s embassies and consulates can connect you with reliable interpreters or other professional services in your target market.

Join a trade mission

EDC, along with the Government of Canada, provincial and territorial governments, and industry associations all host trade missions to key markets abroad. Some focus on specific industry sectors, while others are open to a variety of industries. Learn more about upcoming Government of Canada trade missions.

Go to an industry trade show

What better way to explore a market’s potential than to attend a trade show or event? Trade shows offer excellent opportunities to conduct market research, evaluate the competition, make contacts and meet potential customers and partners. The Trade Commissioner Service maintains an up-to-date list of international trade shows and events around the globe.

Find reliable partners

Success in any country depends on the people you choose as partners in your export journey: accountants, banks and financial institutions, customs brokers, distributors and others. It takes time to build a reliable network of on-the-ground professionals with the expertise and local knowledge you need to succeed.

- Accountants will help you navigate the country’s banking system, taxation system and other financial requirements of doing business in the market.

- Banks and financial institutions (including insurance companies and export credit agencies like EDC) work with you to protect cash flow and extend credit in export markets.

- Customs brokers can clear your import shipments, prepare documentation for export shipments, and collect duties and taxes.

- Investors may provide the much-needed funds your company requires to expand into the market.

- Lawyers can clarify the language of trade agreements and advise you on a country’s customs laws, tariffs and other legal issues.

- Local distributors buy your products from you, warehouse them and sell them to resellers or consumers in your target market.

- Sales agents can represent your company and sell your products or services in the market, usually in exchange for a commission.

- Technology partners often bring expertise and innovative solutions to enhance or support your offering in the market.

How to find the right partners

You know the value of a great partner, but what qualities matter the most? Use this checklist to help you identify the right partners for your company. Make sure the partner:

- adds value to your business and will advance your goals in the market

- has market knowledge and experience you can leverage

- understands the partnership’s limits and your expectations

- will support your brand and your vision

- will not expose you to additional risk

- is fluent in local languages and understands the business climate

- has extensive domestic and international experience

- shares your values and approach to business

It’s also important that you have strong personal chemistry with your partners. These are relationships built on trust. Chemistry matters—as does their reputation. To learn more, read our white paper on how to choose the right partner.

Choose your market entry strategy

When entering new markets, most exporting companies ask themselves some important questions: Should we sell our products directly to the market? Use a distributor? Hire a sales agent? Open a local office? While the choice is up to you, each has its pros and cons:

Direct sales to the market

Direct sales within a market occur when you have established a relationship with a customer in-person, online or by telephone. also sell through your web site and by telephone. When you sell directly to a market, it’s important to visit the market regularly.

| Pros | Cons |

| This is a simple and cost-effective way to enter a new market. | This approach tends to isolate you from your customers. |

| You get a higher return on your investment because you’re not sharing your profits with others or paying for a local office. | You will have to commit time to the market to understand it, build relationships and negotiate deals. |

| Your business can set lower prices. As a result, you will be more competitive in the market. | You may need to hire local talent or interpreters to assist with sales and after-sales support. |

| You will have a direct relationship with your customers, which often builds loyalty and leads to long-term sales. | If you don’t have local staff, you need to visit the market when things go wrong (if remote troubleshooting is not possible). |

| Buyers and customers give you direct feedback, so you can tailor and improve your offerings to meet their needs. | Your business’ progress in the market will probably be slower than other market-entry options. |

| You can control your brand and how your products and services are marketed. | To continue growing, you may need to establish a presence in the market over the long-term. |

Distributors

A distributor will buy from you, warehouse your products and sell them to the market and their customers.

| Pros | Cons |

| Distributors remove the potential for many types of trade risks. | Distributors take on risks, so they expect significant discounts and good credit terms. |

| Distributors often stock the products they sell, so they manage warehousing and inventory. | Distributors will demand exclusivity, so choose one that understands your products and has the customers to buy them. |

| Distributors have established networks and reputations, so it’s easier for them to introduce new products to the market. | Distributors do not work on commission, so their motivation to prioritize your products may vary. |

| Distributors will invest in marketing your products, but they may want you to contribute your financial share. | Depending on your contract, you may have to give up control of how your products are priced and marketed. |

| Distributors often set up credit options to encourage potential customers. | |

| Distributors manage the shipment of goods, customs and related paperwork. |

Sales agent

A sales agent sells your products or services in the market and receives a commission to do so.

| Pros | Cons |

| Sales agents know their market and their customers. They can easily identify and pursue opportunities for you. | You must manage shipping and logistics to get your product to market. Your agent may be able to help with this. |

| While it can take you time to build a customer base, your sales agent should already have a solid list of potential customers for you. | You will need to share your financials with your agent as part of your commission payment agreement. |

| This option saves you the cost of recruiting, training and managing payroll for your own employees in the market. | After-sales service may be a challenge because you are selling through an agent, so you need a plan in place to deal with issues. |

| You have more control over your brand, marketing and pricing with a sales agent than you do with a distributor. | If you want your agent to conduct customer credit checks for you, you must specify this in their contract. |

| With an agent, you have less control over your product or service’s brand image and marketing than direct sales. |

Opening a local office

Establishing a local presence means you open a branch or subsidiary in the target market or enter into a joint venture with a local company.

| Pros | Cons |

| With a local office, you get operational and strategic control over the business—and you can choose to expand if you’re successful in the market. | Opening a local office is more costly than other options, as you need to commit time and resources to managing the office. |

| If you establish a joint venture, you can share the risk. You will also benefit from your partner’s local knowledge and reputation. | Unless you set up a joint venture, you will take on all the risks yourself. If things go wrong, the cost can be high. |

| All profits from your business in the market go to you—or will be split between you and your joint venture partner. The opportunities for reward are high. | You will need to hire legal and accounting support to navigate employment and tax laws in the country, and to file taxes. |

| With a local base, your ability to build customer loyalty is higher. This is especially true if your products need service support. | You need to establish good working relationships with suppliers, partners and customers. This takes time and a clear commitment to the market. |

| You may save money on administrative and marketing activities by sharing common financial systems and resources across all locations. | Your parent company takes on the risk for its subsidiaries, so a problem with a subsidiary can result in losses for the parent company. |

Foreign affiliate: is it right for you?

A foreign affiliate is a company related to, but not strictly controlled by, a corporation. This may be a subsidiary company that is owned or controlled by another company. It operates as a local business, which means it follows the regulations and laws of the country in which you establish your presence. You also pay local country taxes.

A foreign affiliate is the most common way that Canadian companies tend to set up operations abroad. It can take any of the following forms:

- Foreign office—Also known as a local office, this is when a company establishes a presence in the market.

- Joint venture—A joint venture is when you partner with another company, or multiple parties, to share the cost of operating in an international market. You may partner with a company that is well-established in the market to position your venture for success when you enter the country.

- Manufacturing plant—Your company may purchase or establish a manufacturing plant in a market to enhance your presence there or to benefit from reduced operational costs to produce your product.

- Purchase locally—Some international investors choose to buy an existing company in the market to leverage its brand and customer base.

While opening a foreign affiliate is generally the most expensive and time-consuming way to enter a market, the rewards can be great for companies that choose this route.

Most Canadian companies use their foreign affiliates to sell their products and services in the market. Others use them to produce products for the market or to warehouse products for local distribution.

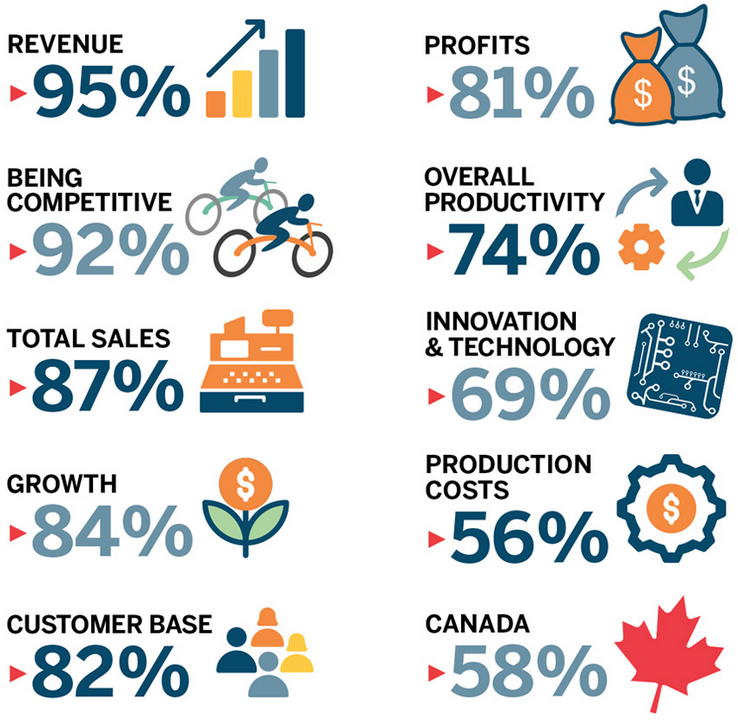

Operating a foreign affiliate has helped many Canadian companies thrive. In a survey of Canadian companies with foreign affiliates, EDC found that companies reported the following benefits:

Learn more about foreign affiliates in our blog post, Investing Abroad to Find Global Customers. Take a look at the pros and cons of opening a local office.

Here are some valuable resources to help you investigate and plan for country risk:

- EDC’s Country Risk Quarterly provides risk information on more than 100 countries.

- The World Bank Group’s Doing Business website examines business rules that apply to local firms in 190 countries and in selected cities worldwide. The rankings section looks at how easy it is to do business in these places.

- Transparency International, based in Germany with 100 chapters elsewhere, publishes the yearly Corruption Perceptions Index that measures the perceived level of public sector corruption in 180 countries.